If you are the CEO of a small-to-midsized Software as a Service (SaaS) company, hiring a SaaS fractional CFO can be transformative. SaaS companies typically need significant upfront investment and must scale quickly, creating complex operational and financial challenges requiring specialized expertise. Yet most can’t afford (or don’t need) a full-time CFO. Below, we explain how fractional CFOs can help and how to hire fractional CFO services for your organization.

Table of Contents

Understanding Fractional CFO Services

What is a Fractional CFO?

A fractional CFO (Chief Financial Officer) is a strategic financial advisor who oversees your company’s economic activity and helps you make sound financial decisions, like a full-time CFO, but on a part-time basis. They monitor your company’s financial health, compare it to your growth plans, and collaborate with your executive team to develop and execute financial strategies.

Fractional CFOs (aka outsourced CFOs) can also build and manage your finance and accounting team, take on special projects, and sometimes own the human resource function. Therefore, their day-to-day activities can vary, depending on your company’s structure, needs, and maturity.

What are the Benefits of a Fractional CFO?

The main benefit of a fractional CFO is that they help you avoid financial problems for a fraction of the cost of a full-time employee by identifying and addressing risks and roadblocks before they spin out of control. Strong financial management is crucial for every organization. Yet, many small businesses don’t realize they need financial leadership until something goes wrong.

The No-BS Financial Playbook for Small Business CEOs

Are you tired of making costly financial mistakes? Stop guessing and start growing. Learn how to create a scalable and valuable company while minimizing risk with this playbook from a serial entrepreneur who has been in your shoes.

SaaS organizations, for example, often have brilliant technologists at the helm, striving to resolve a problem with customer research and product development. Many don’t seek financial advice until they encounter uncomfortable money questions from their board or miss growth opportunities. Fractional CFOs empower you to avoid these issues without breaking the bank.

What Does a SaaS Fractional CFO Do?

SaaS Fractional CFOs use their deep understanding of SaaS metrics and business models to provide strategic analysis, insights, and direction to the CEO, C-suite, and external stakeholders. Their responsibilities include:

1. SaaS Financial Reporting and Analysis

The CFO owns the reporting function, ensuring you track metrics critical to every business and those specific to your industry. In SaaS, that typically means:

- Monthly Recurring Revenue (MRR) – Or, in some cases, annual recurring revenue (ARR).

- Lifetime Value of a Customer (LTV) – The average total revenue earned when the company retains a customer for a set duration, typically 3 years.

- Customer Acquisition Cost (CAC) – The cost of gaining a customer.

- Churn Rate – The percentage of customers lost over a specific period.

They also look beyond your financial statements to spot trends, developing financial models to identify issues like revenue leakage and make recommendations, like pricing or customer retention strategies.

2. Strategic Financial Guidance for Scaling

CFOs work closely with your executive team, creating financial forecasts and leading vital discussions about your company’s economic health. They help you explore cost savings and revenue generation opportunities, enabling you to develop sensible business growth strategies. SaaS CFOs guide discussions about burn rate, runway, and path to profitability. They formulate plans for efficient growth, balancing customer acquisition costs with lifetime value, and determining when to prioritize growth vs. profitability

3. Team Management and Leadership

Accurate revenue recognition for subscription businesses requires specialized expertise. SaaS Fractional CFOs build cost-effective teams that understand ASC 606 compliance, manage complex billing scenarios, and produce investor-ready SaaS metric dashboards.

4. Systems Development

CFOs build and refine financial systems – developing and implementing scalable processes, procedures, controls, and solutions, thus improving financial operations to support your growth initiatives.

5. Relationship Management

SaaS fractional CFOs build and nurture relationships with investors, bankers, and board members. They prepare presentations that tell your growth story through cohort analyses, retention curves, and expansion revenue trends.

6. Special Projects

CFOs lead the preparations when you are ready to raise capital, helping to secure loans, pursue venture funding, or manage an IPO. They also play a pivotal role in mergers, acquisitions, and partnerships, assessing each proposal’s financial and strategic viability, leading due diligence, and managing implementation.

Download our Financial Infrastructure 360° and Building a Winning Team resources to learn more.

When to Hire Fractional CFO Services

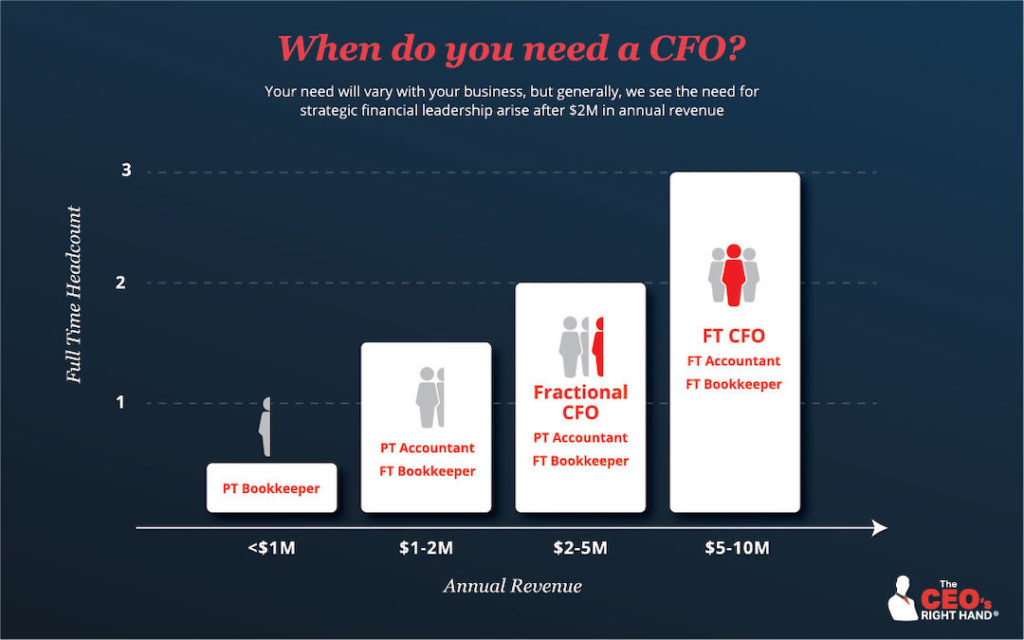

When a company hits $2M in annual revenues, it is generally time to consider hiring a fractional CFO, although some business models require investment earlier. Here are the common signs that it is time for financial leadership.

- You Must Raise (and Manage) Significant Capital to Fund Your Growth Plans

Early-stage companies often pursue inexpensive sources of capital, like friends and family investments or bank loans. However, suppose you must raise a million dollars (or more) to develop your product, hire, invest in customer acquisition or retention initiatives, or expand into a new market. In that case, you may need to explore equity financing and hire a CFO with experience in capital raising. - You Have a Complex Business Model Requiring C-Level Financial Expertise

SaaS business models often require extensive operational and financial data analysis and someone who can translate it into actionable insights. For example, subscription models create deferred revenue you recognize over time. Although that creates a predictable revenue stream, it also creates an obligation to deliver reliable services, making operational discipline and careful cash flow management essential. An experienced SaaS CFO will understand this and partner with you to identify and track the metrics and KPIs that indicate success, opportunities, and problem areas. - A Lack of Financial Leadership is Stifling Your Ability to Grow

Sometimes, CEOs or COOs assume the finance role initially, then become a bottleneck as the business grows. That can lead to cash flow issues or unhappy employees and vendors. In this case, you need a CFO to set up processes. Then, they will monitor the situation – watching for accounts receivable, accounts payable, or vendor issues that could stifle your growth, while managing your banking relationships and insurance needs. - You Are Unable to Make Financial Decisions with Confidence

If you have financial strategy questions or want to make certain investments and are uncertain whether you can afford them, that’s a great reason to hire a fractional CFO. For example, CFOs can help answer questions like the following:- Can I afford to hire more people or expand into a new market?

- What will happen to my profit margins if we adopt a different pricing model?

- Should I build or buy technology to broaden our solution’s capabilities?

- A Merger, Acquisition, Expansion, or Spin-Off is on the Horizon

Like capital raising, acquiring another company or spinning off a business unit requires specialized expertise. A CFO with M&A experience would partner with you in the preparation phase to explore options and make wise decisions. They would stay by your side as you move forward, securing funding, communicating with stakeholders, and setting up the appropriate business structures. Finally, they would help with the integration while providing strategic advice. - You Need to Overhaul Your Financial Infrastructure

Many companies outgrow their financial infrastructure as they expand. For example, you might need to upgrade your accounting solution to something more scalable that can integrate with other systems, like your ERP solution. Or perhaps you need more processes and controls to spell out your hiring procedures, expense reimbursement policies, compensation packages, and diversity practices. That is a great reason to hire a fractional CFO. - You Need an Executive-Level Presence to Communicate Financial Data

Many CEOs are fantastic salespeople, marketers, or product engineers, but lack financial acumen. If this is the case for you, consider hiring a CFO to develop and present your financial reports (and answer tough questions) in meetings with investors, bankers, the board of directors, or even your executive team. Your team will appreciate it and feel more confident in your leadership abilities.

When you are ready to seek help, consider hiring an outsourced CFO service vs. a freelance fractional CFO because they will be better equipped to help you build a finance and accounting team as you grow. Some even offer fractional HR services, making it easy to hire less expensive resources (like bookkeepers, accountants, and controllers) and (eventually) a full-time CFO when it is time for them to step back into a more advisory role.

How Much Does a Fractional CFO Cost?

Fractional CFOs typically charge between $250 and $500 hourly, so an ongoing relationship runs between $6,000 and $12,000 monthly, or $72,000-$144,000 annually, depending on your needs. That compares favorably to the cost of a full-time hire, which will run around $300,000 to $400,000 annually, including bonuses, benefits, equity incentives, and overhead. You can use our full-time vs. fractional CFO cost calculator to tailor this math to your situation.

How to Hire Fractional CFOs

Hiring a fractional CFO is much like hiring a full-time CFO, in that you must define the role or project, look for candidates, and engage in an interview process before choosing a match. However, there are some nuances. Let’s go through the steps together.

1. Clarify Your Business Needs

Think about your business, team, and long-term vision. What do you hope to achieve by hiring a financial professional? Jot down your goals, existing skills, missing capabilities, and budget. Besides having someone oversee your finances, consider whether you need help with capital raising, complex financial analysis, process development, or executive-level financial communication.

Then, use that information to develop a clear scope of work (a list of what you need and when) to attract a part-time CFO with the right skillset and capacity.

2. Develop a Job Description

Write a detailed job description explaining what your company is like, what you are looking for in a candidate, and what you offer in return, just as you would if you were looking for a full-time CFO. Clarify what must happen immediately and what can wait, so potential applicants can consider their bandwidth before applying for the role. In other words, specify the following information.

- Company Characteristics: size, growth stage, and short vs. long-term vision.

- Corporate Culture: what it’s like to work at your organization, and how that translates to your desired qualities.

- High-Level Job Description: your immediate priorities and longer-term needs.

- Requisite Experience: years working in SaaS, necessary credentials, skills, etc.

- Hours, Location, and Budget: cite specifics, indicating any areas of flexibility.

3. Launch a Search for Fractional CFO Candidates

SaaS CFOs with specialized qualifications and experience are in high demand, so finding viable candidates can be challenging. However, when seeking fractional help, you have more options.

- Fractional CFO Service Providers – Light Google or AI research on the questions you hope an expert can help with, like “business exit planning” or “how to increase the value of a business,” will often surface content from companies offering fractional CFO services, much of it written by available CFOs.

- Networking & Referrals – Speak to your team, partners, CPA, legal advisors, etc. Let them know what you want in a CFO and ask for recommendations.

- Professional Organizations, Associations, or Communities – SaaS-specific groups sometimes offer job listings, chats, or meetups where you can find a good fit.

- Job Boards – LinkedIn or Indeed are good, but sites like Upwork are also helpful when seeking part-time candidates, especially if you are open to remote arrangements.

Vet all applicants to develop a short list of the most promising candidates, then move on to the interview step.

4. Prepare for and Conduct Interviews

Make the most of each meeting by preparing a great list of open-ended CFO interview questions to extract insights into each candidate’s background and experiences. Ask how they approached problems like yours in the past, and how they can help you reach your goals, focusing on the following areas.

- Strategic Financial Leadership Skills

- SaaS Industry Knowledge

- Technology Capabilities

- Team Management Experience

- Specialized Expertise Relevant to Your Needs

- Cultural Fit

Then, if you find a few great options, ask for proposals.

5. Evaluate Proposals and Fees

Fractional CFO proposals typically include a statement of understanding and a suggested approach (the recommended services, a time estimate, and a fee structure). Common fee structures include:

- Fixed Fee – for discrete projects with specific deliverables

- Hourly (or Daily) Rates – for variable scope work

- Monthly Retainer – for defined ongoing relationships

The CFO will also ask you to sign a service contract containing legal protections and billing terms. Review everything closely, clear up any concerns, and then compare your options to determine the best fit for your needs and budget.

6. Ensure Smooth Onboarding and Ongoing Management

When your SaaS fractional CFO finally joins your team, set them up for success with a strong onboarding process. Give them access to any necessary systems and files and help them integrate with your staff, just as you would with a full-time hire. Then, work closely with them to establish goals, objectives, and evaluation criteria to measure success – creating a system for regular communications and feedback.

Hiring SaaS Fractional CFO Services: The Bottom Line

Hiring a fractional CFO will be well worth it if you need executive-level financial services but can’t afford (or don’t need) them full-time. Look for someone with experience in the SaaS industry who can improve your financial infrastructure, provide advice for strategic decisions, and tackle critical projects requiring financial expertise. At The CEO’s Right Hand, we offer industry-specific fractional, interim, and project-based CFO services to small- and mid-sized growth companies. Contact us today to explore how we can help you.