The month-end reporting package from your finance team has always been critical for making business decisions. But whereas a simple income statement, balance sheet, and maybe a statement of cash flows used to be enough, today’s fast-paced, data-driven environment demands more. In addition to these basic statements, your company’s financial leader should track trends, analyze changes, and incorporate operational data into timely, accurate, and relevant insights to share with you and your leadership team.

Below is a primer on month-end reporting, what the package should contain, and the steps involved to give you a sense of what to expect from your accounting department (and, ultimately, your Chief Financial Officer).

What is Month-End Financial Reporting?

In its simplest form, month-end financial reporting involves reconciling your company’s monthly transactions to ensure that your records are accurate before you close the books and generate financial statements. But while this may sound relatively straightforward, like balancing a checkbook, the month-end close process for a business can be quite complex due to its scale.

In addition to reviewing all actual and anticipated inflows and outflows of money, your team may also gather updates from other departments on the state of your inventory, sales projections, petty cash, or upcoming investments. Then, ideally, they will combine all this information to develop and deliver comprehensive financial reports and analyses explaining where things stand today, what you can expect going forward, and what you can do about it.

Of course, some organizations skip that last step and rely on their CEO to draw conclusions, but in our experience, leaving that work to a financial professional is more effective.

What is the Purpose of Month-End Reporting?

Month-end reporting may sound time-consuming, but it is an essential best practice for every business, especially those that plan to grow and scale. For example, consider the following benefits and how they might affect your business.

- End-of-month reports give you and your team the financial information necessary to run the company and make confident decisions.

- Monthly reporting empowers you with reliable and timely financial data, so you can quickly address issues, pursue opportunities, answer questions from stakeholders, and interact with your board. In addition to simply being a better way to run your business, it helps you build trust with constituents.

- Rigorous end-of-month reports make navigating each season’s year-end close easier because you can rely on the accuracy of your data.

- Developing the sustainable, scalable practices necessary to empower month-end reporting is vital to a robust financial infrastructure that will power your business for years.

- Companies with outside lenders, like a bank line of credit, require month-end reporting that includes the basic financial statements plus reports specific to those institutions.

So, your monthly financial reports have more value than meets the eye because they contribute to your company’s overall health in many ways.

What Should Your Month-End Reports Contain?

Month-end reports should undoubtedly include your company’s financial statements. However, they should also contain operational data, metrics, and dashboards that are useful and meaningful for generating insights. Remember, your company’s leaders will use this data to make decisions.

For example, a month-end financial report for an e-commerce company might include the following:

- Financial Statements:

- Income Statement (a.k.a. profit and loss statement)

- Balance Sheet

- Cash Flow Statement

- Margin Analysis by SKU, Customer (for Wholesale), Product Line

- Financial Metrics: Average Order Value (AOV)

- Sales & Marketing Metrics:

- Click-Through Rates

- Conversion Rates

- Website Traffic

- Operational Metrics:

- Number of Repeat Customers

- Inventory Turns

- Social Media:

- Number of Followers on Facebook or Instagram. Better yet, the level of engagement and eventual sales.

Depending on the size and complexity of your business, you could have more or fewer metrics to track. In addition, other types of companies, such as manufacturing, business services, SaaS, etc., will have different KPIs unique to those industries.

Pro Tip: Ask AI to Tailor the List Above to Your Industry Using the Following Prompt

“I am the CEO of a [$X million revenue] [industry] business with [number] employees. I want to create a comprehensive month-end financial reporting package. Please provide me with a detailed outline of what this package should contain, including:

Financial Statements and Analysis:

- Core financial statements needed

- Key variance analyses (month-over-month, year-over-year, budget vs. actual)

- Critical financial ratios and metrics

Industry-Specific KPIs:

- Top 5-7 operational metrics specific to my industry

- Performance indicators that drive decision-making

Executive Summary Requirements:

- Key insights format that one could review in 30-60 minutes

- Red flags or areas requiring immediate attention

- Actionable recommendations

Additional Context:

- My business model is [B2B/B2C/SaaS/manufacturing/etc.]

- We [do/don’t] carry inventory

- We [do/don’t] have recurring revenue

- Our main challenges are [cash flow/growth/profitability/seasonal variations/etc.]”

Follow-up AI Prompt

“Based on the package outline above, help me create a one-page executive summary template highlighting the most critical information for board presentations.”

This two-part approach will give you an industry-specific month-end reporting package structure and a board-ready summary template.

The Value of Executive Oversight

Be careful, though. Providing helpful information at month-end does not mean overkill with useless data. Although some businesses adopt great dashboards and metrics, others sometimes go to the extreme, producing an overload of information that leads to “analysis paralysis.”

The ideal financial report will favor efficiency. The executive team should be able to review it in one hour and get a good feel for where the company is, where it is going, and where the challenges and opportunities lie.

That is where having a CFO who can guide your team in developing this information is crucial. A good CFO will insist on accurate, understandable data that they can translate into easy-to-consume operational dashboards and metrics. They will review the trends, use them to build or update financial forecasts, and then analyze the results so they can interpret them for the management team and recommend the next steps.

How to Prepare and Present a Month-End Reporting Package

Just because the month-end close process is complex doesn’t mean it has to be a struggle. A well-run finance team will adopt a clear set of month-end reporting processes and procedures to ensure that month-end closing and reporting activities occur quickly. There is even a standard set of Generally Accepted Accounting Principles (GAAP) to guide this work.

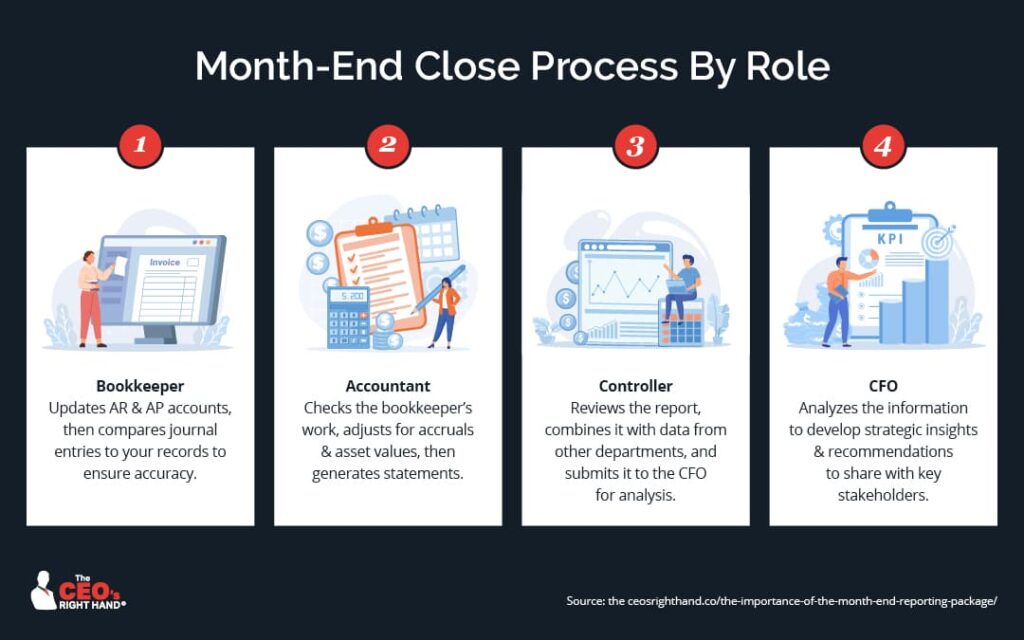

For example, most organizations will break the process down into repeatable steps and involve several people. That allows them to share the workload and check each other’s work. So, depending on the structure of your team, the month-end close process may play out as follows:

- The bookkeeper updates your accounts receivable and accounts payable accounts, then compares all journal entries in the general ledger to your records to ensure accuracy.

- An accountant checks the bookkeeper’s work, creates any needed accruals, adjusts your variable and fixed asset values, and generates financial statements using your accounting software.

- A controller reviews the resulting information, combines it with data from other departments, and then submits a preliminary package to your financial leader for analysis.

- Your CFO reviews the trends, asks questions, and analyzes the information compared to the company’s overall strategy. The CFO develops insights and recommendations to share with the executive management team and may also create variations of the report to share with other stakeholders.

Naturally, the month-end reporting checklist will vary from company to company and evolve as your business matures. For instance, a small-to-mid-sized service-based business with no inventory may have an accountant do most of this work and use a fractional CFO for oversight. A large eCommerce company, however, will likely employ an entire team of clerks, accountants, and financial analysts who must collaborate.

Key Takeaways

The month-end reporting package should contain more than just financial statements straight from your accounting system. An excellent package will also include the following:

- Vital operational data for making impactful business decisions.

- Key metrics and dashboards customized to your company and industry.

- Meaningful and consumable insights you can translate into action.

We welcome you to download our monthly reporting template for an example to share with your team.

Editor’s Note: This blog post was initially published in April 2019 and was last updated for accuracy and thoroughness in June 2025.