I have noticed that business experts often speak of growing and scaling companies as if it were the easiest and most natural thing in the world to do. But that simply isn’t true. Most entrepreneurs are vision-driven – they want to fill a gap in the market or solve a problem. The nuances of growth vs scale are rarely top-of-mind until they experience growing pains. So, let’s discuss what these terms mean and how you might apply these concepts to your business.

What is the Difference Between Growth and Scale?

Business growth is about increasing top-line revenues at any cost, whereas scaling a business is about increasing revenues while minimizing your costs, effectively improving your bottom-line or profit margin. Economists refer to this latter phenomenon as achieving “economies of scale.”

In other words, if you make widgets for $70 and sell them for $100 and both parts of that equation are inflexible, your business can grow but not scale because your costs will rise at the same rate as your revenues and profits. If, however, you can reduce your costs, perhaps by way of a volume discount from a supplier, you might be able to scale your business and earn higher profits.

But this is a very simplistic example. Many factors contribute to the cost and price of a product and your ability to serve more customers. So, let’s explore further.

Understanding Business Growth

Nearly every business owner would like to see their revenues grow because (on the surface) growth indicates that you have built a successful company.

However, growth for the sake of growth is a small game, and it may not be a sustainable business model. If the only way you can make more money is to sell and deliver more of your product or service, you will eventually hit a tipping point. You will max out on the amount of business you can accept, given your available resources.

When this happens, you will have to make a choice. You can:

- Remain a small business and work crazy hours (potentially sacrificing your mental health, profits, or the quality of what you deliver),

- Adjust your pricing model, or

- Consider hiring more people and investing in other resources so you can continue to add revenue and grow.

But adding resources will make your costs go up and your profits go down, at least temporarily, until you ramp up sales and begin adding revenue to cover those costs.

Now, sometimes a business owner’s only motivation is to achieve a certain income level so they (and their team members) can live comfortable lives. And this is perfectly acceptable if you are comfortable repeating this cycle of adding resources at pace with your growth.

Professional services organizations, where the primary source of revenue comes from selling labor, are a common example of this. If they don’t find a way to scale growth, the only way to take on more clients is to hire, so the cycle continues.

Most growth-minded entrepreneurs, however, have bigger ambitions. They want to build a business that will grow in value, then eventually cash out and pursue other goals. Such entrepreneurs must understand growth vs scale and adopt growth strategies that will result in a successfully scaled business. This will improve their ability to earn a profit today and command a good price when they are ready to pursue an exit.

What Does it Mean to Scale a Business?

Scaling a business means that you grow your revenues and increase your profit margins at the same time by finding ways to be more efficient. This empowers you to continue adding customers and delivering the same level of service without incurring undue costs.

SaaS companies offer the most clear-cut example of this. A significant up-front investment occurs as they build the solution, but once they launch, they can serve a veritable universe of customers. Presuming that there is a real need for what they offer, and the solution delivers what it promises, the potential upside can be impressive.

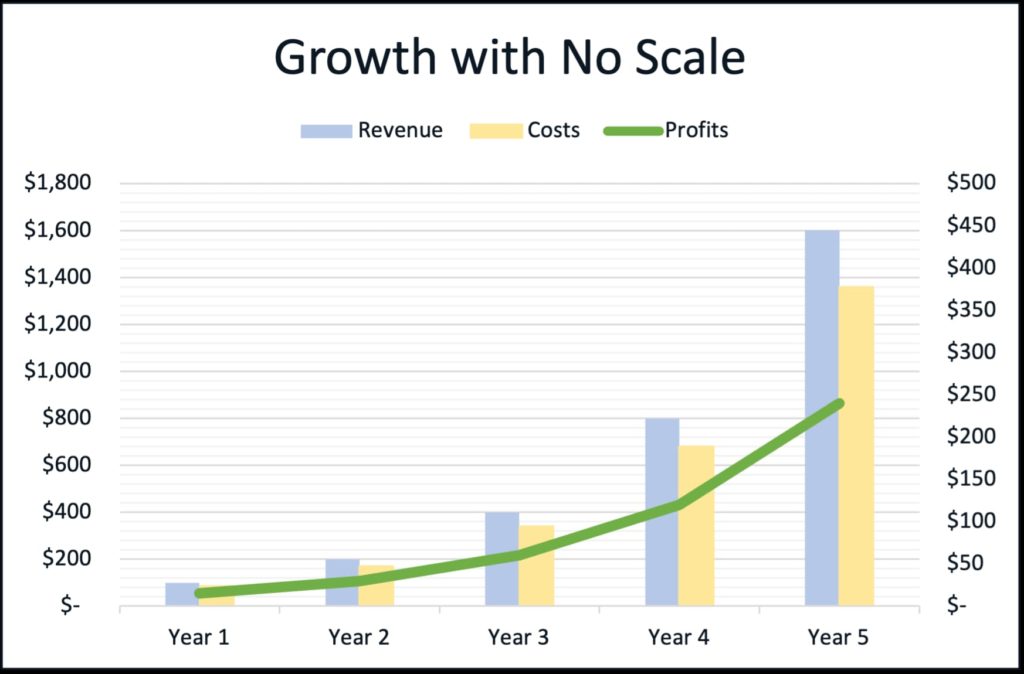

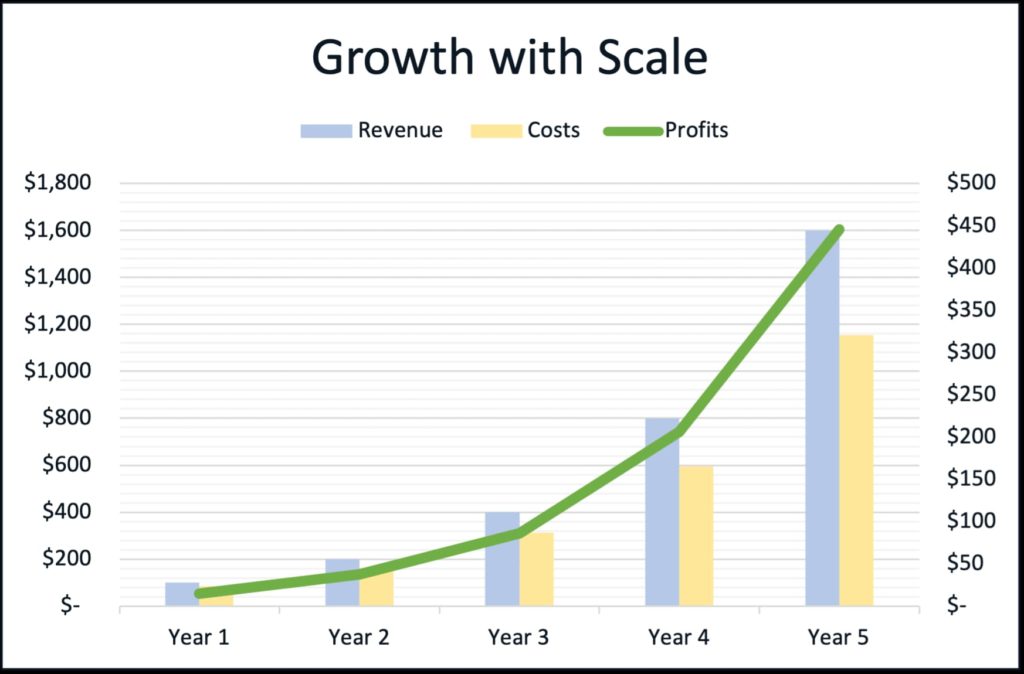

However, like most things worth pursuing, scaling a business is not easy. The methods for doing so will vary from one company to the next, and you can expect some ups and downs. But, if you know what you’re doing, this is what the growth curve for a company that has achieved scale might look like in comparison to one that has not.

Profit is 186% higher with scale!

As you can see, as you earn more revenue, your costs still go up, but at a slower pace because you’re finding economies of scale. This leads to a higher profit margin. Of course, there may be times when you must make an investment, which will affect your profit margins for a while, but that’s normal and expected. So, what actions can you take to build a business that can achieve scale vs growth alone?

How to Scale Business Growth

There are many ways to find efficiencies in a business. Earlier, we pointed out that you might be able to reduce the cost of your product by negotiating with suppliers for volume discounts, but there are plenty of other things you could do, such as:

- Reduce the Cost of Your Product or Services

In addition to reducing the cost of your materials, you could find cheaper sources of labor, negotiate better shipping rates, or find ways to reduce your rent or equipment expenses. - Invest in the Value of Your Product or Services

On the flip side of reducing costs, you can invest in making your product better. Perhaps you can add more features or capabilities, increase your level of service, or train your employees. Such improvements would allow you to charge more, which should boost your bottom line. - Build Strong, Efficient Internal Processes and Procedures

Nearly every area of your business could benefit from establishing repeatable, predictable processes and procedures. For instance, in your finance and accounting department, ensuring that you bill customers automatically and impose penalties for late payments could save you money. Or you could create an expense reimbursement policy instead of leaving spending decisions to the discretion of your employees. - Invest in Productivity Enhancing Technologies

The right tools can significantly improve your productivity. For instance, with the right technology, you can track customers throughout their life cycle with your company. Besides making your marketing and sales efforts more effective and efficient, such investments can also flow through to your customer service team. This will allow them to present a more unified presence to your customers, improving your reputation. - Allow for Specialization

Hiring full-time employees and expecting them to be a jack-of-all-trades isn’t always cost-effective. Such practices can lead to costly errors and burn-out. Instead, consider hiring specialists to lighten the load and improve your efficiency. If you don’t need (or can’t afford) to hire full-time specialists, outsource some work to freelancers. That way, you can get the expertise you need at a lower cost.

And these are just a few ideas. When executives are serious about exploring the opportunities for growth vs scale within their business, they will work with their finance team to develop a budget and a detailed cash flow forecast. This exercise forces you to examine how cash flows in and out of your business so you can spot and remedy problem areas.

Growth vs Scale: Which is Better?

So, growth vs scale, what is more desirable? Well, by now, you probably know that it depends on your long-term goals.

If you started your company because you love what you do, enjoy the people you work with, and simply want to make a decent living, growth without scale is fine. However, there are risks to such a business. For example, if the owner decides to retire, you lose a big customer, or changes occur in the market, the entire company could be at risk.

If, however, you want to build a thriving organization that will provide value to its customers, employ a lot of people, and live on long after you (comfortably) retire, you must seek economies of scale. Such a business grows in a sustainable, cost-effective manner. It can weather the inevitable ups and downs and deliver a return to its stakeholders year after year.

At The CEO’s Right Hand, we work with growth-minded entrepreneurs who wish to grow and scale their companies. We help them build a solid financial foundation for the business and provide strategic financial advice so they can stay focused on their big picture goals, knowing that their day-to-day finance and accounting needs are under control. Visit our services page to learn more.