Running a company is a juggle for small business owners. In addition to crafting business strategy, delivering services, and motivating a team, many find themselves involved with other tasks like bookkeeping and accounting. Although you know you must delegate, finding the expertise you need at a reasonable cost is challenging. Finance as a Service offers an affordable bookkeeping and accounting solution to help with this problem, so below, I explain what it is and how it works.

What is Finance as a Service?

Finance as a Service (FaaS) is a streamlined approach to providing outsourced bookkeeping and accounting services where the provider delivers financial expertise for a flat monthly fee instead of a traditional hourly rate. It is a packaged service with well-defined deliverables, typically using cloud-based solutions, making producing fast, cost-effective results with few errors easier. That makes it ideal for small and mid-sized companies with relatively simple bookkeeping and accounting needs to get affordable help with minimal commitment while they work to grow and scale.

What Problem Does Finance as a Service Address?

Basic finance and accounting functions seem like they should be simple, so when business owners struggle to find affordable services, many get frustrated. That can result in them doing the work themselves or hiring a jack-of-all-trades to keep the company’s books in addition to other tasks.

The problem with this approach is that small business bookkeeping and accounting is much more involved and complex than many people realize. Companies are subject to complex rules and regulations that dictate how you must record transactions and report results, so hiring someone with financial expertise who can do this right is crucial. Those who don’t understand that can unintentionally create a big mess that can be costly and time-consuming to unravel.

The No-BS Financial Playbook for Small Business CEOs

Are you tired of making costly financial mistakes? Stop guessing and start growing. Learn how to create a scalable and valuable company while minimizing risk with this playbook from a serial entrepreneur who has been in your shoes.

Another reason it is wise to get an expert involved is because sound financial management can empower you to make better, more informed decisions. When you are confident in the accuracy of your company’s financial data, you can use it to develop a regular and timely financial reporting and analysis cadence. That cycle will help you spot and address issues with your core business, manage cash flows, and engage in financial planning exercises, empowering you to run a more efficient and proactive organization.

How Does Finance as a Service Work?

The FaaS model is compelling because you get much-needed bookkeeping and accounting services at a predictable price. Most small businesses don’t need (and can’t afford) a dedicated in-house finance team. Yet, bookkeeping and CPA firms with hourly models can charge anywhere from $80 to $120 per hour for bookkeepers (depending on your business, location, and requirements) and more for senior roles. For early-stage companies, especially those without a clear vision of what they want and need, that can result in a hefty bill.

With Finance as a Service, you first choose a service level that suits your business. For instance, most small companies start with basic bookkeeping, placing this critical function in the hands of an expert. Your bookkeeper will understand the rules and regulations governing businesses. They will develop a keen understanding of how your company works and keep everything clean so you always know where things stand and can avoid surprises (e.g., unforeseen liabilities) at tax time.

Then, if you decide you need more, you can request additional services. For example, some business owners start the engagement with a general clean-up before settling into a monthly bookkeeping cadence. Then, as you grow, you may develop more sophisticated needs, making it necessary to layer on other services, such as expense tracking or reporting.

What are the Benefits of Finance as a Service?

With this modular approach to finance and accounting outsourcing, companies typically experience the following benefits:

- Cost Savings – You get the expertise you need at a fraction of the cost of hiring full-time help, with flexible pricing to suit your growth stage.

- Subject Matter Expertise & Fresh Ideas – When you hire experts, they bring new perspectives to your team. Fractional providers bring a regular influx of new ideas due to their work with multiple companies.

- Improved Internal Focus – When you are confident in your financial data and settle into a regular rhythm of reviewing and discussing your financial statements, you can relax, make better decisions, and focus on running your business

- Increased Productivity and Flexibility – Outsourcing allows you to scale up or down as needed, giving you a great way to manage your cash flow while boosting your capacity during crunch times or for special projects.

- Risk Management – When you have the right skills on your team, you are more likely to produce accurate and actionable financial reports, catch mistakes, develop essential processes, and identify fraudulent activity. That will make things easier day-to-day and smooth the way for business tax preparation.

Of course, these are just the basics. To better understand what you might get with a Finance as a Service provider, here are more details about our solution, Right Hand Finance™.

Introducing Right Hand Finance™

The CEO’s Right Hand provides a Finance as a Service offering for small and mid-sized companies with a low-priced entry point. Right Hand Finance™ is a monthly subscription for financial reporting and insights comprised of two distinct services – Right Hand Books™ and Right Hand Reports™. This solution is ideal for early-to-mid-stage companies that don’t need (or cannot afford) our full range of services.

Right Hand Books™

Right Hand Books™ is the bookkeeping service component – a stand-alone offering that starts at $300 per week. We work with top accounting software packages and can help with data migration if necessary.

We kick the engagement off by pairing you with a dedicated bookkeeper in your same time zone. That ensures prompt responses to your inevitable questions and concerns. They familiarize themselves with your financial situation, assume responsibility for your day-to-day bookkeeping needs, and meet with you each week to discuss where things stand. The services they provide include the following:

- Accounts Payable Processing

- Accounts Receivable Support

- Bank Reconciliations

- Bank Transactions Processing

- Month-End Close

- Payroll, Benefits, Taxes – Posting

- 1099 Processing

- Annual Income Tax Support

- Journal Entries for all Accruals

In addition to essential bookkeeping services, this solution comes with controller oversight for quality control.

Right Hand Reports™

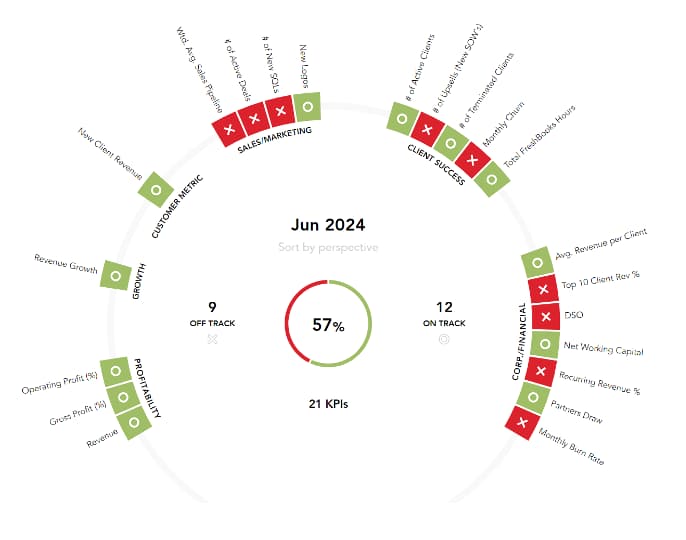

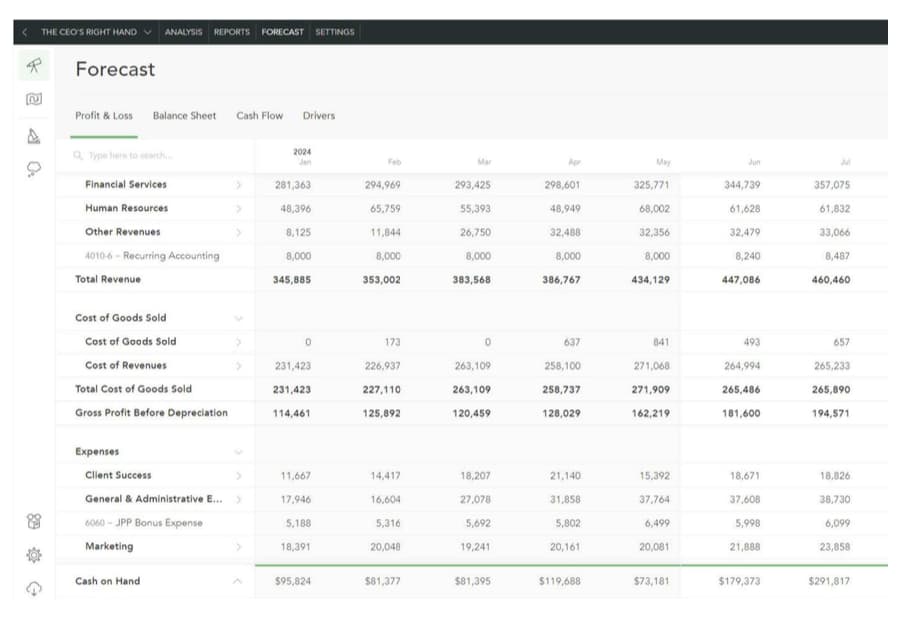

Right Hand Reports™ is the reporting component of our solution that allows you to visualize your financial data. It empowers you with easy-to-digest information about the company’s health that you can share with your management team, investors, and other key stakeholders. It also integrates with other data sources to combine financial and operational data. Then, you can organize the information side-by-side in a dashboard and track trends over time.

This solution has a robust forecasting module that allows you to analyze how various scenarios impact outcomes. Furthermore, as part of this service, you get a dedicated Fractional CFO who will meet with you monthly to review your reports, explain their meaning, and make recommendations.

This service includes the following:

- Advanced Analytics

- Annual Budget

- Annual Financial Plan with Quarterly Updates

- Budget vs. Actual Reporting

- Cash Flow Analysis

- KPI Tracking & Analysis

- Monthly Financial Reporting

- Bookkeeper Oversight

- Profitability Analysis

- Trend Analysis

An additional benefit of the TCRH solution is that you get to build relationships with our finance experts. Although the basic service may be all you need initially, having a relationship with a trusted advisor could be helpful later as you grow, scale, and tackle special projects.

Is a Finance as a Service Solution Right for You?

Finance as a Service is a great way to get affordable bookkeeping and accounting services while having the flexibility you need to grow and scale. It is best for organizations with relatively simple bookkeeping, accounting, and reporting needs, but the reports module can be helpful for companies of all sizes. Contact us today to explore whether our solution is right for you.