A common challenge for many small and mid-size business owners is the financial side of running a company. Analyzing financial performance and planning for future growth isn’t easy and consumes valuable time. You want financial insights and advice to guide your business decisions, but full-time CFOs (Chief Financial Officers) are expensive. Fractional CFOs offer a solution to this problem, so I explain what a fractional CFO is, what they do, and how to hire one below.

What is a Fractional CFO?

A fractional CFO (aka outsourced CFO or part-time CFO) is an executive-level financial professional who works with organizations to develop financial strategies, offer advice, and solve money problems. Unlike a full-time CFO or interim CFO, who typically oversees and manages all financial operations for one company, a fractional CFO generally works with multiple companies as needed. Their duties range from solving one-off tactical issues to serving as long-term strategic financial advisors.

A fractional CFO provides high-end knowledge and financial expertise at just a fraction of the cost of committing to a full-time CFO, making this a compelling and cost-effective option for many businesses.

What Does a Fractional CFO Do?

A fractional Chief Financial Officer can perform the same functions as a full-time executive, just on a part-time basis. In short, a CFO leads a company’s administrative, financial, and risk management operations, including developing and implementing long-term strategies. It’s a big job, so consider your needs, goals, and the time commitment you would expect before looking for a fit.

The No-BS Financial Playbook for Small Business CEOs

Are you tired of making costly financial mistakes? Stop guessing and start growing. Learn how to create a scalable and valuable company while minimizing risk with this playbook from a serial entrepreneur who has been in your shoes.

For example, a fractional CFO can help you raise capital to invest in product development or expansion, supporting a strategy for accelerating growth. They could also work with your team to analyze your finances and build a better cash flow management and forecasting system, making it easier to grow without raising capital. Although these tasks are related, each requires a different approach.

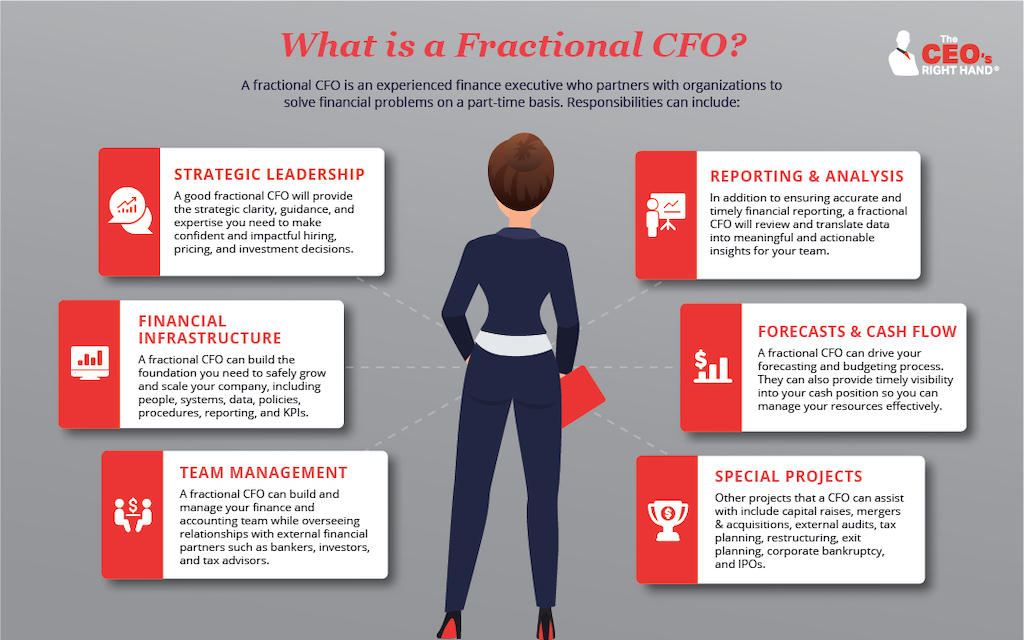

Below is an infographic summarizing the responsibilities a fractional CFO might assume. Feel free to download a copy for future reference, then read on for the details.

Strategic Leadership and Team Management

A CFO’s role is very strategic. They look to the future, drive goal setting, and lead their team in streamlining processes and creating the infrastructure to support your company’s ability to grow and scale. In doing so, they ease decision-making about the following and more:

- Short and long-term growth strategies

- Expanding or reducing your staff

- Setting budgets

- Employee compensation plans (stock options, equity, etc.)

- Investments in equipment and property

Said differently, CFOs help CEOs develop strategic financial and operational plans and pursue their visions by removing obstacles and tracking the firm’s progress over time.

Companies typically hire fractional CFOs for this work when they lack the resources or skills in-house or want an outside, unbiased opinion for strategic planning purposes.

Financial Infrastructure Development

A fractional CFO becomes a trusted partner to the CEO and others on your management team. Their role is to examine your plans through an economic lens and eliminate any surprises associated with the budget. For this, a robust financial infrastructure is vital. It ensures a well-run administrative, finance, and risk-management function and the development of the financial insights you need to make confident decisions. Key aspects of financial infrastructure include:

- A talented and well-supported accounting and finance team

- Financial technology that is current and properly configured

- Reliable internal and external financial reporting, including cash flow forecasts and key performance indicator (KPI) dashboards

- Rigorous processes and procedures for data collection and management

- Policies, controls, and procedures guiding essential business activities

Financial Challenge Resolution

Sometimes, companies encounter financial challenges that require the technical savvy of a CPA and the strategic vision and business consulting skills of a CFO. These typically arise as unique, one-off scenarios and are perfect opportunities to tap into a fractional CFO’s expertise. When this is the case, look for a financial expert with experience in resolving your specific issue. Examples include:

- Creating a financial package to share with prospective lenders

- Preparing a go-to-market strategy for pursuing equity funding

- Overhauling existing accounting systems

- Navigating an external audit

- Identifying cash flow or gross margin issues

- Business exit planning

- Preparing for a merger or acquisition

What Are the Benefits and Drawbacks of Fractional CFOs?

Given that a fractional CFO will become a key player on your executive team, it is essential to consider the arrangement’s positive and negative aspects. For example, benefits of working with a fractional CFO include:

- Top-Tier Expertise for Less

A fractional CFO offers the knowledge and expertise of a high-end CFO at a fraction of the cost. Not all companies require a full-time employee to help with strategic financial management. With a fractional CFO, you only pay for what you need, and (depending on who you hire) they might also help you find other fractional resources, like bookkeepers. - Specialized Skills for Specific Projects

Fractional CFOs can tackle one-off financial challenges, so some develop expertise in certain areas. Hiring a specialist to review your situation and share their perspectives with your team can help you develop creative, out-of-the-box solutions.

But, of course, there are some drawbacks to consider:

- No Skin in the Game

If the compensation package does not include equity, some worry that a fractional CFO’s incentives will conflict with the rest of your team. However, professional fractional CFOs have well-developed pricing structures (to ensure fair compensation) and a reputation to protect, effectively mitigating this concern. - Delayed Growth of Internal Talent

Leaning too heavily on a fractional CFO or an outsourced accounting team can reduce the need to grow in-house talent and knowledge. However, most companies see this as a worthwhile trade-off. Just look for someone willing to pass the baton (or even help with hiring) when it’s time to bring the function in-house.

How Much Does a Fractional CFO Cost?

Most fractional CFOs charge by the hour or day, so the cost depends on your needs. You might hire a fractional CFO for a one-time project or set up a retainer arrangement for regular financial guidance and advice.

Generally, an ongoing relationship with a fractional CFO will cost between $6,000 and $12,000 monthly. Agreements with small to mid-sized companies typically fall between $5,000 and $7,000 a month.

For comparison, a full-time CFO’s salary will vary depending on industry and location, but an average base is $225,000-$275,000 per year. Factor in bonuses, benefits, equity, and overhead; you could be looking at over $300,000-$400,000 annually. That means hiring a CFO on a part-time basis can deliver upwards of 70% in cost savings.

Use our full-time vs. fractional CFO calculator to tailor the math to your situation.

When Should You Hire a Fractional CFO?

The need for a CFO varies depending on the business. Some small companies with simple business models can do fine with only a bookkeeper or CPA. Others find they must hire a fractional CFO immediately to help establish the business, choose revenue models, and pursue funding. That said, it is likely time to seek executive-level financial advice when you find yourself struggling to answer questions like the following:

- Can we afford to acquire a business, hire more staff, or expand into a new market?

- If not, what steps do we need to take to raise capital?

- How can we create the efficiencies necessary to grow and scale?

- What can we do to make the business more attractive and valuable to potential buyers?

- How long will it be before we run out of the cash required to run this company?

- What mechanisms can we put in place to make financial decision-making easier?

How Can You Find the Right Fractional CFO for Your Company?

Like many executive roles, the best CFOs are in high demand and, consequently, not easy to find. Yet it is crucial to be selective, holding out for someone who has experience in your industry and is a good fit for your team.

Although you could browse LinkedIn or freelancer platforms, it is often better to ask your network, CPA, or attorney for recommendations. Alternatively, look for a fractional CFO service to find and vet the right CFO for your business and serve as a resource for related professionals.

Finally, be sure to screen any candidates thoroughly. You are welcome to use our list of CFO interview questions to prepare. A good fractional CFO will be qualified and trustworthy – two vital characteristics for anyone handling your finances. They should also have extensive experience with companies in various development stages within your industry, and if you have a specific goal, seek someone who has accomplished it before and can share the results.

What is a Fractional CFO Service?

A fractional CFO service can handle all your finance and accounting needs. In other words, in addition to receiving outsourced CFO services, you gain access to an entire team of finance and accounting professionals to support the CFO role.

For example, the CFO would strategize with your leadership team to make high-level financial decisions and resolve complex financial problems. Then, they would delegate day-to-day responsibilities, such as preparing financial statements, building financial models, or completing taxes, to less expensive accountants, bookkeepers, etc. This division of duties can make a fractional CFO service an affordable one-stop shop, allowing you to delay hiring full-time employees until you really need them.

Consider downloading our “Building a Winning Team” resource to learn how a finance team can evolve as your business grows.

The Bottom Line

A fractional CFO will become a vital member of your executive team, the financial voice of your company, and (in some cases) possess the authority to make decisions. Therefore, finding someone with a solid professional reputation that you can trust is critical. At The CEO’s Right Hand, our fractional CFOs have decades of experience across multiple industries. We encourage you to reach out to discuss how we can help.

Editor’s Note: This blog post was originally published in June 2020 and then updated for accuracy and thoroughness in October 2024.