As a Fractional CFO, I enjoy working with CEOs of service-based companies because they often possess valuable and fascinating industry knowledge. Yet, I have noticed that while these experts may be familiar with financial statements, many don’t know how to use them to make decisions. This is nothing to be ashamed of – it is impossible to be an expert in everything. Still, it is essential to understand the basics, so in this post, I will explain how to read an income statement for a service company in layperson’s terms and how to apply that information.

Incidentally, I was recently a guest on a Collective 54 podcast, discussing this topic with the host. Feel free to check it out for more information.

What is an Income Statement?

An income statement (a.k.a. profit and loss or P&L statement) is a financial document showing how your business generated and spent money to produce profit over a certain period of time. In other words, it compares your revenue streams and associated expenses to demonstrate how your business activity contributed to your operational health. Most companies create an income statement monthly, quarterly, and annually, but you can adjust that timing to suit your needs.

The income statement is one of three vital financial statements used to track and manage your company’s financial performance. The other two statements are the balance sheet (a snapshot of your accumulated assets and liabilities) and the cash flow statement, which shows how cash moves in and out of your organization.

How Do Business Leaders Use Income Statements?

Knowing if your business generated a profit during a specific timeframe is essential and simple to determine if your data is sound. In general, you were profitable if your total revenue was greater than your total expenses. But that’s only part of the story.

To tap into the true power of the income statement, business leaders set goals and then use the information in their statements to document their progress over time. That enables them to spot trends and project forward into the future to see what could happen if specific trends continue. In doing so, they avoid problems and harness opportunities to stay on track.

You will also use your income statement when filing taxes and sharing your story with key stakeholders. For instance, suppose you wish to pursue funding or explore a merger or acquisition. Anyone interested in engaging with your business this way will expect to see your income statement (and other financial records) because they provide insight into how you manage the company and what will likely happen.

But no one expects you to do this in a vacuum. As the company’s CEO, it is vital that you understand and can explain your income statement. However, ideally, your team will help. In a well-run business, the CEO regularly meets with their CFO (or fractional CFO) and others on the executive team to read and analyze their numbers. They ask the CFO to read between the lines and explain what the numbers mean about how the business is doing. Then, they discuss and make plans to address any concerns.

To prepare you for that discussion, let’s go through an example income statement for a service company step-by-step.

How to Read an Income Statement for a Service-Based Company

Below, I will share an example income statement for a service company, but first, let’s start with the basics. Service company profit and loss statements will ideally show revenue and expenses broken into the following components with subtotals (the indented lines below):

- Revenues

- Cost of Revenues

- Gross Profit = revenues minus cost of revenues

- Operating Expenses

- Operating Income = gross profit minus operating expenses

- Other Expenses

- Net Income = operating income minus other expenses

However, your income statement may look different. Service companies often start with all expenses under one “expense” category. But if you wish to use your statement to run your business, you will need more granularity for benchmarking and analyses.

Let’s discuss each of these components further. Then, I will share a few things you can learn from reviewing the numbers.

Revenues

The income statement for a service company typically shows money earned from delivering services, most of which is labor-related. For instance, you may generate revenues based on hourly services performed, fixed-bid projects, membership fees, license fees, etc. Breaking each revenue stream into a separate line item for future analysis is best.

Accrual vs Cash-Based Accounting (Revenue Recognition)

For most professional service companies, we recommend accrual-based rather than cash-based accounting for accurate insights into your business’s operating performance. With accrual-based accounting, you record (recognize) revenues when earned (i.e., when you perform the work), whereas with cash-based accounting, you recognize revenues when you receive payment.

If you, like many, started with cash-based accounting, switching to accrual-based accounting will be an effort, but it is a one-time investment that is well worth it for two reasons.

- Accrual-based accounting is necessary if you wish to use your financial statements to make the management decisions I describe below. It allows you to compare apples to apples, leading to better insights.

- Lenders and potential investors expect to see accrual-based financials, so you must make this switch before pursuing any growth plans requiring external capital.

Cost of Revenues

Any costs directly associated with delivering your services should be included in the “cost of revenues” category. This includes labor costs (full-time employee salaries, subcontractor costs, associated taxes or benefits), materials, and fees. Some firms label this category “cost of sales,” and product-based companies typically use “cost of goods sold” (COGS).

Operating Expenses

Operating expenses (slang: OpEx) include any costs for operating your business that are not directly associated with delivering services yet necessary for the day-to-day functioning of your firm. These include owner compensation, insurance, rent, technology, payroll, sales, and marketing costs (including client perks like gifts, dinners, etc.).

We typically recommend grouping these costs and documenting which line items belong in each bucket for accurate tracking. I realize this may sound tedious, and it can be, but it is also vital. For instance, you can establish categories for sales, marketing, client success, administrative expenses, etc., and then use the information to:

- Calculate your return on investment for specific marketing or sales initiatives.

- Benchmark your results against other firms like yours to see where improvements can be made.

- Ensure that expenses do not exceed your budget.

- Communicate with people outside your organization as opportunities or issues arise. For instance, if someone expresses interest in acquiring your firm, they will expect to review these numbers.

Other Expenses

Anything outside of your cost of revenues or operating expenses should appear under other expenses. But it might surprise you that many items – fees, expenses, and losses- land in this bucket. So again, you will need to categorize them appropriately for tracking purposes. For example, late fees (that you pay or charge customers), debt interest, income taxes, bad debt, and any depreciation or amortization would fall under other expenses.

You may have seen my note that “OpEx” is slang for operating expenses. There is also slang for capital expenses (“CapEx”). Capital expenses include equipment or large software purchases you depreciate or amortize over time. You may hear these terms occasionally because leaders must sometimes decide strategically whether to record purchases as OpEx or CapEx. We don’t see CapEx much with service companies, but this occasionally happens.

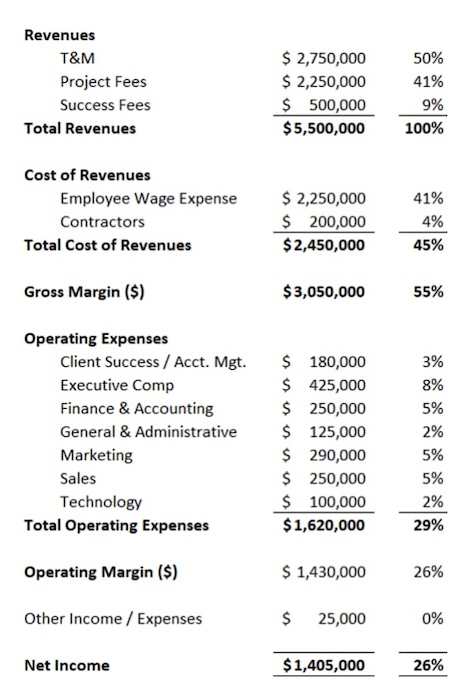

As promised, here is an example income statement showing the above components. Please review it to ensure that you now understand each category.

Gleaning Insights from an Income Statement for a Service Company

An income statement can provide incredible insights if you read between the lines. But like most things, these insights can vary depending on your growth stage, goals, and service area. Below, I provide a few examples of what you might look for. Still, I strongly encourage you to ask your CFO for guidance specific to your business because each of these figures (and many others) can either tell the story of your success or be a red flag, depending on the audience. That said, here are a few things the CEOs I work with care about.

EBITDA

When discussing income statements, you may hear the term “EBITDA.” EBITDA stands for Earnings Before Interest, Taxes, Depreciation & Amortization. Sometimes, we can estimate a company’s worth by multiplying EBITDA by an industry-average multiplier. Therefore, if you eventually want to sell your company, you might track this figure as one of your KPIs. Since most service-based companies have little depreciation or amortization, their EBITDA is typically equivalent to operating income.

Operating Margin

Operating margin is a ratio you can calculate by dividing operating income by total revenues. It is a significant number to watch because it tells you how much money your business makes after paying the necessary costs of running your company, but before backing out taxes, interest expenses, etc., as a percentage of your revenues.

In the example income statement above, we show a 26% operating margin, which some business owners might feel is good if comparable to industry benchmarks. However, an investor might look at that exact figure and argue that it could be higher.

Recurring vs. Non-Recurring Revenue

A recurring revenue stream is when you receive set fees for your services and expect to continue receiving them over a period of time. Subscription, membership, or flat retainer fees are examples of recurring revenue. This differs from repeat sales or one-time purchases, which are non-recurring revenues. For instance, if clients pay you on a time and materials basis, that is non-recurring revenue, even if you work for them monthly and the arrangement has existed for years.

Recurring revenue is less risky and, thus, more valuable. So, having at least some recurring income is wise, especially if you eventually wish to impress potential lenders, investors, or buyers and maximize the value of the business. Therefore, I encourage my clients to track the percentage of recurring revenue vs. non-recurring revenue as a KPI and look for ways to improve that number.

Revenue per Person

Another great metric to track is revenue per person (a.k.a. revenue per head or employee). To arrive at revenue per person, take your net revenues (after discounts/credits) and divide that number by the total number of people you employ to run your business (including subcontractors, i.e., full-time equivalents). Once you know that number, use it to gauge your business’s success by asking questions like the following.

- Is our revenue per person increasing or decreasing, and what does that mean?

- How does this figure compare to industry standards?

- When viewed in the context of your long-term goals, how will that number need to evolve as you grow and scale?

- How might an investor view this number?

Answering Questions

Of course, in the end, most CEOs also want quick answers to their questions. But the great news is that when you set up your income statement correctly and set goals, answers to your questions are much easier to come by. For example, service company CEOs often ask questions like the following.

- Are we reaching our goals?

When you set goals, you will likely also build a Key Performance Indicator (KPI) dashboard. Then, each month, you can use your updated income statement to refresh the numbers and review the trends to determine if you are meeting your goals and whether that is likely to continue. - How much money are we really generating?

This is a good question because your business might generate a lot of activity. But that can be misleading. If profits are consistently low, you won’t build wealth for your stakeholders or accumulate enough cash to invest in growth. When this happens, you must determine why your profits are low. Perhaps you’re not charging enough, your costs are too high, or your firm has developed inefficient practices. - Can we afford to ___________?

Analyzing your income statement makes communicating with your team and answering tough questions easier. It can help you understand whether you can give raises, hire more people, or invest in a new line of business and explore options for making these things possible.

The Bottom Line

Your service company profit and loss statement can be a fantastic tool for proactively managing your organization and sharing your story with stakeholders. However, we all know the adage “garbage in, garbage out.” So, first, ensure you understand the components your income statement should contain so you can read it confidently. Then, work with your CFO (or hire a fractional CFO) to establish good accounting practices, set goals, and develop a system for tracking progress. Finally, commit to reviewing the results each month with your team and using what you learn to make decisions.