There comes a time in nearly every business leader’s career when you must convince someone to invest in your success. Some discussions are informal, dependent on little more than your ability to be charming. While others, especially those where the stakes are high, need careful planning and the creation of a pitch deck to help you share your story. But what is a pitch deck, exactly?

What is a Pitch Deck and Why Would You Need One?

A pitch deck is simply a set of PowerPoint or Google Slides that you can display during a persuasive presentation. We call it a “pitch” deck because you are tossing out an idea, like you would a ball, hoping that you can inspire someone to catch it and join your game.

There are many reasons to create a pitch deck, but in most cases, it’s to convince someone to invest their money, time, or both. For example, in the film industry, you might create a TV show or movie pitch deck to present a good idea to the various studios. Likewise, imagine you have a product or service-based business and need funds to grow. In that case, you might develop a startup pitch deck or an investor pitch deck before meeting with potential investors, such as venture capitalists.

After coaching many businesses through their capital-raising process and raising funds for my own company, I’ve learned a thing or two about how to prepare for, create, and deliver a winning pitch.

The No-BS Financial Playbook for Small Business CEOs

Are you tired of making costly financial mistakes? Stop guessing and start growing. Learn how to create a scalable and valuable company while minimizing risk with this playbook from a serial entrepreneur who has been in your shoes.

What Should Be Included in a Pitch Deck?

Please keep in mind that the exact contents of your pitch deck will depend on your goals and business stage. If you’re raising money, for instance (which is what I will assume throughout this post), you will need to decide which sources of capital are suitable for you so you can tailor the pitch accordingly. A fledgling startup that desires startup incubator support will need a different spin than an established company that wants a strategic investor who can help it break into a new market.

Also, preparation is key. The pitch deck outlines only the most essential information for investors. It will contain 15-20 succinct slides designed to generate interest and secure a second meeting. Yet there must be substance behind these slides. Investors will expect deep research (to back up any claims), a detailed and accurate financial model, and a business plan to dig into later. So, there is work to do before you can start creating a pitch deck. Still, it is helpful to know where you’re aiming.

So, how do you structure a pitch deck? The goal of any pitch is to explain who you are, what you are planning to do, and what you need from your audience in a clear and concise way that inspires action. Therefore, the flow of your deck can vary based on what you wish to emphasize. In general, you will share the following information:

- Your Company Vision

- The Problem You Solve

- How You Solve the Problem

- The Size of Your Market

- The Ideal Customer for Your Solution

- Competitive Positioning

- Your Business Model

- A Go-To-Market Strategy

- Where Things Stand Today (Current Traction)

- Historical and Projected Financials

- Insight into Your Team

- What You Need and Why

Below, I explain what should be on each of these slides, and there is a lot of information here. If you’re in a hurry, you are welcome to bookmark this page for later and skip ahead to the next section.

Your Vision

The first few slides in your pitch deck will provide an overview of your business, starting with your vision. The vision slide will contain your company name and quickly communicate your “why.” Why you exist and why you’re passionate about what you do.

This is your aspirational goal. We’re not looking for a paragraph here, just one crisp sentence that quickly tells your audience what you’re about in a way that will be meaningful to them. For example, if I put together an investor pitch deck for my company, I wouldn’t say “we provide fractional CFO services” because investors may not know what that means. Instead, I would say, “We help companies grow and scale.” That tells them why we’re in business and that we love working with growth companies.

The Problem Slide

Briefly explain the problem you solve with your product or service and how this problem affects your target customers. But be careful to keep it specific and realistic, i.e., describe a challenging but manageable problem that your business can truly address.

Going back to my company, I wouldn’t tell investors that companies lack financial leadership, which dooms them to failure. That’s too vague (not to mention embarrassingly dramatic), and it simply isn’t true in most cases. Instead, I would tell them that growing companies need experienced financial leadership, but they don’t always need (or can’t always afford) a full-time CFO.

How You Solve the Problem

Once you’ve set the stage, explain what you do – how you solve customer problems and make their lives better. This is where you can provide information about your solution(s).

If I were to create this slide for my organization, I would say we solve the need for less expensive but experienced financial leadership with a team of finance and accounting professionals who have a broad mix of specialized and industry expertise. We own the finance and accounting function for our customers and provide executive-level financial advice for a “fraction” of the cost of full-time employees. Then, I would show a few bullets describing the scope of our services.

Your Target Market

Once you’ve explained what you are trying to do, you will need to show that you have done your research and have a deep and accurate picture of the opportunity, starting with the market size. The way you approach this will depend on your business.

Uber, for instance, took a broad approach with their pitch – they were solving an inefficient car service problem. Since there is a need for car services worldwide, the potential market size was (and is) enormous. Contrast this to a business with a niche market, like Mercedes. Mercedes makes premium cars and sells them for a premium price, so their market is narrow. They need to reach people with a sizable income who are willing to pay more for quality.

A small market isn’t necessarily bad because it lends focus, but it’s important to be honest about the potential. For instance, your solutions may be most suitable to a certain industry, a specific part of the world, or a particular age group. Whatever it is, you need to know it well.

Your Ideal Customer

Although the market for your products or services may be sizable, you need to be able to describe your ideal customer. Companies often figure out who their ideal customer is through trial and error. But you can save yourself time, money, and stress by putting some thought into this. Furthermore, investors will expect you to know these details.

For example, your ideal customer would be a person or organization who would benefit from your solutions, but they aren’t the right fit if they can’t afford them. So, when describing your ideal customer, you may cite things like their age, gender identity, job title, circumstances, values, fears, or location. You might also bring up things that you don’t want in a customer, such as a limited budget, a business in an ill-suited industry, or someone who would be too expensive to support.

Competitive Positioning

Investors will look for you to tell them not just the size but the composition of your industry. You should know who your main competitors are and how you will differentiate your products or services in the market. Some refer to this as your “unique selling proposition.”

Describe the competitive landscape. Will you compete based on price, quality, level of service, speed, superior technology, or something else? How does that compare to what your competitors offer? And how will you communicate and defend your position?

Business Model

When you ask someone to invest in your business, they will want a return on that investment. So, make sure you are ready to explain how you expect to make money and your plans for ensuring that happens. In other words, your business model.

Your business model will consist of a cost structure and a pricing model. The cost structure includes all the expenses you must incur to run your business, raw materials, labor, etc. Whereas your pricing model is how you charge for your products or services. Do you have a subscription-based business, charge an hourly rate, or do you make or buy a product and charge a certain percentage over your costs?

There are hundreds of ways to price things and ensure that you are profitable. It’s important to be specific and able to justify your decisions.

Go-to-Market Strategy

How do you expect to get the word out about your offering? Investors will want to see a sensible plan for how you will reach your target customers and communicate what you do.

How do you expect to get the word out about your offering? Investors will want to see a sensible plan for how you will reach your target customers and communicate what you do.

Most companies will have a mix of marketing and sales strategies. For example, you might build relationships with referral partners or sell your products through distributors. You’re also likely to have a marketing strategy where you promote your solutions through a mix of channels such as organic search, social media, an affiliate network, or advertisers. Businesses with longer sales cycles will also have a sales strategy that specifies how they plan to nurture leads and turn them into paying customers.

Current Traction

On the traction slide, you’ll explain where things stand with your business today, sharing whatever information will most interest potential investors. Include any milestones and other indications of progress, such as:

-

- The state of your product. Is it ready for market? Are people using it? What kind of feedback are you receiving? And what’s next on your product roadmap?

- Partnerships – Have you built relationships that will help you ramp up quickly once your product is ready or help you move into new markets? Be prepared to explain what this will mean for your business.

- Who is on your board? – It will instill a certain level of credibility if you already have a reputable board in place.

- Have you raised money before? If so, how did you use those funds to fuel your business?

- Key metrics (or KPIs) that measure the health of your business, such as how many customers or subscribers you have, how that translates into revenue, and your growth over time.

Current and Projected Financials

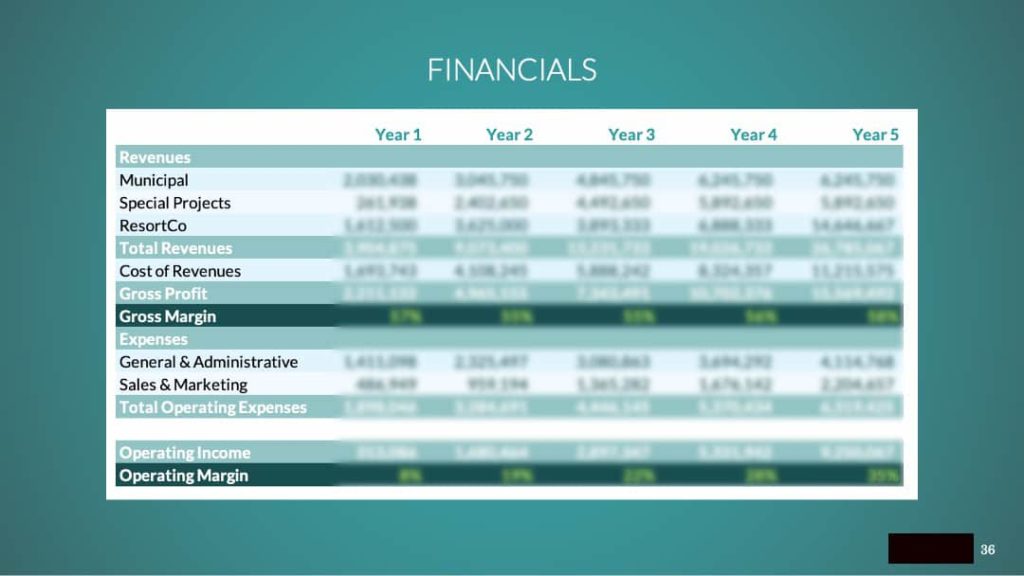

You will need to show a high-level, year-by-year snapshot of your financials – about three years of history and your expected trajectory for the next 3 to 5 years. Include all sources of revenue, cost of goods sold, profit, operating income, etc. Although investors won’t get into the details in this meeting, the historical numbers must be accurate, and the forecasts need to be realistic. This is because investors will look for a comprehensive financial model that can hold up to scrutiny in later meetings.

The Team

The team slide can be at the front or back of your deck, depending on who is on your team and the stage of the company. For example, if you have a leadership team full of reputable people who have built and sold companies before, you might put it up front to establish credibility. In this case, you could showcase each individual to get the investors excited, with logos of where they’ve worked in the past.

However, if your team needs work, you may choose to put this slide later. This isn’t necessarily a red flag, as long as you have a good product. But you will need to tell the story about where you are and how you plan to fill in the gaps until you have the capital you need to hire.

The Ask: What You Need and Why

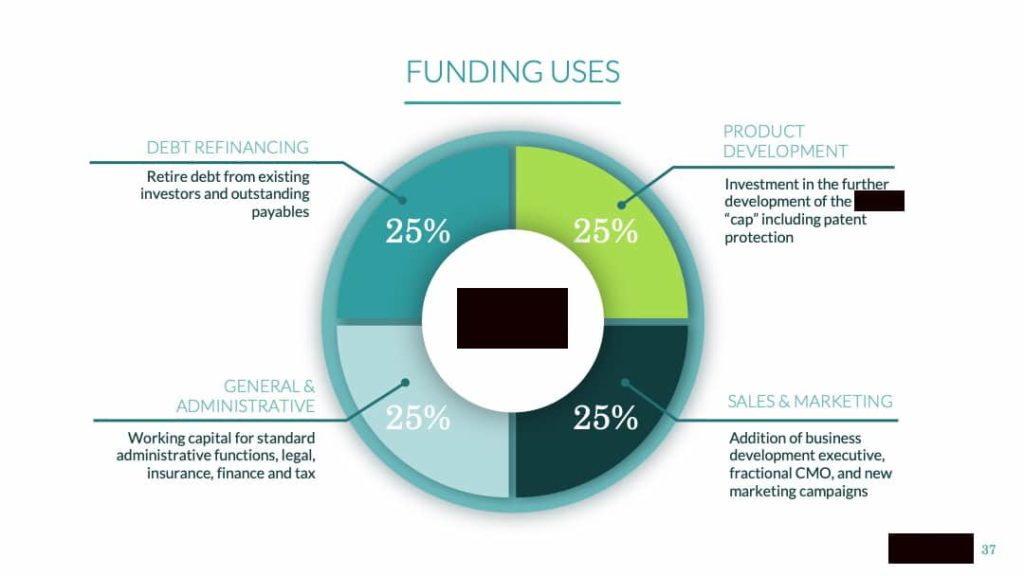

Finally, you will need a slide or two explaining what you need. Be precise. Describe how much capital you intend to raise, how you wish to structure the deal, and the high-level terms you seek.

Then you will explain how you plan to use the funds. Again, you won’t go into any depth, just a few bullets reminding your audience of your goals and describing how you will spend the money. For example, you may be planning to invest in research and development, marketing, or hiring. Whatever it is, investors will want to see that you plan to put their funds to good use.

How to Create a Pitch Deck

It’s one thing to know what to put in a pitch deck. It is quite another to make it all happen.

As we mentioned earlier, your pitch deck should only contain high-level, easy-to-understand information, but it is the culmination of months of detailed planning. Ideally, you will start this process by developing a capital-raising strategy. That will allow you to break the process into clear steps so that by the time you’re ready to create a pitch deck, you will have everything you need at your fingertips.

Then, when the time comes, keep it simple, visually appealing, and compelling. Use bullet points, where relevant, combined with imagery and easy-to-read charts to make the information consumable. If possible, hire a graphic designer to help. A professionally designed, impressive pitch deck that is free of errors and distractions is well worth the money and will help you walk into your meetings with confidence.

Example Pitch Decks

Since pitch decks contain sensitive information, most companies keep them confidential. But some organizations, like Uber, have shared their decks with the public. And Business Insider offers an entire database of pitch decks for a nominal fee.

There are also some pitch deck templates you can explore, such as this one from venture capital firm Sequoia Capital.

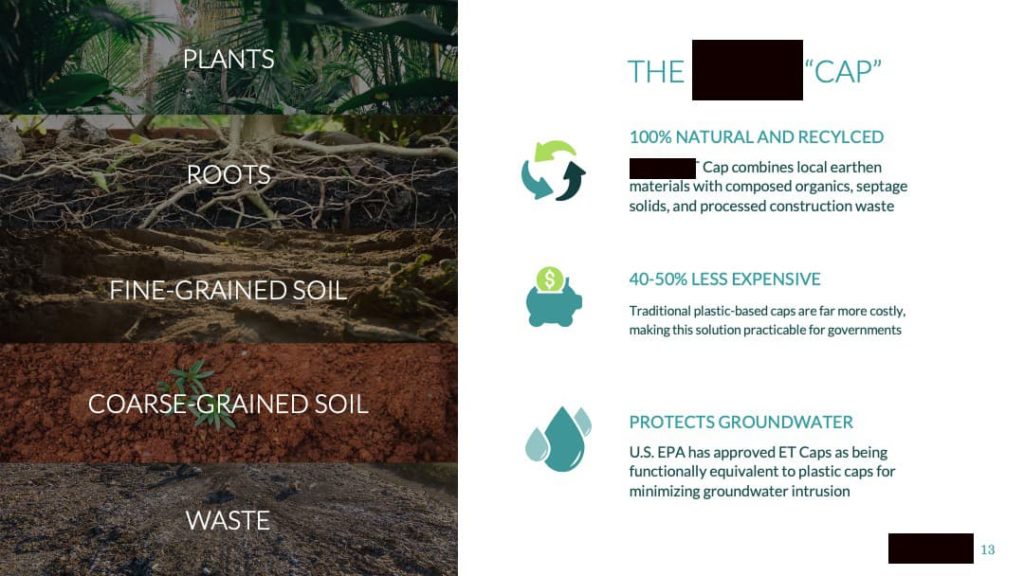

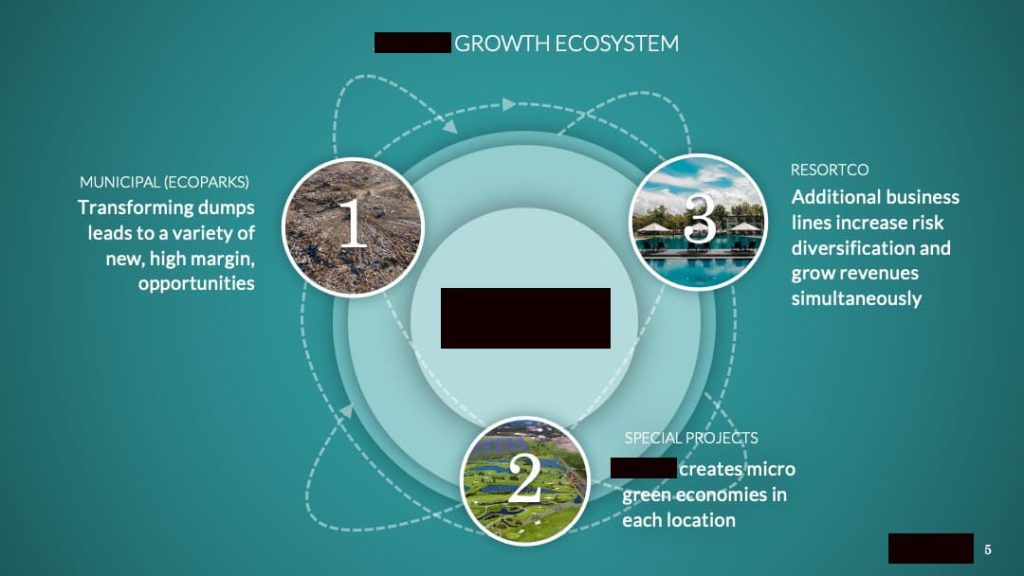

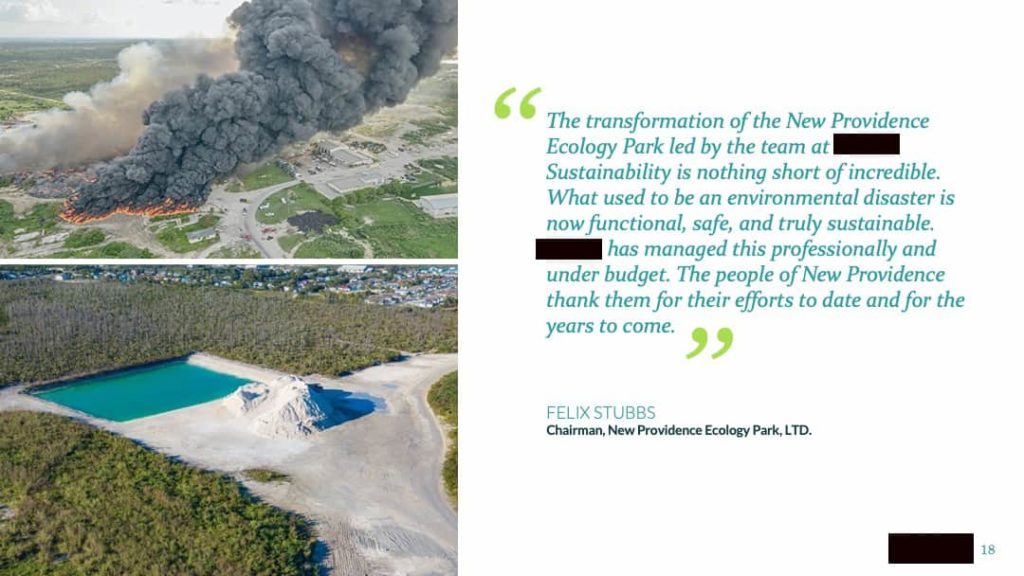

Finally, below are some sample slides from a pitch deck we created for one of our clients:

Although I would recommend that you build a customized pitch deck in-house, with the help of a professional, such inspiration can get you started.

Tips for Delivering the Pitch

When you finally have your pitch deck ready, take the time to practice your delivery. Ideally, in front of some “friendlies” at first, such as your internal team. Then present the information to your advisors, followed by your existing investors who will be less forgiving. Encourage them to watch for any confusing industry jargon, to ask the same piecing questions a potential investor would ask, and to critique your answers. Each experience will provide you with the insights you need to refine your pitch.

I cannot stress enough how important this is. Unfortunately, many executives choose to skip this exercise because they feel that they are seasoned presenters. While that may be true, investors are a different (and tougher) audience who will influence your company’s future. So, practice your pitch until you can demonstrate your vision and enthusiasm for solving customer problems while flawlessly addressing the inevitable hard questions.

Then, schedule your meetings strategically, with the less critical ones first. That way, you can continue to work out any kinks and be ready to impress your most desirable prospects later.

Finally, come to the meetings with something you can leave behind, such as additional materials, case studies, press packets, etc. Each presentation should go quickly (about 20 minutes), with any remaining time reserved for questions. While many investors will make up their minds immediately, others will need time to absorb the information before deciding how to proceed. Having a reminder of your key points at hand will make it easier.

What is a Pitch Deck: The Bottom Line

A pitch deck is a set of slides (aka a slide deck) that helps you tell your company’s story and articulate what you want from your audience during a persuasive presentation. The purpose of the deck is to convince people to take action – to invest their time, money, or both in your business. At The CEO’s Right Hand, we’ve raised over $2 billion in funding for our clients. Learn more about what this entails by visiting our capital-raising services page or contacting us today for a free consultation.