Virtually all businesses engage in some form of budgeting as a non-negotiable part of running an organization. But how many prepare a cash flow forecast? In my experience, not enough. Yet, it’s an essential tool that makes confident decision-making easier.

Virtually all businesses engage in some form of budgeting as a non-negotiable part of running an organization. But how many prepare a cash flow forecast? In my experience, not enough. Yet, it’s an essential tool that makes confident decision-making easier.

In this article, we’ll discuss the importance of cash flow forecasting as a core element of sound financial management. We’ll cover the many advantages and potential drawbacks of cash flow projections and various approaches to the exercise. And, finally, we’ll explore the high-level steps involved in creating a forecast.

What is a Cash Flow Forecast?

A cash flow forecast (aka cashflow forecast) is an informed projection of a company’s future cash position. In other words, it’s a prediction of the amount of cash you expect to flow in and out of your business. It starts from your current position (based on recent financial statements and the cash balance in your bank account). Then it projects forward based on anticipated revenues and expenses.

While we can’t predict the future with 100% accuracy, we can draw on past experiences and data to explore likely scenarios and prepare for them. In this way, making and monitoring cash flow projections offers improved visibility into a company’s future financial conditions.

Cash flow forecasting is most effective when paired with a budget. Think of your budget—likely an annual exercise—as strategic guidance that’s pegged to the business’ longer-term goals. Then overlay cash flow forecasts, which are typically updated more often—monthly, or even weekly when situations necessitate more frequent updates. These forecasts, which are more focused on the current and short-term environments, are incredibly useful when making tactical decisions.

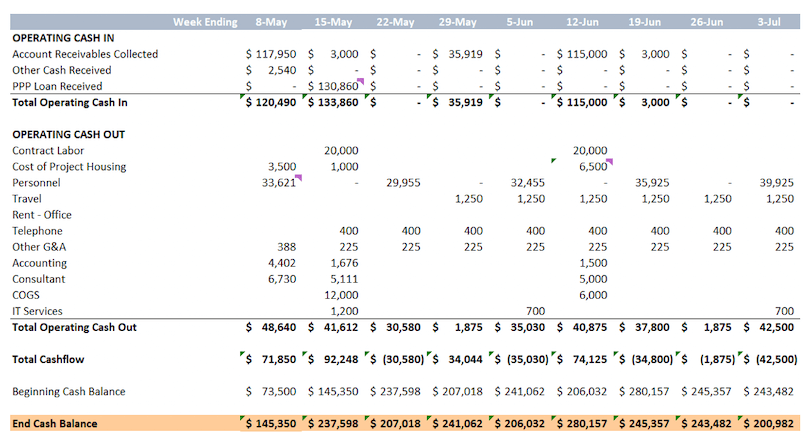

Cash Flow Forecast Example

Benefits and Drawbacks of Cash Flow Forecasting

Creating an accurate cash flow forecast may seem like a tedious task but remains an essential and beneficial tool in any business.

Potential advantages include the following:

- It allows a business to have some control over its future financial health. Cash forecasting helps management make informed decisions and confidently plan for short-term, medium-term, and long-term growth.

- Forecasting forces management to look deeply into the organization’s financial conditions and consider practical means to achieve its goals over a period of time. It encourages management to plan proactively and seek opportunities to increase cash flow when needed rather than relying on backward-looking income statements and balance sheets.

- It predicts a business’s ability to generate cash and highlights times of potential surpluses or shortages. This means leadership can see the likelihood of having enough cash on hand for existing operations, as well as for new initiatives such as an expansion or acquisition. Forecasting can also provide advance warning of a potential cash gap, allowing management time to implement mitigation tactics to prevent running out of cash.

- Cash flow forecasting helps a company visualize various scenarios and test their financial impact. For instance, management could enter different metrics for projected revenue growth (or decline) across a “base case,” “worst case,” and “disaster case.” This will help you see how different inputs affect potential outputs. Name any other important decision-making scenarios. Can your business afford to take on more staff? Should you consider changing suppliers? How would a change in price impact margins? Cash flow forecasting makes it easier to see all your options.

We should note, however, that forecasting isn’t foolproof. It can’t be 100% accurate because we simply aren’t able to fully foresee or control future events. You need to make adjustments as you go along to account for the changing market and economic environment. In this sense:

Potential drawbacks of cash flow forecasting include:

- There are unpredictable factors that the model can’t consider.

- Forecasts are only a rough estimate and might present a false sense of security.

- The output is only as good as the input. Forecasting involves contributions from multiple people across an organization who are responsible for different cash flows. Quality output is possible only when all sources of input into the forecast model are accurate and assumptions are grounded in reality.

- Making sense of data requires financial acumen. The numbers may be sound, but if there’s no capability at the management level to turn them into actionable takeaways, the work that went into forecasting won’t add much value.

Understanding Cash Flow Forecasting Models

Broadly speaking, there are two types of cash flow forecasting: direct and indirect.

The direct method is literally cash-based. This means the forecast accounts for all the expected sources (e.g., cash received from customers) and uses (e.g., cash paid to suppliers) of cash. Projections show the known inflows and outflows, which allows for greater accuracy for shorter-term forecasting. While simple, in theory, the direct forecasting method can become cumbersome if a company needs to account for a large number of transactions.

The indirect method, which is the more widely used approach, involves the balance sheet and income statement to analyze and predict cash flows. Forecasts start with the net income, then adjust for non-cash items such as depreciation. This is more useful for longer-term planning.

Both the direct and indirect methods have their uses, depending on the company’s specific needs. There may even be an advantage to employing both methods—for insight into shorter- and longer-term prospects—as resources allow.

Your organization may already have a template it prefers to use. If not, here’s a basic cash flow forecast template built into Excel that you can download.

How to Forecast Cash Flow

Step 1: Identify assumptions about receivables and payables.

Forecasts rely on assumptions. The assumptions and the underlying data for a cash flow forecast must be accurate and realistic in order for the resulting analysis to be of any use.

Assumptions can come from the company’s past performance. They can include insights gained from customers and suppliers, industry trends, and projections for the broader market and economy. Before detailing the actual numbers for income and expenses, identify key assumptions about:

- potential sales growth or slowdown;

- changes in cost (i.e., price increases by suppliers, price volatility of raw materials, etc.);

- cash timing (i.e., figures that relate to accounts receivable and accounts payable); and

- the potential impact of seasonality and inflation.

Step 2: Estimate your weekly or monthly cash inflows and outflows

A cash flow forecast needs to outline estimates for all sources and uses of cash. Data for cash inflows include receivables, revenues, loans, etc. Data for outflows include payables to vendors, payroll, rent, and loan payments.

Some not-so-obvious cash inflows and outflows to consider include any potential rebates and tax refunds, cash from asset divestments, or any fees and taxes. Regardless of how simple or complex the categories get, it’s important to make these estimates on an objective and conservative basis using only the most likely figures. Don’t let optimism run high in these numbers.

Step 3: Pull it all together on a roll-forward basis.

Starting with the amount of cash your business currently has, apply the identified assumptions to the inputted items. Then roll forward the previous period’s net result.

That’s a forecast in a nutshell. It can become more complex as business needs dictate. However, you can create a simple one by using the data in your historical financial statements (your income statement, balance sheet, and cash flow statement) and applying the appropriate assumptions.

Remember, the value of a forecast is only maintained when you watch it closely and keep it current. Continue to refine your projections, but don’t try to forecast more than about a year into the future. Too many variables and too much guessing can start to work against your efforts.

Cash Flow Management as a Key Driver of Business Growth

Sound cash flow management is essential to the survival and success of large and small businesses alike. Cash flow forecasting, although not perfect, is useful to that end. It encourages proactive planning, insight, and confidence in financial management. And it can help ensure a business stays on track toward its strategic goals while being able to maneuver tactically along the way.

The CEO’s Right Hand, with its deep bench of financial and operational expertise, serves as a strategic partner to business leaders looking to grow and scale. We would welcome an opportunity to discuss your business goals and innovative solutions toward achieving them.