Raising capital is an unavoidable responsibility for nearly every business owner. The trick is finding a way to do so in the most efficient, flexible, and financially responsible manner. Equity financing may sound appealing, but it is not an optimal or even possible solution for every company. So, what is debt financing, and how does it fit into the capital-raising landscape?

The myriad of debt solutions can be confusing for many executives. Below, we explain debt financing, its role in the capital-raising ecosystem, and what to consider when deciding how to raise money for your organization.

Table of Contents

- What is Debt Financing, and How Does It Work?

- How Does Debt Financing Compare to Other Types of Capital Raising Options?

- Debt Financing Terminology

- Types of Financing

- Factors to Consider Before Taking on Debt

- The Advantages and Disadvantages of Debt Financing

What Is Debt Financing, and How Does It Work?

Debt financing is a transaction whereby a lender provides funds in exchange for a commitment to repay the lender over time with interest and, occasionally, fees. Sometimes referred to as debt capital or debt funding, it is a common way for businesses to secure the money needed to fund working capital and growth. For example, many companies borrow money to invest in equipment, real estate, an acquisition, or ordinary course working capital.

Although some business owners are wary of debt, so long there is an understanding of the benefits and commitments, there is good reason to consider debt financing solutions. Debt typically costs quite a bit less than equity over time. Therefore, debt financing can be a great way to fund your growth plans, presuming the financial analysis shows that the business can support the required repayment terms.

How Does Debt Financing Compare to Other Types of Capital Raising Options?

For most for-profit companies, equity financing is the main alternative to debt financing. Equity financing involves selling an ownership stake in exchange for capital and, in some cases, control or governance concessions. Equity capital is generally “returned” to the investor during a strategic or liquidity event such as the sale of the business, whereas debt repayment is contractually required.

There are numerous tradeoffs to both debt and equity financing, for instance:

Cost

The overall cost of debt financing is typically lower than equity capital because there is no dilution of ownership. Any profits or increases in valuation remain with the original owners, so the value generated typically exceeds the interest and fees associated with debt. In addition, debt financing costs are generally tax-deductible.

However, although the cost of debt is usually lower, the cash drain associated with debt financing can be challenging for early-stage, rapidly growing, or asset-rich, but cash-poor, organizations.

Timeliness and Flexibility

There are usually many more debt financing solutions available to companies than equity solutions. Also, since debt financing typically involves explicit repayment provisions and relatively straightforward agreements, it is easier and quicker to secure, even for large sums. For instance, sometimes you can raise debt capital within weeks, whereas equity typically requires months.

Availability

Companies without much history (early stage), weak or negative cash flow from operations, or limited assets are less likely to qualify for sensible debt financing solutions. In these cases, securing debt financing could require personal guarantees or pledges of “boot” collateral (personal cash or assets beyond what the business can provide). Equity financing can also be elusive in such situations, but possibly less so if the company has a good “story” and the potential to grow, ultimately achieving profitability.

Debt Financing Terminology

To shed light on what can be a dizzying array of debt financing options, we provide an overview below. However, there are a few terms you should know before we press forward:

- Covenants

The terms and conditions of a loan that restrict how you run your business while the loan is in place are called covenants. For example, the lender may require a certain level of profitability or limit additional debt.

Covenants help lenders manage risk, so the least expensive loans typically have many strings attached. Lenders enforce them by requiring the submission of regular reports. Breaches of covenants can represent a default but can normally be “cured” with a workout agreement. Failure to cure may result in the lender taking actions to remedy the situation, which can potentially pose a risk to and damage the business. - Warrants

Certain types of loans include warrants to sweeten the deal for the lender. Warrants represent a grant of equity ownership (and, in turn, an additional form of compensation) in specific scenarios, much like stock options. - Secured vs. Unsecured Loans

Secured loans are those where an asset is held as collateral, meaning the lender can take possession of that asset if there is a failure to pay. In contrast, unsecured loans have no collateral. Instead, the lender agrees to the loan based on your financials and credit score. Since secured loans are less risky for the lender, they tend to be less expensive.

Types of Financing

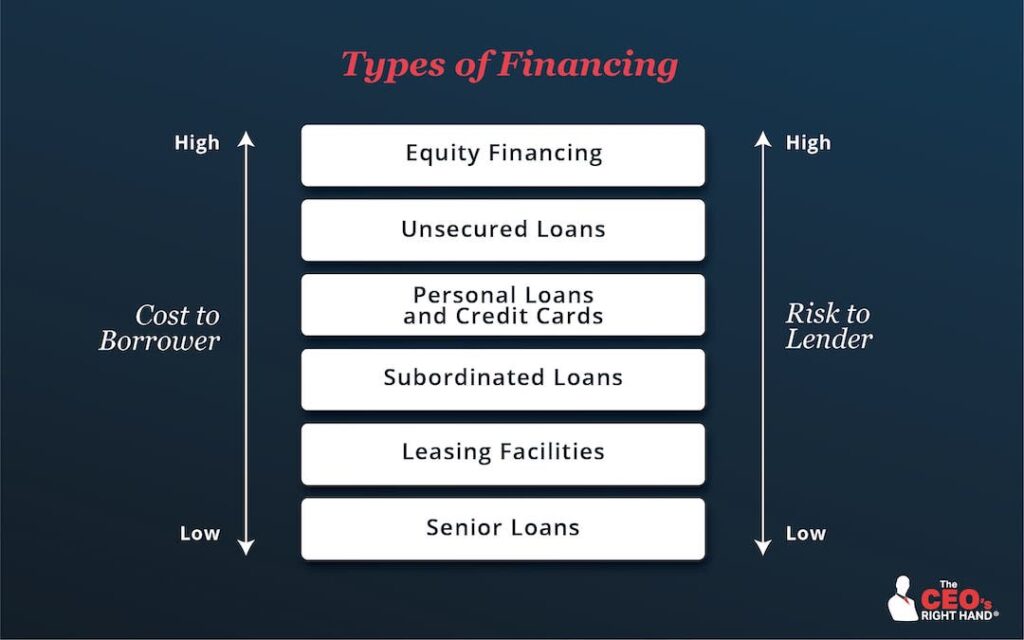

So, how do you break down the various funding options and make decisions? When working with CEOs and others on our clients’ executive teams, we like to show the hierarchy of debt and equity from the lowest cost of capital for the business owner (and lowest risk to the investor) to the highest. Please see the pictorial below:

Let’s look at each type of financing, starting with the least expensive option.

Senior Secured Loans

Senior loans are typically the most affordable form of debt financing because they pose the least risk to the lender. An asset lien secures the loan, so if the company defaults or files for bankruptcy, the lender has a legal right to take possession of the asset and secure repayment before other creditors or stakeholders.

The asset(s) offered as security could be anything of reliable value, such as cash, inventory, machinery, collectibles, or real estate. And sometimes, the lender will require a personal guarantee or boot collateral to support the loan.

Strict covenants and floating interest rates are also common with these loans to provide additional protection for the lender. Floating interest rates rise and fall with market rates, so business owners must factor some cost variability into their plans. Senior bank loans are available from money centers, regional banks, and specialty lenders and can take the form of a term loan or revolving line of credit. Government entities, like the Small Business Administration (SBA), also provide senior loans.

Lease Facilities

When you lease equipment, the equipment secures the loan, so leasing is generally considered a senior loan. However, we show it separately because it is usually more expensive for the business over time, has a longer duration consistent with the underlying asset, and involves a different structure.

For some businesses, leasing makes a lot of sense. The monthly payments are tax-deductible, relatively low (compared to a purchase), and like a “rental” agreement in that the business surrenders the equipment at the end of the contract. That makes leasing an appealing option for companies with less cash flow flexibility. Furthermore, if you need to upgrade the equipment by the end of the term, it can be a great way to deal with obsolescence issues.

Subordinated Loans

Subordinated loans are unsecured financing instruments whose repayment is junior in rank to a senior loan in the event of bankruptcy. To compensate for the higher risk, lenders charge more interest.

Despite the higher cost, subordinated loans can still play a valuable role in a company’s financial structure. For example, businesses sometimes find value in raising much-needed growth capital based on the company’s future cash flow (vs. specific assets representing lender security). The improved financial flexibility can be a powerful tool for driving improved growth and profitability.

Personal Loans and Credit Cards

The next tier (in terms of business cost) consists of loans that require no security but carry a significantly higher interest rate (roughly 25%). Credit cards and personal loans fall in this category. These loans are typically algorithmically based and represent good flexibility at a relatively high cost.

Unsecured and Secured “Hard-Money” Loans (Non-Bank Lenders)

Unsecured and even some secured “hard-money” loans are one of the more expensive debt financing options because they are typically available quickly with less documentation and provide fewer covenants, less diligence, and less time to complete. These loans generally carry high-interest rates, ranging from 15%-35%, and many require boot collateral and a personal guarantee.

Examples include peer-to-peer and online lenders, such as OnDeck Capital or Kabbage, as well as many cross-over lenders and hedge funds. These lenders can be a source of funds when options are limited, or a quick cash infusion is required.

Equity Financing

Equity financing is more costly than other types of funding. First, it takes significant time and money to prepare for and pursue. At the very least, you will need a business plan and pitch deck. Then, the investor will require ownership and control in exchange for the capital infusion, so pursuing equity financing is not a decision to make lightly.

It can help to consider the arrangement from the investor’s perspective. Equity investors are last in line for payment in the event of bankruptcy, and many small businesses fail, so they see these investments as highly risky. The only reason to take this risk is if there is also the potential for a high return.

Venture capitalists, who invest in private companies, typically structure their investment with a preferred equity component plus common equity. Such arrangements provide some protection and the potential to deliver a high return on their capital in the future.

Factors to Consider Before Taking on Debt

Given the array of debt financing choices and variability in cost, it is crucial to narrow your options to avoid wasting time and money. For example, consider the following factors to determine which types of financing might be suitable for your situation:

Your Company’s Business Model and Segment

How your company generates (or plans to generate) revenue can impact the types of funding available to you. For example, a business manufacturing auto parts will have significant capital tied up in manufacturing equipment. Presuming the company has healthy cash flow, using that equipment as collateral to secure a lower-cost debt solution might be a good option. Whereas early-stage, business-building companies with long-duration cash flow characteristics will often require equity investors to underpin the vast portion of their permanent financial structure.

The Organization’s Level of Readiness

Before pursuing financing, you will need a clean set of books and a business plan. A capital raising and repayment plan are required as well. Still, raising capital is challenging, and success will also depend on many factors and criteria, such as:

- Company size, cash flow, and asset base.

Certain types of financing are suitable for startups, while others are best for mature companies with healthy cash flow and assets to support the funding. - Your growth trajectory and potential.

Equity investors look for growth, scale potential, and rapid achievement of profitability. - Whether you have a product ready for market.

Although some venture capitalists invest in startups, they may require 30%-50% ownership of the company or more for “pre-revenue” companies. As a result, early-stage companies may wish to turn to “friends and family” at the outset. - Business profitability, the experience and credibility of management, and prospective ability to adhere to loan covenants.

Terms and conditions for senior and subordinated financing sources must match the supportive attributes of the business and its ability to deliver on performance, loan, and covenant criteria.

Whether a Funding Source is a Match to Your Goals

Low-cost debt financing is ideal if your goal is to close on a capital raise quickly, maintain full ownership and control, and optimize the firm’s value proposition over time. But sometimes, the amount of money you need or the speed at which you need it (or can repay it) can eliminate options. And sometimes business owners want more than money. So here are a few other considerations for evaluating financing options.

- To balance your sources of capital.

Too much debt on your balance sheet can hurt your company’s valuation and appear risky in the eyes of potential investors, buyers, or other capital sources. That could put you in a position where equity financing is your only choice. - High interest rates.

If your goal is to invest in growth, but the financing option imposes such a high-interest rate that cash flow will become a problem (slowing your growth), an alternative solution is advisable. - To offset high taxes.

Since interest expenses are tax deductible, in most instances, the expenses involved with debt financing can materially reduce the cost of the financing solution.

Access to management support or resources.

Sometimes business owners hit a point in their growth where they need support in addition to funding. Some equity investors offer a “win-win” partnership arrangement with access to new markets, an expanded network, or management training. - Mitigate risk.

Many founders (and their close relations) invest their own money in the company, especially in the early days. So, sometimes it makes sense to secure funding to extract their personal assets from the company, reducing risk and diversifying their portfolio of assets and exposures.

What Are the Advantages and Disadvantages of Debt Financing?

For your convenience, below is a summary of the benefits of debt financing compared to the risks. However, since every company is unique, comparing the advantages of debt financing to the disadvantages is best done by a professional who can provide insights tailored to your specific situation and organization.

Benefits of Debt Financing | Risks of Debt Financing |

Ownership and Control – Equity is not required. Also, presuming that you adhere to the terms of the loan, you maintain control over your use of the funds. | Affects Cash Flow – A monthly commitment to pay back the loan will affect your cash flow and liquidity. There can be financial and business risks for failure to perform under the loan documents. |

Flexibility – There are many debt structures with creative solutions to bridge the gap and support working capital and growth between equity financing rounds, giving you extra time to increase your valuation. | Affects Growth Potential – If securing debt financing hinders the company’s ability to grow (due to the monthly payments), other options for growing and scaling your business may prove superior. |

Precise Duration – Debt is easy to plan around. Short-term or long-term loans and related pay off can be flexibly structured to meet changing needs. You can set repayment schedules to the cash flow forecast and overall company budget. | Debt/Capital Ratio Imbalance – High debt poses a risk, especially if the business experiences a setback. |

Easy Acquisition – With good credit and financial records, securing a loan can happen quickly. | Assets or Equity Can Become Collateral – Some loans require an asset lien or impose warrants that give the lender an equity claim in the event of certain circumstances. |

Builds Your Credit – Small starting loans can help build a credit history, making it easier to secure funds later. | Personal Risk – Personal loans can present risk in the event of performance failure. |

Lower Cost – In almost all instances, debt financing costs less to pursue and service than equity financing. | Qualification is Not Guaranteed – If you cannot qualify for certain types of loans, you may need to consider more expensive options. |

Tax Benefits – Interest expenses can be claimed on your taxes as a deduction. |

The Bottom Line

Debt financing can be a cost-effective way to secure the funds you need to grow and scale your company. But it is essential to understand your options and whether they optimally support your organization’s operations and overall situation. If you are unclear about what is right for you, consider speaking with a financial advisor (like an outsourced CFO) who can provide expert and unbiased advice.