The prospect of selling your business can be exciting and anxiety-provoking, especially when you have invested years into building a company. Although the potential for financial gain may be alluring, the journey is complex and involves change, which can stir up conflicting emotions. Having guided many clients through this endeavor, I explain how to sell a business step-by-step below.

Before we dive in, please know that it is never too early to start exploring how to sell your company because thinking ahead is the key to a satisfying outcome. If you believe a sale is in your future, get a business valuation, start looking for the right experts, and strengthen your position as you go. That will ensure you are ready to pursue opportunities when the time comes.

Then, once you officially decide to sell your business, here are the essential steps.

9 Steps to Selling a Business

1. Planning

Although it is best to start preparing your business for sale as early as possible, most kick off this project in earnest about 12 months before the sales process. You may be tempted to do it yourself, but you can significantly improve your results by hiring a merger and acquisition (M&A) advisor (such as a business strategist or fractional CFO) to provide unbiased advice and guidance.

The No-BS Financial Playbook for Small Business CEOs

Are you tired of making costly financial mistakes? Stop guessing and start growing. Learn how to create a scalable and valuable company while minimizing risk with this playbook from a serial entrepreneur who has been in your shoes.

During the planning stage, we examine your situation to identify and address any opportunities to increase your valuation and readiness through the following activities.

Business Assessment

A good advisor will scrutinize crucial elements of your organization through a potential buyer’s lens in search of strengths to highlight and weaknesses to mitigate. Said differently, buyers want to make money, so we must assess your business with that in mind and develop a plan for making it clear how your company could make that possible. We will review the following (and more), document everything, and create a baseline valuation.

- Products, real and intellectual property, or proprietary knowledge

- Market positioning

- Leadership team, talent, and culture

- Client mix and any ongoing contracts

- Financial statements and models

- Planning systems, processes, controls, and procedures

Goal Clarification

Next, we will discuss your goals for the business and what you hope to achieve personally. For example, what kind of buyer do you wish to attract? A financial buyer will purchase the company and continue running it after you are gone. In contrast, a strategic buyer may only want your technology, intellectual property, customers, or something else.

On a personal level, we will ask why you want to sell the business, what you plan to do next, and your ideal outcome (price, terms, and where you are willing to compromise). The idea here is to understand what you expect (to ensure you are being realistic) and prepare you for what you will experience as the seller so we can be sure you are ready financially and emotionally.

Then, we compare your goals to our assessment to see if they align or if we must adjust.

Plan Development

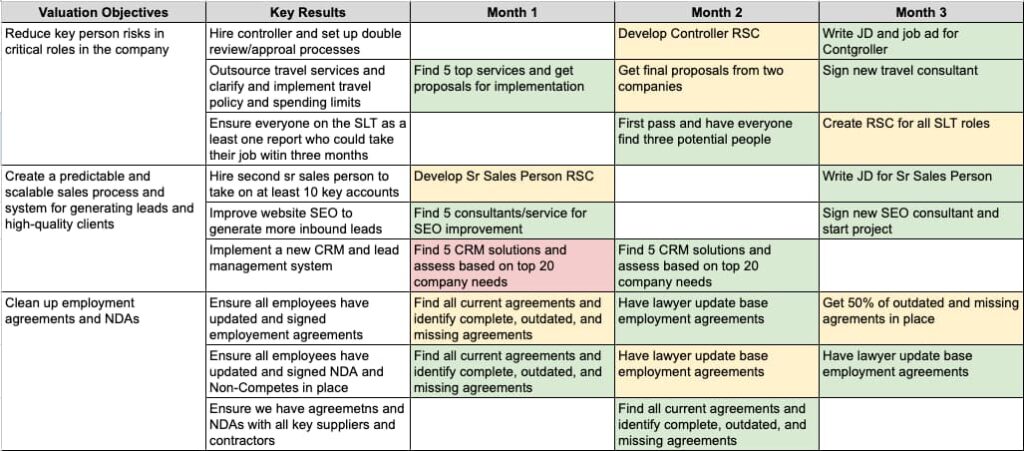

Using the information above, we develop a plan to change aspects of your business to maximize value and secure favorable sales terms while addressing anything that could diminish your valuation. We identify improvements with the highest impact potential, set targets, and build an implementation team. Your plan will likely look something like this.

When I work with clients, we typically budget about one intense month for planning. Then, I stay with them throughout the sales process – leading the team, connecting them with other critical players, and providing advice as we prepare the business and navigate the sales process.

2. Preparing the Business for Sale: Value Creation

At this point, we may need to involve certain people within your company, but only on a need-to-know basis. Most business owners prefer to keep a prospective sale private until the deal is imminent. We will discuss this with you beforehand and find a way to give anyone we involve some stake in the process.

Then, with your plan in hand, the team will make improvements to boost your company’s value while resolving anything troublesome that could negatively affect the sales process. The effort takes time, but it is well worth it. When we reach a logical stopping point, we reassess what your business is worth and compare that to your goals to determine if we are ready to move forward.

One thing to know at this stage is that sometimes, business owners become so wrapped up in the optimization and sales process that they neglect the critical task of running their business. That is a massive mistake because it can adversely impact the company and, ultimately, the sale. That is why you hire experts. Our job is to make improvements, handle the sales process, and minimize distractions so you can keep the business running, thus preserving its value.

3. Build Your Team and Go to Market

When you are ready to pursue a sale, we will build your deal team. The appropriate team and resources for you will depend on the size of your business.

For example, for small business owners, we might hire a business broker to find a qualified buyer. With mid-sized companies, we, as M&A advisors, can spearhead expanding the options by finding potential acquirers. For large companies, we can bring in specialized investment bankers with propriety networks of large companies looking to do significant transitions. In all cases, we help you navigate the mechanics of the sale and think outside the box to find strategic opportunities.

Then, we will package the business and develop your story. For instance, we will create a one-page information sheet to generate interest without revealing sensitive information. We will also build a much more detailed business overview with financials, forecasts, etc., which we will only share with serious buyers later. The contents of these documents can vary depending on the type of buyer you hope to attract. Still, the key is to present necessary information about your business in a favorable yet factual light.

Finally, when the time is right, your investment banker or M&A advisor will share the one-page information sheet with their network to generate a broad list of suitable, high-caliber buyers.

4. Buyer Selection and Initial Deal Structuring

Together, we will review the list of potential buyers and narrow it down. Then, we will ask the remaining prospects to sign non-disclosure agreements before sending them an in-depth overview of your company. We are cautious at this stage because we don’t want to reveal intimate details of your business to other parties unless we believe they will likely submit a viable offer.

The buyers will examine the materials and, if they wish to press forward, submit a term sheet, Indication of Interest (IOI), or Letter of Intent (LOI) stating their interest in your company and their offers, which will consist of a price and terms (the criteria for completing the sale). Term sheets, IOIs, and LOIs are similar, except term sheets and IOIs are completely non-binding, while LOIs are more formal, requiring both parties’ signatures and an agreement to a financial penalty if you don’t proceed with the sale. Typically, you get the term sheet or IOI first, then the formal LOI, as the deal moves forward, but the precise progression for you will depend on the nature of the sale.

A well-run sales process says a lot about a business and will translate to higher offers. Good advisors and bankers get to know you and your organization intimately and create a selective, competitive environment. They also coach you on presenting your company and answering questions accurately yet compellingly to keep the deal moving. You will vet each prospective buyer’s goals and intentions while buyers work to differentiate themselves from the competition. Then, there will likely be negotiations before you choose a buyer with whom to move forward.

Please note that a failed sales process can be a red flag for future buyers and could diminish your company’s perceived value, so it is best to get this next phase right. However, you will be ready if you carefully follow steps one through four.

5. Due Diligence

Next, the buyer conducts due diligence to gain as complete an understanding of your company as possible. They pull in any necessary third-party specialists to dig through your audited and unaudited financials, tax returns (if relevant), your quality of earnings report (QoE), and anything else that provides insight into your business. The goal is to verify that everything you shared in your business overview is true.

A stellar internal management team and investment banker will pay dividends during this step. During preparation, skilled professionals aim to make the due diligence process a formality, not a minefield, by eliminating or disclosing potential roadblocks. Then, as you engage in due diligence, they act as your buffer, anticipating and answering your buyers’ numerous questions while you focus on running the company. Naturally, they will keep all this activity under wraps until you finalize the deal.

My general rule is to get my clients to a point where they are happy with the cash they receive at signing. So, even if you agree to stay with the company for a while, we aim to structure a deal that gives you freedom and flexibility. Therefore, I would coach you to avoid any arrangement that leaves you in a situation where you desperately want or need an eventual payout.

6. Legalities

After you reach an agreement, your lawyers will take the necessary steps to finalize any remaining terms, conditions, and legal details. We sorted out the business terms during the negotiations, so during this phase, your legal team works through everything else (shareholder rights, warranties, governance, etc.) and creates the official, legally binding purchase and sale agreement.

7. Seal the Deal

Finally, when the paperwork is complete, both parties thoroughly review the agreement. The transaction isn’t final until all buyers and sellers have signed on the dotted lines and the wire transfers go through, so although this step may seem somewhat route, it can be stressful. If either party becomes spooked, the entire transaction could fall through.

8. Navigate the Integration

Once the business is sold, the handover process begins. Successful integrations usually take about 6 to 12 months and require a new round of planning.

If you went with a financial buyer, they would evaluate every aspect of the company, including systems, processes, management, and employees, and make any necessary adjustments. Or, if you went with a strategic buyer, the new owner would likely make significant changes, letting go of some things while assuming control of others. As the prior business owner, the depth of your involvement will depend on the terms of the deal.

9. Earn Out and Rollover Equity

If someone purchased your business in an all-cash deal, step 7 was the end of this process for you. But sometimes, business owners agree to stay on for a while to ensure a smooth transition and have additional payment opportunities based on business performance and likely equity in the new company. When this is the case, you will continue with the organization in some capacity until you have satisfied the terms of the deal and receive your final payout.

How to Sell Your Business – The Bottom Line

Preparing your company, finding a buyer, and navigating the selling process is not easy. But, with much planning and a great team who can coach you through the inevitable challenges, you can sell your company gracefully and secure the desired results. Contact us today to discuss your organization and how we can help.