Running a company is a juggling act. And while you know you cannot do it all yourself, it is not always clear what kind of help you need and how much you can afford. For example, most business owners quickly realize that they need a bookkeeper and someone to file their taxes, but when do you need a CFO?

In this post, we’re going to discuss the Chief Financial Officer (CFO) role, when you might need one, and how your requirements will evolve as you grow.

What is a CFO and What Do They Do?

A CFO is a strategic financial advisor who oversees the financial activity of your entire company. This person assesses the financial health of your business and compares it to your short and long-term growth plans. Then, they work with your senior executive team to develop and execute strategies for achieving your vision, given your financial constraints.

The CFO is also responsible for building and managing your finance and accounting team, and in some cases, they also own the human resource function. So, their day-to-day activities can vary widely, depending on the business’s structure, needs, and maturity.

When is it Necessary to Have a CFO?

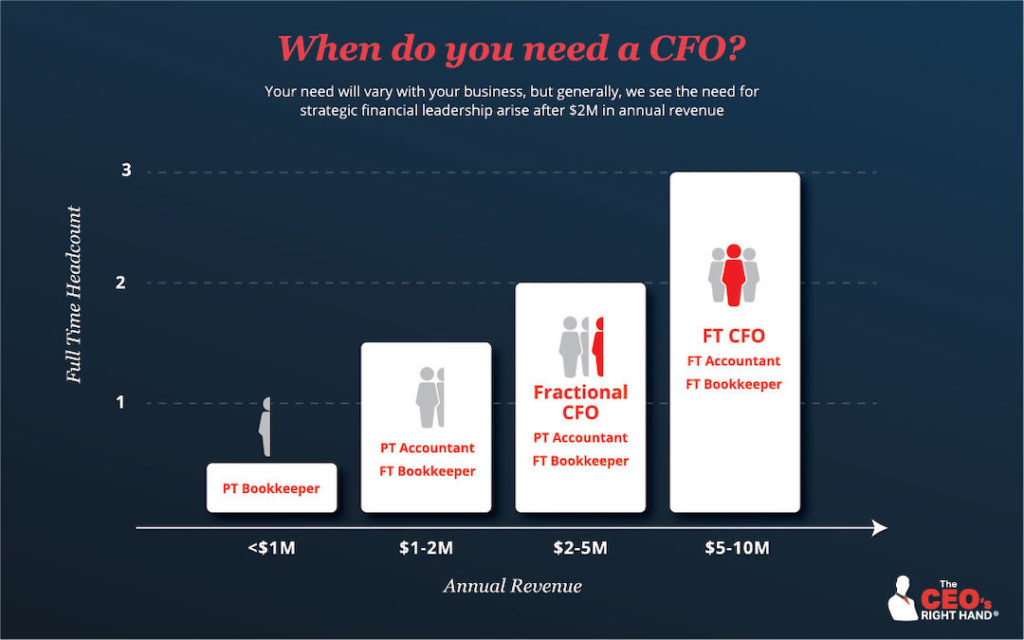

For most companies, the need for a CFO will start small and grow over time. Therefore, it is common to start by hiring a part-time CFO (also known as a fractional CFO or outsourced CFO) to handle special projects or provide advice before hiring someone full-time. But when do you need a CFO for such activities? Below are a few signs that you are ready for CFO services.

1. You Must Raise Significant Capital to Fund Your Growth Plans

Every small business owner needs funding to run their company. But in the early stages, it typically makes sense to pursue less expensive sources of capital, like friends and family investments or bank loans. As your company evolves, however, and you begin to make plans to grow and scale the business, your cash requirements will become more substantial.

For example, you may decide you are ready to branch out into a new market and need a million dollars (or more) to buy new equipment, hire people, and invest in advertising. However, instead of taking on more debt, you may wish to pursue equity financing, which requires unique expertise.

In this case, you would look for a CFO who has experience with capital raising. This person could work with you to set goals, assess your readiness, and help you put together your story. Then, your CFO would help you practice your pitch until you can confidently deliver it while fielding tough questions from prospective investors, significantly increasing your chances of success.

2. Your Business Model Requires C-Level Financial Expertise

Some business models are relatively straightforward and can function just fine for years with a bookkeeper or accountant. Others, however, are complex and require the analysis of a lot of operational and financial data. When this is the case, you need someone who can translate that data into actionable insights so your executive team can make decisions. Such businesses may need a CFO right away.

A good CFO will understand the “knobs and dials” of your business and will develop processes and systems to track the metrics and KPIs you need to spot problems and opportunities. They will take a long-term view and partner with you to help you achieve your vision. For instance, if you are running a manufacturing business, a good CFO will tell you if a problem in your shop is affecting your cost of goods sold (COGS) and make recommendations.

Human Resource Infrastructure 360°™

Don’t let costly human resource issues creep up on you. Learn about the 5 components of HR Infrastructure 360°™ - our proprietary framework for building and supporting your team.

3. Your Lack of Financial Leadership is Stifling Your Ability to Grow

When companies are just starting, the founders often wear multiple hats. However, as a company matures and begins to shift focus from achieving traction to growing and scaling, such practices are no longer sensible. So, if your CEO or COO is spending way too much time on finance and accounting-related tasks, it is time to look for financial leadership.

For example, imagine a company where the bookkeeper handles invoicing and bill payments, and the CEO must approve their work. As this company matures and there are more demands on the CEO’s time, they can become a bottleneck. Such a scenario could lead to cash flow problems and unhappy employees or vendors.

This generally occurs when companies reach around $2-$3 million in annual revenues. It is time-consuming to keep the machinery of such a business running, so you need to delegate. A CFO will set up processes and keep an eye out for any accounts receivable, accounts payable, or vendor issues that could stifle your growth. They also own your banking relationships, negotiate your insurance needs, and manage real estate transactions.

4. You Are Unable to Make Financial Decisions with Confidence

People often seek C-level financial advice when they want to make certain investments in their company but are uncertain if they can afford them. For instance, you might hire a CFO to answer questions such as:

- What will happen if I invest in a new technology that promises an ROI? How long will it take for the technology to deliver results, and what will happen to my cash flow in the meantime?

- Can I afford to open another location or branch out into a new market?

- Is there a way to lower my prices while keeping my profit margins the same?

- If I want to expand my product line, should I acquire a company or develop and build the new products myself?

To arrive at a recommendation, a CFO will review your financial reports to understand the available information. Then they will work with your team to fill in the gaps. For example, nearly every bookkeeper will produce basic financial statements, like a balance sheet and income statement. But a CFO will take the next step by helping you develop and analyze the reports you need for strategic financial planning, like a budget and cash flow forecast.

5. A Merger, Acquisition, Expansion, or Spin-Off is on the Horizon

Similar to capital raising, when you’re thinking about acquiring another company or spinning off a business unit, it is essential to have the right expertise at hand. In this case, an experienced CFO would partner with you to explore the various options and make a financially sound decision. Then, when you’re ready to move forward, they will help you find funding, communicate with stakeholders, and set up the appropriate business structures. Finally, they would stay involved to help with the integrations and develop processes while providing strategic advice.

6. You Need to Overhaul Your Financial Infrastructure

Your financial infrastructure will be relatively straightforward in the early days of your business, consisting of little more than a basic accounting solution and a few simple processes and controls. As you grow, however, your needs will become more complex.

For example, you might need to upgrade your accounting solution to something more scalable that can integrate with other systems, like your ERP solution. And you will likely need to expand your processes and controls to spell out your hiring procedures, expense reimbursement policies, compensation packages, and diversity practices.

A good CFO will work with your finance, accounting, and human resources team to ensure that your company gets suitable systems in place and adheres to best practices.

7. You Need an Executive-Level Presence to Communicate Financial Data

The best CEOs recognize their strengths and weaknesses and look to hire people with complementary skills who can help them succeed. For instance, some CEOs are fantastic salespeople, marketers, or product engineers but lack financial acumen. If this is the case for you, consider hiring a CFO to develop and present your financial reports (and answer tough questions) in meetings with investors, bankers, your board of directors, or even your executive team. Such a presence will make everyone more confident in your ability to achieve the company’s goals.

Many other business situations could warrant financial expertise, but I imagine you have the idea by now. Essentially, anytime you find yourself asking strategic financial questions that your current finance team can’t answer, you might benefit from a CFO.

When is a Full-Time CFO Necessary?

Some companies can get along for years without hiring a full-time CFO. But when do you need a CFO full-time, and when will a fractional CFO do? Well, it all comes down to your requirements and how much you can afford.

The cost of an outsourced CFO can vary greatly, depending on the scope of your needs. In general, however, an ongoing relationship will run somewhere between $6,000 and $12,000 per month, or $72,000-$144,000 per year. In comparison, a full-time CFO will cost anywhere from $300,000 to $400,000 annually, including bonuses, benefits, equity incentives, and overhead.

Many companies work with a fractional CFO first, then transition to a dedicated resource later. And, since the CFO’s job is to help your company grow and scale, a good fractional CFO will consider it a win when you’re ready to move on. They may even guide you through the transition by bringing in an outsourced human resources service to help build your finance and accounting team and eventually hire a full-time CFO so that they can step back into a more advisory role.

When this is the case, an engagement with a fractional CFO will look something like this:

The Bottom Line: When Do You Need a CFO?

If you are facing a complex financial problem or need strategic advice so you can grow and scale with confidence, it might be time to hire a CFO. But, often, you can start with a fractional CFO first, then add more services as you evolve.

Like any critical role, take your time finding the right person. If possible, get a human resources expert involved. Or, at the very least, ask your network for recommendations so you can find someone with a good reputation that you can trust. And be sure to check out our post on CFO interview questions before meeting with candidates.