As the CEO of a growing company, you know it is crucial to track the health of your business. Yet, the methods for doing so are rarely straightforward. As a fractional CFO, my job is to guide this effort – to narrow your focus to the most critical metrics and to offer strategic advice so you can make decisions. Still, there are some key financial metrics and KPIs that every CEO should know, so in this post, we will discuss those metrics and how they can vary by industry or stage of growth.

But first, let’s clarify the terminology.

What is a Financial Metric?

There are hundreds of metrics one can use to gauge success. And each department within your organization will measure their team’s performance differently. For the CEO, however, such detail can become overwhelming when all you want to know is whether your company is financially viable and on track for sustainable, long-term growth.

Financial metrics aim to answer this question for all aspects of your business, including your finance and accounting function. Therefore, there is often some overlap between financial metrics and other departmental metrics because the finance team is responsible for measuring and managing anything that affects the following:

- Revenues – What are the sources of income for your business, how do they ebb and flow over time, and what can you do about it?

- Costs – What costs must you incur to run a successful business? And how do those costs affect your overall financial performance (gross profit margin, operating margin, and net profit margin)?

- Assets and Liabilities – How much cash (working capital) do you have and how long will it last, given your obligations and growth plans? If necessary, what can you do to increase cash flow?

- Debt and Equity – What is your balance of debt vs. equity (a/k/a debt to equity ratio) and how efficient is your usage of the company’s capital?

In other words, a financial metric is any metric that provides insight into your company’s financial health. The trouble, however, is that there are a lot of these metrics. And, to complicate matters further, the metrics that indicate business success will change as your company evolves, which is why I would encourage you to use financial KPIs.

What is a Financial KPI?

A financial KPI (key performance indicator) is a high-level financial metric that indicates whether your company is on track for meeting its goals. These are the most meaningful metrics to your management team because they give you the ability to monitor the health and longevity of your business and address issues before they spin out of control.

As we mentioned earlier, the right KPIs for your business will change over time. For instance, whereas startups typically focus on traction, mature companies often shift their attention to revenue growth, profits, and scalability. So, I’d recommend that you choose just a handful of KPIs that reflect your company’s current goals. Then, get the whole company engaged by asking each department head how their team’s initiatives will contribute to those goals.

10 Key Financial Metrics and KPIs for CEOs

Although I recommend focus, there are some financial metrics that every CEO should know. These metrics allow you to combine data from your financial statements to gain deeper insight into your company’s financial health. Some variation of them will likely land on your list of financial KPIs.

- Annual Revenue Growth Rate (Current Year Revenue / Prior Year Revenue – 1 = X%)

Every company tracks its revenue and captures it in financial reports, but income data in isolation isn’t informative. The annual revenue growth rate provides context by showing how much your revenue has grown or declined over the prior year. For those who desire more timely information, you can easily adjust this metric to track your quarterly growth rate or monthly growth rate instead. For a longer-term view, you can also create a compound annual growth rate over five years or more which is basically an average over a period of time.

- Annual Gross Margin Growth Rate (Current Year Gross Margin/ Prior Year Gross Margin – 1 = X%)

You can’t get an accurate picture of revenue growth until you subtract the costs of generating that revenue (cost of goods sold) to arrive at your gross margin. The annual gross margin growth rate adds even more context by telling you how much your gross margin has changed since the prior period. As you collect more financial data, this metric will also begin to tell the story of how your business has performed over time.

- Gross Margin as % of Revenues (Gross Margin / Revenues = X%)

The gross margin ratio tells you how much profit you made after subtracting the cost of goods sold. It’s a profitability ratio where the percentage represents how much you retained of each dollar earned. Healthy gross margin ratios can vary from company to company, so it can be helpful to find some industry benchmarks for comparison. In the end, however, you need to decide what works for your business, then aim to improve (if necessary) by either reducing costs or increasing revenues.

- Operating Expense Ratio (Operating Expenses / Revenues = X%)

The operating expense ratio reflects how much it costs to run the “back office” operations of your business. Operating expenses include all the selling, general and administrative expenses, as well as product development / R&D, customer services, and other overhead costs. To create a scalable organization, you want to have an operating expense ratio that decreases over time. This will show that you can funnel more business through the engine without increasing costs at the same rate. The lower this ratio, the better.

- Operating Cash Flow Margin (Operating Cash Flow / Revenues = X%)

Most CEOs realize that cash flow is the key to survival when building and scaling a small-medium business. Without cash flow as the fuel, your engine will seize up and fail very quickly. The operating cash flow margin provides an indicator of how much cash your business is generating as a percentage of revenues. In other words, for every dollar of sales, how much cash comes out of the other end of the “sausage-making machine.” Of course, different types of companies will have different benchmark targets. For example, a manufacturing company will have a much lower cash margin than a SaaS company with a much lower cost structure.

- Net Working Capital to Assets Ratio ((Current Assets – Current Liabilities) / Total Assets = X%)

Net working capital is a measure of how much capital (i.e., money) you have at your disposal to invest in the business (or payout to the owners/shareholders) at any point in time. The net working capital to assets ratio is simply the amount of working capital you have as a percentage of your total assets. The higher the ratio, the better. However, there are indeed situations where you want to use some debt (i.e., liabilities) as a way of financing short-term investments. For example, borrowing from a bank line of credit may be a good way to fund purchases from suppliers overseas.

If you only get these first six financial metrics down, you’ll be in good shape. But, for those who have the stomach for more, here are some others that I find incredibly telling.

- Revenue Per Employee (Revenue / # of Employees = $X)

Revenue per employee is an excellent number to watch over time as it is a measure of employee productivity. We want this number to be as high as possible while keeping your employees happy and free from burnout. An occasional dip can be acceptable if you can explain it, but if the drop is a surprise, take note and investigate the cause. Many firms can generate $200,000 or more annually per employee. Companies with a high revenue per employee ratio tend to be more profitable.

- Days Sales Outstanding = Average Accounts Receivable / (Revenues x 365)

Days sales outstanding (DSO) tells you how long your collections process takes on average. A low DSO would suggest an efficient accounts receivable function. Whereas a high number might indicate a cash flow problem. As usual, the key here is to determine what DSO is healthy for your business, then track your trends over time. For example, B2B businesses tend to have 30-day terms, so you want DSO to be around 30 – 45. Anything higher signals that you may need to research what’s happening in your A/R and collections department.

- Days Payable Outstanding = (Average A/P) / (COGS / 365)

The days payable outstanding (DPO) metric represents how long it takes your company to settle its financial obligations. This number is tricky because what’s good for one company or industry may be bad for another. For instance, if you are in the manufacturing industry and have negotiated good terms with your suppliers, a high DPO might indicate healthy and proactive cash flow management. However, if you’re in the professional services business and hire many contractors, a high DPO could suggest a problem.

- Asset Turnover (Revenue / Average Accounts Receivables)

The asset turnover ratio tells us how quickly a company generates revenue from its assets. This number is most telling when compared to others in the industry. In a service-based business with relatively few assets, it can be normal for this number to be high. In retail, however, if your asset turnover ratio is lower than your competition, that could indicate slow sales or inefficient management of the products you have in stock.

A more telling metric for those in the retail industry is inventory turnover. Calculated by dividing the cost of goods sold by the average inventory value, this metric tells you how often your company has sold and replenished its stock over a specific time frame. The inventory turnover metric is critical for those in the retail space, and the higher it is, the better. It’s meaningless, however, to industries that don’t function in this manner.

There are many other financial metrics, of course, that we use for different purposes. For instance, I typically monitor a company’s operating cash flow along with its liquidity and solvency ratios, like the quick ratio (aka acid test ratio) and debt-to-asset ratio, as these metrics provide insight into its cash situation. Likewise, if the company raised equity capital, I would also watch metrics like shareholder’s equity and return on equity in anticipation of questions from investors. But the CEO doesn’t need this level of detail until it becomes relevant.

Industry-Specific Financial Metrics

Although the financial metrics and KPIs above will interest every CEO, it is worth noting that they can vary by industry. Here are just a few examples:

eCommerce Financial Metrics

For an eCommerce business that sells relatively low-cost or commodity items, volume is critical. Therefore, most companies of this sort invest heavily in marketing and rely on nuanced revenue and profitability metrics such as:

- Average Order Value (AOV) – To reveal areas of strength or weakness for your business, you can scrutinize the average dollar size of customer orders.

- Lifetime Value of a Customer (LTV) – This metric tells you how much customers spend during their entire journey with your company.

- Customer Acquisition Cost (CAC) – In a marketing-driven business, CEOs must focus on the total cost of gaining that business and how it compares to AOV and LTV.

Software as a Service (SaaS) or Subscription Business Key Metrics

Subscription-based businesses build long-term relationships with customers and aim to compound their earnings each year, which means they focus on metrics like:

- Monthly Recurring Revenue (MRR) – Companies focus on revenues that recur every month or year when one-time purchases aren’t meaningful.

- Lifetime Value of a Customer (LTV) – How much total revenue will the company earn if the average customer stays with the company for three years?

- Customer Acquisition Cost (CAC) – How much does it cost to gain a customer?

- Churn Rate – What percent of customers do you lose over a specific time period?

Financial Metrics for Manufacturing

In manufacturing, you must produce quality, cost-effective products on time while keeping the work environment safe. Therefore, such businesses often focus on metrics such as these:

- Inventory Turns – How quickly do you sell the product you make?

- Defect Density – How many products become damaged during production as a percentage of the total number produced?

- Capacity Utilization – How much available capacity do you have in your manufacturing process?

Services-Based Business

When a business relies on human capital for generating revenue, the metrics of interest are quite different. Services-based businesses measure:

- Billable Hours – The amount of time spent on client work vs. administration.

- Average Billing Rate – How much do you charge for client work?

- Utilization Rates – Is your team efficient with their working hours?

How to Choose the Financial Metrics and KPIs to Track for Your Business

Earlier I mentioned that it is best to focus on just a few metrics that indicate whether your company is on track to meet its goals. And, in most cases, this means you will selectively measure some variation of revenue growth, gross margins, and net income. But when you’re ready to pinpoint the most important metrics for your business, follow these steps:

- Build a Financial and Operational Model – Capture your historical revenue and expenses in a spreadsheet, then plot out your projections for the next twelve months.

- Set Goals – Document the targets you need to hit over this same timeframe.

- Identify Potential KPIs – Reflect on the data from steps 1 and 2 to identify your business’s most meaningful and actionable metrics. If you come up with more than a handful, work with your team to whittle the list down.

- Review Your Financial Data – Once your team is in alignment, make sure you have the necessary systems in place for tracking your financial KPIs.

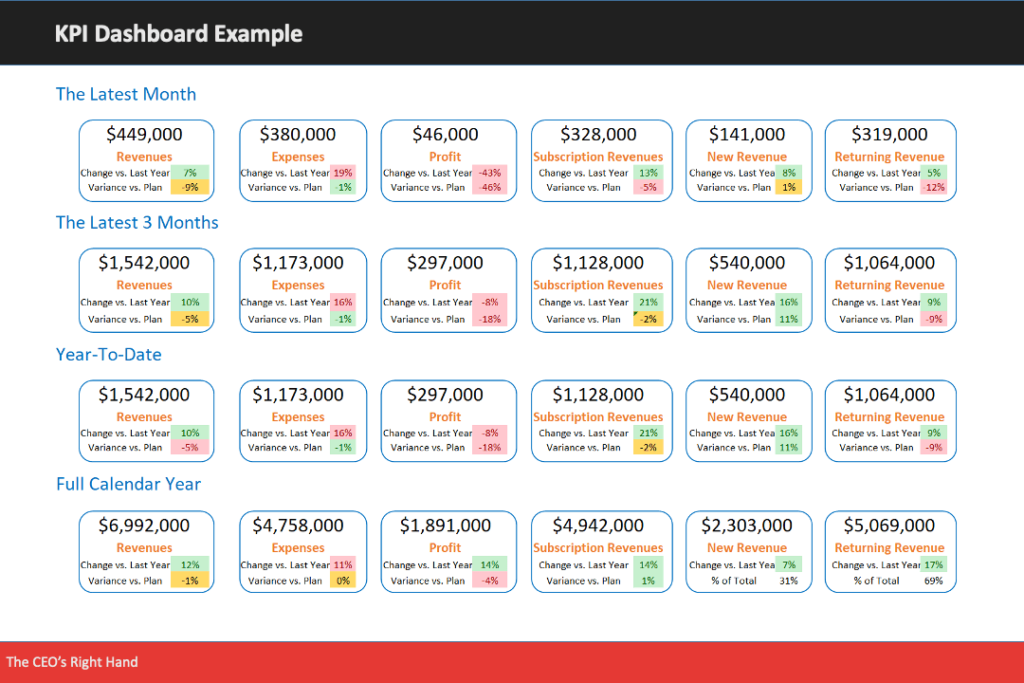

- Build a KPI Dashboard – Create a new tab in your financial and operational model and build a KPI dashboard. Set it up to pull information automatically when you update your numbers each month.

Then, every month, go over your numbers and analyze them for trends to ensure your company is on track. And be sure to revisit this process and make any necessary adjustments as your priorities change.

The Bottom Line

In the world of finance, we live by the saying, “if you can’t measure it, you can’t manage it.” As the CEO, however, you must avoid getting caught up in the details. Although every CEO should know the financial metrics above, I’d encourage you to focus on financial KPIs and track them over time. This will empower you to spot and address problems, benchmark your results against others in your industry, and set up relevant comp plans to reward your team’s performance.

At The CEO’s Right Hand, identifying such metrics is one of the first things we do when working with new clients, as it helps us find ways to fuel the company’s growth. Contact us today to learn what we can do for you.