The Chief Financial Officer (CFO) is one of the most important hires you will make for your company. This person will provide strategic financial advice to your C-suite and lead your accounting and finance teams, so it is vital to find someone you trust. Great CFO interview questions should help you find the right fit for your organization – someone whose financial expertise, strategic leadership skills, management style, and industry knowledge will help you minimize risk, make confident financial decisions, and build a viable business.

As a fractional CFO and accounting services provider, I often coach clients through such interviews and sometimes provide executive search services because when my team succeeds, our clients graduate from our services and hire full-time employees. So, whether you are looking for your first fractional CFO, a full-time hire, or are an aspiring CFO preparing for an interview, the questions below will help.

What Qualities Make a Good CFO?

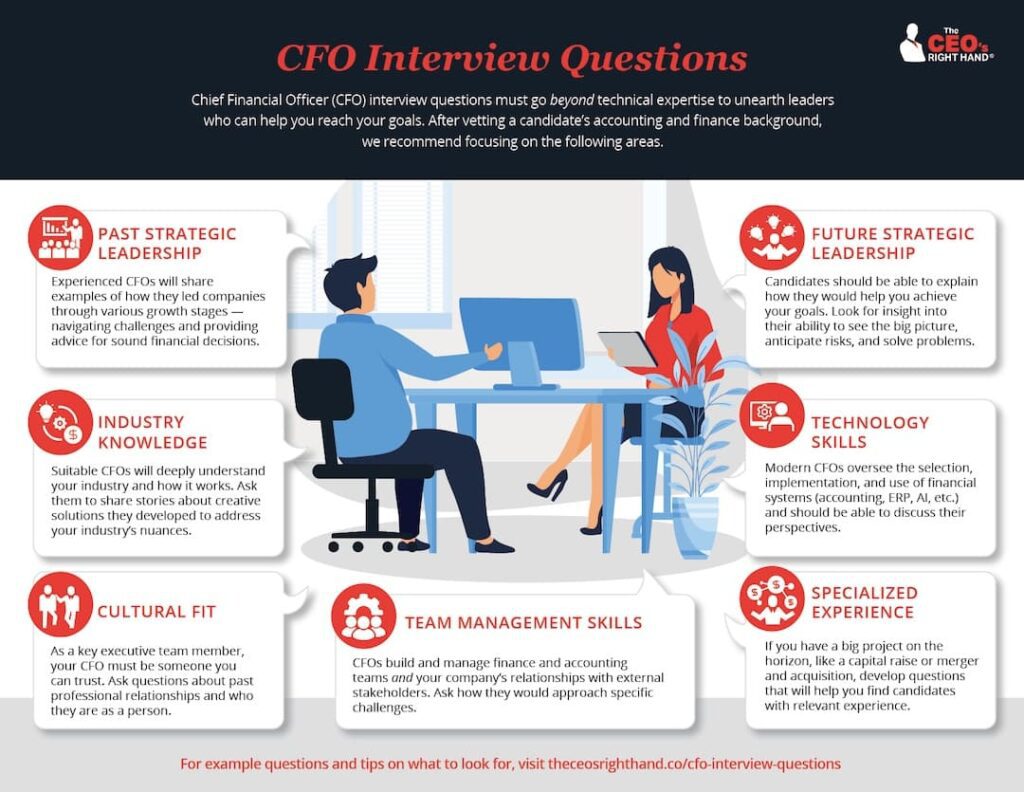

Since the CFO must build, manage, and lead your financial team, you need someone with a finance and accounting background. However, in my view, that is just the “minimum viable product” that is a CFO. Although you should prepare CFO interview questions to reveal any inadequacies, you will glean most of that information from the candidate’s resume and screening interviews.

More importantly, the CFO position is responsible for your financial strategy, which will vary depending on the industry and your organization’s size, setup, and plans. Therefore, I would encourage you to focus on whether the CFO candidate can help your company get from point A to B. In other words, you need a CFO who can examine your plans from a financial perspective, has strong problem-solving skills, and is passionate about your industry and what you do.

The No-BS Financial Playbook for Small Business CEOs

Are you tired of making costly financial mistakes? Stop guessing and start growing. Learn how to create a scalable and valuable company while minimizing risk with this playbook from a serial entrepreneur who has been in your shoes.

Check out our article “What Does a CFO Do?” for more details. However, you came here seeking questions to ask a CFO in an interview, so let’s get to it.

Chief Financial Officer Interview Questions

Most companies engage a team of people in the hiring process. The executive search firm or head of HR will develop a set of questions designed to weed out candidates who are unlikely to succeed. They will look for red flags such as a lack of specific skills or experience, an unwillingness to relocate or travel, or a mismatch in salary expectations. We don’t plan to cover such questions here.

As candidates move on to speak to others in the organization, the questions should be quite different. They should be broad, open-ended questions designed to help you understand if this person would be a good fit. For instance, the CEO will aim to determine if this person would be a strong partner and advisor in their quest to lead the company. Conversely, the Controller will be more interested in the candidate’s leadership style and may dig deep into technical requirements. Below are some interview questions for CFO candidates that are ideal for this stage. For convenience, you can also download them as a Word document.

Warm-Up Questions

Interviews can be uncomfortable, so start with a few easy questions that will help you establish a good rapport. That can be as simple as asking about a mutual connection or for clarification about the candidate’s background with questions like the following:

- I see you worked at the XYZ company. What did you enjoy about your time there?

- Why are you looking for a new opportunity?

- What do you find compelling about this role?

These questions will provide insight into what the candidate values in an organization and position while putting them at ease. Then, you can tell them more about what you want before launching into more challenging questions.

Questions to Reveal a Candidate’s Strategic Leadership Skills

As I mentioned earlier, the role of a CFO is very strategic, so a CFO candidate should emphasize the big-picture, long-term view. They should be able to explain what they have done (or would expect to do) to support a company’s strategic vision and financial goals as put forth by the CEO, board of directors, and executive team.

Human Resource Infrastructure 360°™

Don’t let costly human resource issues creep up on you. Learn about the 5 components of HR Infrastructure 360°™ - our proprietary framework for building and supporting your team.

As you listen to the candidate’s answers, look for insight into how they achieved their goals and how they work, not just as an individual contributor but as a leader. I find it helps to ask a general question first. Then, use that context to dive into their past while guiding them with follow-up questions.

- Tell me about the difference between growth and scale.

- What have you done in the past to help a company like ours grow or scale? What did you set out to achieve? What hurdles did you overcome, and how?

- Which resources did you rely upon to reach your goals and to propel that company forward?

- Which of those resources existed already, and what did you bring in?

- How did you manage or lead those resources?

- How did you convince people that what you needed to do was the right thing to do?

- What conflicts arose during that process (among people or between departments who may have been at cross purposes), and how did you resolve them?

If these questions aren’t quite right for you, here are a few more:

- Tell me about the financial roadmap for the last company you worked for. For instance, our balance sheet was like this when I started, and we wanted to sell the company in 3 years. How did you do it? What was your roadmap like, and how did you help steer the ship?

- Describe a difficult financial challenge you helped a company unravel. What plan did you propose, how did you implement it, and what were the quantifiable results?

- Pick a company where you have worked before and tell me about its vision. What was the vision when you started at that company? How did you help them achieve it? Or, if you didn’t achieve that vision, why not, and what could you have done differently?

“What could you have done differently?” is a fantastic follow-up question. Most of us have a failure or two in our background, and that’s fine and even expected. What matters is how you deal with such failures. A strong candidate will have a growth mindset and learn from every situation.

When you have exhausted your questions about the CFO’s past, you can ask them to apply a similar thought process to your organization. A motivated candidate will have done their homework and will come prepared to address questions such as:

- Please walk me through how you might grow a company like ours from $5 million to $50 million (or $50 million to $100 million, whatever is relevant).

- What challenges do you anticipate for a company in our growth stage?

- Given what you know about this company, where could you add value?

- What do you see as the external risks to our company’s success?

The answer to this question about risks will help you gauge the candidate’s industry experience and whether they understand the main drivers of your business. They might cite regulatory concerns, economic challenges, climate change, competition, etc.

- At this company, we have a board, and some of those board members are outside investors who sometimes have goals that differ from our company’s goals. For example, an investor might want to sell in three years, whereas the company may not. What have you done (or what would you do) in this situation? How would you coach our CEO on the appropriate way to handle this?

The candidate’s answer to this last question speaks to their investor and board relations skills, which differ from others. Overall, however, these questions about strategy allow you to gauge the candidate’s ability to anticipate and mitigate financial risk while keeping a company on track to meet its goals. They also help you assess the candidate’s people and communication skills, conflict resolution abilities, financial management capabilities, and strategic leadership skills.

Team Management and Leadership Interview Questions

Ultimately, the CFO is responsible for accurately reporting and analyzing the financial data and metrics that track your company’s financial success, but they cannot do it alone. In addition to interacting with your board, CEO, and others on your management team, they will build and run your finance and accounting department. The following CFO interview questions will help you understand your candidate’s prowess as a manager and leader.

- Given your knowledge about this company, please tell me what you would imagine doing in the first 90 days. What would be your plan?

- Please share an example of what might be on the agenda for your weekly finance and accounting meeting.

- How do you mentor your team? What kind of professional development activities do you encourage to grow their skills, help them become better team members, and guide them forward in their careers?

- How do you ensure your team feels challenged, valued, and engaged?

- How do you align your team with your company’s changing goals and keep them on track for meeting those goals?

- What is your approach to budgeting and forecasting, and how might you modify it for our organization?

- How do you hold people accountable? Do you use a framework like RACI (responsibility assignment matrix), or prefer a different system to track and manage your team’s responsibilities?

- What do you do to elevate yourself professionally? For instance, what networks do you associate with, and who do you talk to outside work to stay current and abreast of best practices?

- How have you used artificial intelligence (AI) as a CFO? Please provide concrete examples.

A good CFO understands that employee turnover is costly and that a healthy, motivated, and innovative workforce is the key to success. So, these questions reveal how this person will develop a winning team that can grow with the company.

Questions to Ask a Chief Financial Officer to Explore Specialized Experience

Every CFO should have the skills to guide their company through budgeting, forecasting, tax planning, tax preparation, and (gulp) an audit. They should also be able to set up and use your financial systems to pull financial reports, explore cash flow issues, and help you build a killer KPI dashboard. However, if you have specific plans, such as a capital raise or merger and acquisition, find someone with relevant experience. For a merger and acquisition, for instance, consider asking the following questions:

- Tell me about a time when you navigated a merger and acquisition event for a company.

- What kind of deal was it?

- What worked, and what did not work?

- If you were on the buy side of the acquisition, was it successful? If not, why, and what could you have done differently?

- Similarly, if it was an exit, was it successful? Why, and how might you have changed things?

You will likely have insight into what this person did in the past based on their resume or earlier interviews. The goal here, however, is to determine what they did. If their answers are vague or if they discuss what their team did, you can state this as a follow-up question. “What did you personally do to make that happen?”

Cultural Fit Questions

You will determine whether you would enjoy working with this person throughout your conversation. As you wrap things up, however, you can ask a few final questions to reveal more about the candidate’s personality.

- Tell me about the best CEO you have ever worked with.

- Now, tell me about the worst CEO you have ever worked with.

- If I were to ask your most recent CEO about their experience with you, what do you think they would say?

- What do you do for fun?

- If you weren’t a CFO, what would you do to earn a living?

- What are your career goals and aspirations?

CFO Interview Questions: The Bottom Line

The Chief Financial Officer is a vital management team member, so it doesn’t matter if you are looking for a fractional CFO service or a full-time CFO; the interview process will be similar.

Seek strong, passionate candidates who come to the interview prepared with relevant information about your company, stories about their accomplishments, and questions demonstrating a desire to find an environment where they can thrive.

In the end, the right CFO is the one who leaves you feeling relieved and confident that you have found a great partner to guide your financial decisions. Please reach out if you have questions or want to discuss how we can help.

Editor’s Note: This blog post was originally published in August 2021 and then updated for accuracy and thoroughness in May 2025.