As a fractional CFO, I have had the pleasure of working with business leaders from many industries. And they all ask the same essential question, “How can I build a financially viable company where people can thrive?” My answer is always the same, “Invest in a strong financial infrastructure because it will help you clarify what success means to you and develop systems for tracking progress and addressing issues so you can grow and scale with grace.”

But what does that mean in practice? In the following post, I will explain financial infrastructure and its components, then provide a simple example so you can examine your company through this lens.

What is Financial Infrastructure?

A company’s financial infrastructure encompasses the underlying people, processes, systems, and insights that support essential functions, keeping the business financially viable and running smoothly. You may be more familiar with the term in a macroeconomic sense. When people refer to financial infrastructure, they often mean the financial institutions, technologies, financial markets, etc., that facilitate the movement of money throughout the world. But in this case, we are referring to the microeconomic meaning, the mini economy that is your business.

Some find this concept easier to grasp with an analogy. For example, imagine your business is a house with an excellent paint job, name-brand appliances, and beautiful landscaping. You might get a good offer if you put that house on the market. But suppose the inspection reveals a crumbling foundation (leaky pipes, faulty wiring, and old ducts full of asbestos). In that case, the deal might fall through, or the buyer will negotiate a drastically lower price.

Likewise, some elements within your business form the foundation of your company. These are the back-office functions such as accounting, finance, human resources, and payroll, as well as the policies, procedures, data, and technology that tie everything together. Though critical, these elements are largely invisible and work behind the scenes to keep your organization economically healthy and moving forward as a cohesive unit. We call the combination of these elements your “financial infrastructure.”

Why is Financial Infrastructure Important?

With a solid financial infrastructure, expectations are clear, you resolve issues quickly, and your company runs smoothly. That leads to happy employees and a strong reputation, which makes you more attractive and valuable as a potential employer, partner, customer, or investment. And, as you might imagine, that also makes it easier to hit your revenue goals and pursue opportunities.

All business owners create financial infrastructure as a natural part of building a company. However, you must be mindful of how your infrastructure evolves because it is vital for creating efficiencies. As you grow, your infrastructure needs to grow and scale with you. In other words, with a well-designed, well-integrated financial infrastructure, revenues will go up faster than your expenses, and you will achieve “economies of scale.”

What are Economies of Scale?

The term “economies of scale” refers to business conditions that allow you to realize cost savings as you increase production. You can achieve economies of scale for many aspects of your business, but it doesn’t mean your costs won’t go up. Instead, it means you will become more efficient, so if you double your volume, expenses will go up somewhat, but not as much.

The concept may seem straightforward, but achieving economies of scale is not easy. Furthermore, while a proper financial infrastructure provides the necessary support to run the business, interact with customers, and close deals, poor infrastructure can have the opposite effect. For example, some find that as their business grows, they need to add back-office services at an equal pace, wiping out any potential increase in profit. Worse yet, sometimes costs go up quicker than revenues, destroying the company’s margins.

How does this happen?

Imagine you have a fantastic bookkeeper but a lousy accounting system or bad data. A rise in demand can magnify this problem, creating additional costs or a bottleneck. And now, imagine that this is just one of many problems, so as demand on your financial infrastructure grows, it begins to break down.

What are the Components of Financial Infrastructure?

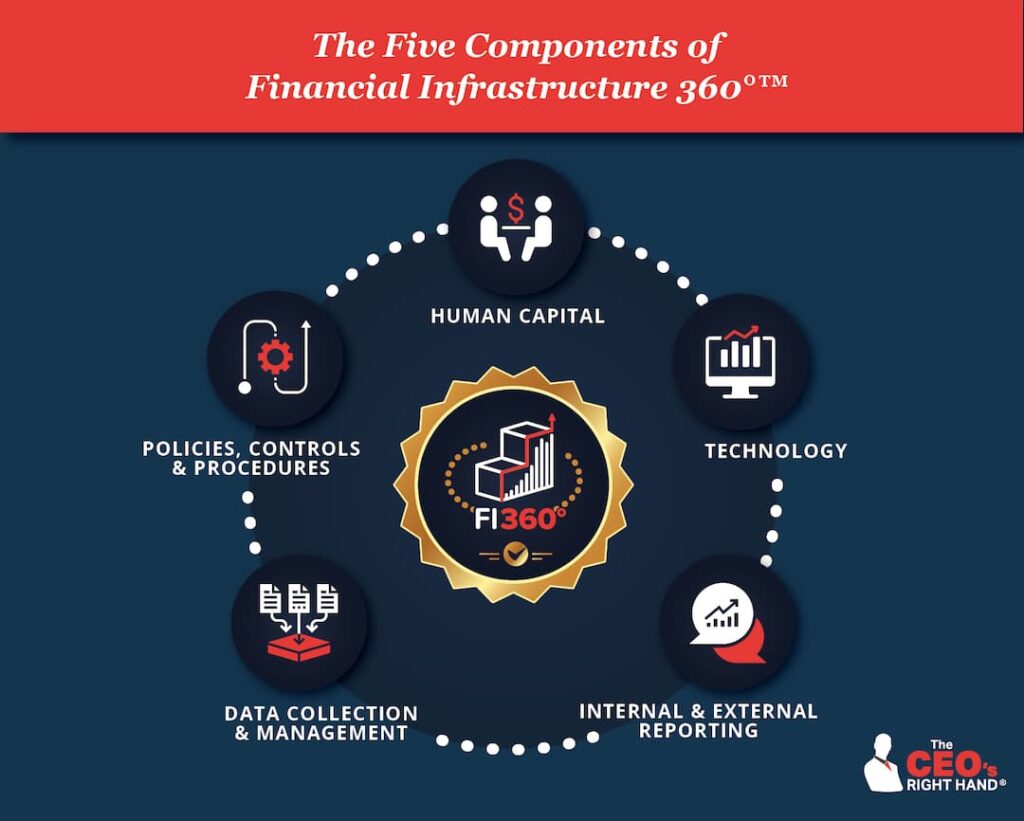

A company’s financial infrastructure comprises five critical areas of your business, human capital, technology, internal and external reporting, data collection and management, and, finally, your policies, controls, and procedures. Let’s take a brief look at each of these areas:

Human Capital

You cannot build a financially sound business and deliver a reputable product if you don’t have the right people, doing the right work and doing it correctly. And this challenge only becomes more daunting when you are ready to grow and scale because you must find a way to hire top talent while minding your budget. That means you need processes, tools, systems, and strategies for attracting, motivating, and training a finance and accounting team that can keep accurate books, perform complicated financial analyses, and lead your company in pursuing strategic initiatives like capital raising.

Technology

When companies are small, they often acquire disparate solutions for payment processing, expense reimbursement, timesheet management, billing, etc. But as you grow, you must constantly reassess and potentially consolidate these systems to ensure they remain efficient and up to date. Unfortunately, while that may sound obvious, many companies fall woefully behind and neglect to make changes until their technology creates more problems than it solves.

Internal and External Reporting

Most companies today generate massive amounts of data, but data is only valuable if you can reliably access and use it to generate the information needed to make business decisions. So, I strongly recommend that you carefully consider the types of reports you need to run your business, what those reports should contain, and the process for generating them. For example, you might need specific reports for internal use (for your executives and department heads) and others for sharing with your Board of Directors, lending institutions, investors, and tax accountants. Then, when your requirements are clear, you can use that insight to scrutinize your data collection and management practices.

Data Collection and Management

Once you know what reports you need, you must ensure that you can capture, store, use, and distribute the necessary data accurately and responsibly. For instance, how do you track money movement in, out, and throughout your organization? Do you have a consistent system for collecting and recording this information so you can be sure that your month-end reports are correct? If you suspect a data integrity issue, remedy the situation immediately because data problems can snowball, leading to poor decision-making.

Policies, Controls, and Procedures

As you shore up each area above, document your decisions and use those materials to guide your employees’ work. That will help you set expectations, maintain compliance with government and industry regulations, and eliminate inefficiencies. These documents typically take the following forms:

- Policies – guidelines for what employees should expect or how they should behave in certain business situations. Examples include expense reimbursement policies, revenue recognition policies, petty cash policies, inventory management policies, etc.

- Controls – documented practices that minimize the potential for fraud or costly mistakes, such as requiring executive approval for expenditures above certain limits.

- Procedures – step-by-step instructions for carrying out certain business activities. Commonly documented procedures include employee and customer onboarding proceedings, the month-end accounting process, or instructions for making travel arrangements.

Please understand that the above components are not in a particular order. Instead, companies will inspect and refine these aspects of their business incrementally as their business evolves and needs arise. Consider the following example to better understand.

A Financial Infrastructure Example

Imagine a fictitious marketing agency specializing in planning and executing ad campaigns for companies in the financial services space. The organization’s leaders are great salespeople who pursue and secure contracts with customers, then hire highly experienced freelance marketing professionals to perform the work. Although this simple business model is easy to manage at first, the company begins to experience growing pains as the business expands.

As its roster of clients grows, the company’s costs increase too. Highly skilled freelancers charge a premium for their work (as they should) and often require a minimum commitment. But in addition to paying their fees, the company must also find and vet these professionals, pay for tools and technology, and incur the standard overhead expenses inherent to running a business, so it is a struggle to turn a profit. If this company doesn’t examine its financial infrastructure and find a way to drive efficiencies, it may soon be operating at a loss.

Every component of financial infrastructure potentially has a role here. But in this case, I would suggest that the company’s leaders review each element in the following order and consider these recommendations:

- Reporting

In addition to its monthly income statement and balance sheet, this company needs a cash flow forecast. A cash flow forecast captures every detail of the company’s income and expenses, then projects forward at least 12 months, so its leaders can spot and address any issues with their plans and test scenarios.

For example, after laying out their financial data this way, the organization’s leaders may see that they are relying too heavily on seasoned freelancers and could reduce costs by pairing them with junior-level assistants. Or perhaps they will notice that they are spending a lot on tools and may be eligible for volume discounts.

- Data Collection and Management

Of course, the cash flow forecast report mentioned above relies on a steady flow of highly accurate data. Therefore, the information will only be helpful if they refresh the data each month and commit to performing an analysis. So, once they understand the inputs, they must examine how the company captures and stores those numbers and whether they can be confident in their accuracy.

- Policies, Controls, and Procedures

One of the things you can do to ensure that the numbers in a cash flow forecast are accurate is to document how you generate the data. For instance, this company relies on people (who sometimes charge by the hour) to deliver its services, so specifying how freelancers should track their time is a must. Although clients pay a retainer, this data is vital as it will help the company create fair proposals and monitor whether they remain fair over time. - Human Capital

Since finding and vetting freelancers is costly, this is another area where the company could seek efficiencies. For example, if the company’s leaders feel they should spend their time on other things, they could consider outsourcing this work. Or they could develop and document repeatable systems to streamline the process and build a great bench of freelancers, so they never find themselves scrambling to fulfill a new contract.

- Technology

This company relies heavily on the data it generates to run an efficient business and provide reports to clients, so keeping the organization’s technology current is critical. Presuming everything is running smoothly, they may not need to address this component but should watch for any issues and address them immediately.

Of course, the example above is highly simplified and focused on a discrete issue. The company is sure to encounter other concerns as it evolves. For instance, the organization may expand into new service areas or markets. When that occurs, its leaders will need to reevaluate and adjust their financial infrastructure to support the company’s continued success.

How Do You Know if You Have a Problem?

Like foundational issues in a house, signs of financial infrastructure problems can be subtle, no more than cracks in some cases. But if you allow these issues to fester, they will eventually get bigger, putting your company at risk.

The trick is to look for clues that certain functions are not performing at their optimal level as you grow. Naturally, signs vary widely from one organization to the next and across industries, but here are a few simple examples of red flags:

- As business ramps up, your accounting department gets behind on invoicing and doesn’t follow up to ensure that collection occurs promptly.

- Your finance team struggles to produce the financial reports you need for making decisions, citing unreliable data or a fussy accounting system.

- Hiring people to support your growing business is a massive challenge because your human resources team can’t keep up with the increased demand.

Financial Infrastructure: The Bottom Line

It is easy to get so caught up in running your business that you forget about the people, processes, systems, and insights that make it all possible. So, as you plan to grow and scale, take a hard look at your financial infrastructure because it may need some adjustments to withstand the pressure.

I realize this topic is complex and deserves further exploration. Our Financial Infrastructure 360° guide contains additional examples of infrastructure breakdowns, deeper insight into each component, and a checklist for rooting out issues. Download it today to learn more. Or, if you prefer a different format, check out this video.