Cash flow forecasts provide critical information about a company’s future cash position, empowering timely decisions that safeguard your operations and ability to hit targets. However, although nearly every management team insists on a budget, far too many stop short of rigorous forecasting, putting their organizations at a disadvantage. Below, I demystify cash flow forecasting, explain its role in sound financial management and strategic planning, and break down the steps involved.

Table of Contents

What is a Cash Flow Forecast?

A cash flow forecast (aka cashflow forecast) is a detailed report that shows your company’s current cash position and an informed prediction of how money will flow in and out of your business, affecting your expected cash position in the coming days, weeks, or months. It starts with your recent financial statements and bank account balance and projects forward for a set period of time, drawing on past experiences, data, and current business conditions to show anticipated revenues and expenses.

Why is a Cash Flow Forecast Important?

Cash flow forecasting is vital to effective cash flow management because it gives you the visibility necessary to ensure you have enough cash for day-to-day operations. While we can’t predict the future with 100% accuracy, we can estimate what is likely to happen given our trajectory and known variables. This insight allows us to make necessary adjustments to meet upcoming expenses and fund our growth plans.

Cash forecasting is most effective when paired with a budget, typically an annual exercise designed to provide spending guidance, given the company’s longer-term strategic goals. We update cash flow forecasts often (monthly, weekly, or even daily when necessary) and focus on current and short-term cash flow, making them incredibly useful for tactical decisions.

The No-BS Financial Playbook for Small Business CEOs

Are you tired of making costly financial mistakes? Stop guessing and start growing. Learn how to create a scalable and valuable company while minimizing risk with this playbook from a serial entrepreneur who has been in your shoes.

Another great reason to create cash flow forecasts is that we can use them to model “what-if” scenarios – cash flow projections showing what could happen to our cash position if a possible future comes to fruition.

For example, we might create financial models showing the potential impact of gaining or losing important customers, investing in technology or talent, raising capital, or pursuing a new line of business. Sometimes these are long-term forecasts, projecting forward a year or more. When we see how these things could affect our financial future, we can prepare for or even avoid issues, craft better strategies, and make smarter business decisions.

Understanding the Difference Between Cash Flow Management, Budgeting, Cash Flow Forecasting, and Cash Flow Projections

Cash Flow Management | Budgeting | Cash Flow Forecasting | Cash Flow Projections | |

Focus | Operational | Strategic | Tactical | Strategic |

What Is It? | The efficient, ongoing management of daily cash needs. | A detailed revenue and expense plan to support strategic goal achievement. | An account of actual and anticipated cash inflows and outflows. | Forecast iterations to explore the possible effects of specific events. |

Business Purpose | Liquidity management. Optimize cash use and availability for daily operations and short-term obligations. | Resource allocation to support the pursuit of longer-term goals and growth plans. | Highlight potential cash surpluses and shortages, complementing the budget. | Scenario planning. To support the development of financially sound strategies. |

Time Horizon | Stort term | 12 months | 1-3 months | Up to 12-18 months |

Update Frequency | Daily or weekly | Yearly | Daily, weekly, or monthly | As needed |

Example of a Cash Flow Forecast

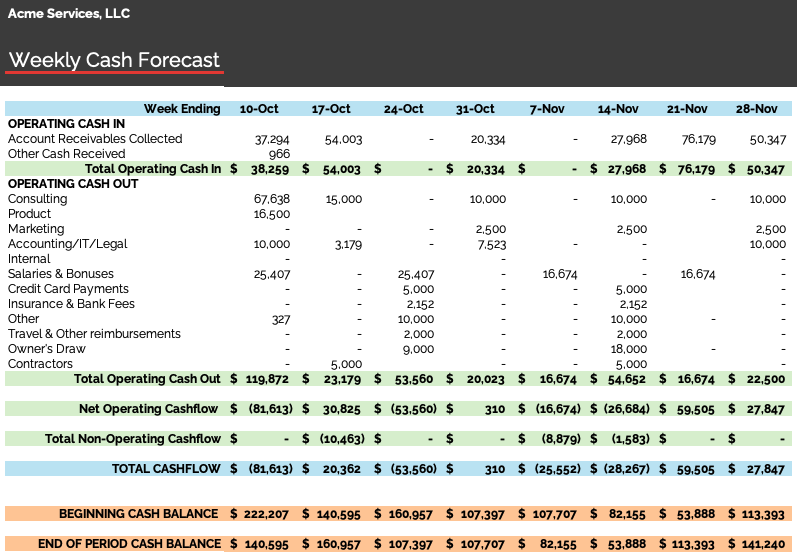

To illustrate, consider the cash forecast example below.

Starting from the top, you will see all positive cash flow activities, i.e., the things that will cause cash to flow in to the company. Below that, you see all negative cash flow activities, i.e., those items that will cause cash to flow out of the company. Then, we calculate the net cash flow (all monies received minus those sent out).

At the bottom of the document, we show the opening cash balance for each week, followed by the expected ending cash balance, which is simply the beginning balance plus the change in cash (“total cashflow”) each week.

You may notice that the company’s ending cash position dips during months without cash flow. Suppose that figure becomes uncomfortably low, especially before weeks with significant cash outflows? In that case, the company’s management might consider taking out a loan or approving the use of cash reserves to create a bigger cushion.

Of course, this is a straightforward example. As companies grow and scale, the numbers and market factors influencing your forecast can become quite complex.

The Evolving Role of Technology

Why did I show a spreadsheet screenshot when most accounting solutions have built-in cash flow forecasting capabilities? Although cloud accounting, AI-driven analytics, and real-time dashboards make fully manual forecasts less common, many companies still extract data from their accounting systems and build cash flow forecasts manually or semi-manually. That is usually because they find the solutions limiting (not reflective of their business model, ill-suited for running what-if scenarios, too complicated, etc.).

Reasons can vary depending on company size, industry, and resources. In general, we see the following:

- Small businesses and startups use spreadsheets because they are cost-effective, flexible, and easy to customize. Yet, they can also be time-consuming, prone to errors, and challenging to keep updated.

- Medium-to-large organizations typically use a hybrid approach. They build a spreadsheet manually, set up an automatic data pull from their accounting or ERP solution, then make manual adjustments for seasonality, one-time income or expense events, or strategic decisions.

- Highly tech-enabled firms may use dedicated forecasting tools that integrate with accounting solutions, reducing manual data entry. But even these teams carefully review the output and make tweaks.

Business leaders use cash flow forecasts to make critical decisions, so they must be timely, accurate, and reliable. AI and specialized solutions help by aggregating data, alerting us to potential issues and risks, and identifying trends, making cash flow forecasting easier and practically real-time. However, we still rely heavily on skilled human oversight and analysis. There must always be a “human in the loop,” otherwise teams could make decisions based on bad information.

Summarizing the Benefits of Cash Flow Forecasting

Creating a cash flow forecast may sound daunting, but it is an essential and worthwhile investment. To recap, here are the benefits you can expect.

- Timely Insights for Decision Making

Cash flow forecasting empowers you to predict and exert some control over your company’s future financial health. It helps you spot and address issues before they happen, confidently manage short-term, medium-term, and long-term growth, and make informed decisions. - Stronger Planning and Budgeting

Cash forecasting forces management to move beyond backward-looking income statements and balance sheets and to proactively consider its liquidity needs when making plans and setting budgets. It can prompt practical questions about the organization’s business practices, strategies, and ability to increase cash flow, as well as the potential impact of external factors like interest rate changes, tariffs, and inflation. - Improved Cash Flow Management

Predicting your company’s cash flows can highlight potential cash shortages or surpluses. It serves as a warning system, giving you time to pursue and implement mitigation tactics or to reallocate cash to take advantage of opportunities. - Reliable Data for Scenario Planning

A well-crafted and carefully vetted cash flow forecast can also help you model the financial impact of various scenarios. For instance, enter different metrics for projected revenue growth (or decline) to create a “best case,” “likely case,” “worst case,” and “disaster case.” Or explore the impact of taking on more staff, changing suppliers, or raising your prices.

Cash Flow Forecasting Best Practices

Cash forecasting isn’t foolproof. Organizations must take it seriously to avoid creating a false sense of security when developing business plans. Please remember the following best practices as you embark on your forecasting journey.

- Build in Safeguards Because 100% Accuracy is Impossible

No one can foresee or control the future. A forecast provides an informed estimate of what is likely to happen if your assumptions are valid. It cannot account for unpredictable events or errors. Many leaders build a buffer into their forecasts to protect themselves (like a cash reserve) and clearly state their assumptions. - Build Processes and Controls to Protect Data Integrity

Quality output is only possible when all historical data sources are accurate, and the assumptions are realistic. Forecasting often requires contributions from multiple people across an organization who manage different cash flows. Automate what you can, then set clear expectations for input to minimize issues that could render your model useless (like overestimating future revenues or failing to account for seasonality or inflation). - Commit to a Rolling Forecast for Agile Decision-Making

Static forecasts quickly grow stale. Build a rolling forecast with an automated data flow. Then, commit to regular reviews to adjust for changing business and market conditions. - Insist on Executive Oversight

Making sense of this information requires financial acumen. Without the management level capacity to ensure sound data, a comprehensive analysis of the results, and the development of actionable insights, this work won’t add much value.

Understanding Cash Flow Forecasting Models

Broadly speaking, there are two types of cash flow forecasting: direct and indirect.

Direct Method

The direct method is literally cash-based. That means the forecast accounts for all expected sources (e.g., money received from customers) and uses (e.g., money paid to suppliers) of cash. Projections show the known inflows and outflows, which allows for greater accuracy for shorter-term forecasting.

While simple in theory, the direct forecasting method can become cumbersome if a company must account for many transactions.

Indirect Method

The indirect method, which is more widely used, involves using the balance sheet and income statement to analyze and predict cash flows. Indirect forecasts start with net income and then adjust for non-cash items such as depreciation. They are simpler and more useful for longer-term planning, but potentially less accurate.

Both methods have their uses, depending on the company’s needs. If resources allow, there may be an advantage to employing both methods (for insight into short- and long-term prospects).

Your organization may already have a template it prefers to use. If not, here’s a basic cash flow forecast template built into Excel that you can download.

How to Forecast Cash Flow

Step 1: Identify Assumptions About Receivables and Payables

Forecasts rely on assumptions. The assumptions and underlying data for a cash flow forecast must be accurate and realistic, or the resulting analysis will not be helpful.

Assumptions can come from the company’s past performance. They can include insights gained from customers and suppliers, industry trends, and projections for the broader market and economy. Before detailing the actual income and expense figures, identify key assumptions about the following:

- Potential sales growth or slowdown.

- Cost changes (i.e., price increases by suppliers, price volatility of raw materials, etc.)

- Cash timing (i.e., figures that relate to accounts receivable and accounts payable)

- Seasonality and inflation

Step 2: Estimate Your Weekly or Monthly Cash Inflows and Outflows

A cash flow forecast must capture estimates for all cash sources and uses. Data for cash inflows include receivables, revenues, loans, etc. Data for outflows include payables to vendors, payroll, rent, and loan payments.

Some not-so-obvious cash inflows and outflows include potential rebates and tax refunds, cash from asset divestments, or any fees and taxes. Regardless of how simple or complex the categories get, make these estimates objectively and conservatively using only the most likely figures.

Don’t let optimism run high in these numbers.

Step 3: Pull It All Together on a Roll-Forward Basis

Start with your current cash situation, applying your assumptions to the appropriate items. Then roll forward the previous period’s net result.

That’s a forecast in a nutshell. It can become more complex as business needs dictate. However, you can create a simple one by using the data in your historical financial statements (your income statement, balance sheet, and cash flow statement) and applying the appropriate assumptions.

To maintain your forecast’s value and usefulness, watch it closely and keep it current. Continue refining your projections, but don’t try to forecast more than a year or so into the future. Too many variables and too much guessing can work against your efforts.

The Bottom Line: Cash Flow Forecasting Supports Cash Flow Management and Is a Key Driver of Business Growth

Cash flow forecasting is vital for sound cash flow management and the survival and success of all businesses. It encourages proactive planning, provides valuable insights, and empowers informed, confident financial management. It helps you ensure your business stays on track toward its strategic goals while maneuvering tactically along the way.

The CEO’s Right Hand, with its deep bench of financial and operational expertise, serves as a strategic partner to business leaders looking to grow and scale. Cash flow forecasting is one of the tools we use to do that. We welcome an opportunity to discuss your goals and help you develop innovative solutions.

Editor’s Note: This blog post was originally published in May 2020 and then updated for accuracy and thoroughness in October 2025.