Many small businesses start with the owner managing operations on a cash basis. While this approach can work for a while, it typically becomes problematic when the company encounters a financial snag or begins to expand. That’s why, as a fractional CFO who primarily works with growing companies, I typically recommend that my clients switch to accrual accounting. Below, I explain cash vs. accrual accounting and how each method affects your business so you can better understand why this change becomes essential.

Table of Contents

What is the Difference Between Cash and Accrual Accounting?

The main difference between accrual and cash basis accounting is when you record revenue and expenses. Here are the basics.

What is Cash Accounting?

Cash accounting (also known as cash-basis accounting) is when a company records transactions when money comes in or goes out of the business. In other words, you “recognize” revenue on your income statement when the cash enters your bank account, and expenses are recorded when they are paid.

What is Accrual Accounting?

Accrual accounting is when a company recognizes revenue when earned and expenses when incurred, even if the money exchange happens at a different time. For example, if it performs a service or delivers a product in December, it records the transaction in December, regardless of when it invoices the client and receives payment.

The No-BS Financial Playbook for Small Business CEOs

Are you tired of making costly financial mistakes? Stop guessing and start growing. Learn how to create a scalable and valuable company while minimizing risk with this playbook from a serial entrepreneur who has been in your shoes.

Examples of Accrual Basis vs Cash Basis Accounting in Action

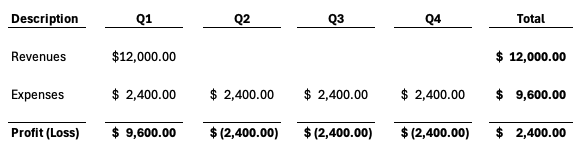

That may not sound like a big deal, but imagine you run a software business where clients pay for a year’s subscription upfront. Let’s assume that the software sells for $12,000 annually and the company has $800 monthly in expenses (engineering, support, hosting, etc.). Using cash-basis accounting, the income statement for the year might appear as follows:

If you were the CEO of this company reviewing your financial statements at the end of the first quarter, you might mistakenly believe you have $9,600 available to spend, not realizing there will be no more money to cover expenses in future quarters. Said differently, cash accounting obscures the connection between revenues and expenditures, putting you in a position where you could make bad business decisions (and put your entire company at risk) based on flawed data. In accounting, this is called the matching principle.

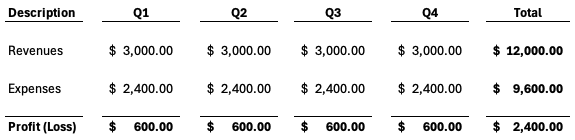

With accrual-basis accounting, your income statement would look like this.

Thus, the company generates $600 per quarter in profits. That’s a big difference from gaining money in the first quarter and losing it in subsequent quarters.

When cash is received, instead of showing the full amount on the company’s income statement (and an asset on the balance sheet), it is shown as deferred revenue (a liability) on the balance sheet. Then, the amount is amortized throughout the year, recognizing 1/12 of it when earned each month, reducing the liability figure, and recording the related expenses. That way, the liability is seen instead of that cash in January, making it easier to know if the organization is profitable and allowing for wiser business decisions.

This simplistic example shows how quickly this situation could spin out of control. But in most cases, the cash basis vs. accrual basis conundrum sneaks up on business owners over time. Let’s discuss another example.

Cash Accounting vs Accrual Accounting for a Service-Based Company

Many consulting firms are initially owner-operated, with one consultant providing services to a few clients, aiming to match their salary. In this scenario, the cash accounting method works perfectly well. However, if the consultant is successful, they will eventually have more opportunities than they can handle alone. At that point, they can either refuse additional work and keep things small or grow, inviting more clients and other participants (partners, employees, lenders, etc.) into the business.

That’s where the trouble begins. As companies grow, money moves in and out of the business more quickly, and you can lose track of things. Before long, it becomes impossible to understand how the numerous changes to your payables and receivables impact the business. In finance, this is called working capital management.

You may not notice it immediately if you make and receive timely payments, perform roughly the same activities each year, and enjoy modest growth. However, as soon as there is a significant change in the company (like growth or shrinkage), it will become a problem.

Example

For instance, I recently took on a client who had been running their business on a cash basis when they experienced a sharp revenue downturn. Since they hadn’t managed their revenues correctly, they couldn’t quickly adjust their expenses to accommodate. It wasn’t that their numbers were wrong; they just didn’t have the financial information necessary to make speedy decisions. Improper working capital management and reporting hid the risk of their business operations and the changes happening in the company.

Indeed, transitioning from cash to accrual accounting involves more than just numbers. When I help companies make this switch, I don’t just change their bookkeeping and accounting practices. I teach them how to use the data to gain insights into the business and make informed decisions.

The company couldn’t review its information and answer questions like the following:

- If this trajectory continues, when will I run out of cash? In other words, how much cash “runway” do we have?

- What changes could I make to my operations to buy more time?

- What is our monthly gross profit and operating profit as a percentage of revenues?

By realigning how we captured and reported their results, we could provide the needed financial reports on an accrual basis so that the CEO and the other executive team members could make informed decisions using accurate and relevant data.

Understanding the Difference Between Accrual Accounting vs Cash Accounting

The biggest risk with the cash-basis method of accounting is that it ignores the timing of earnings and expense activities. This risk can cause a company to go out of business, at worst, and at best, it can cause significant pain points that distract the management team from its core business strategy. It is tricky and frustrating to fix entirely avoidable problems.

Cash accounting puts leaders in a position where they must manage the business based on its cash balance. It’s like running a household based on what is in the bank without putting money aside for property taxes or retirement. It can work in the short term, but it’s not sustainable in the long term.

Suppose a company delivers services for a client in January, and the client doesn’t pay until May. The company must still cover payroll, rent, and other expenses until it receives payment. So, although cash accounting can work when finances are simple, it leaves the company vulnerable, especially if it collects money upfront or the business is in a stage of rapid change management. It makes it challenging to get an accurate picture of financial health, which inhibits the ability to make confident decisions and puts the business at risk of not meeting expenses.

Is your company ready to make a change? The following chart explains when we record revenues and expenses using one method over the other, so you know what to expect.

Cash Method vs Accrual Method

When is it recorded?

Cash Method | Accrual Method | |

Revenue | Upon receipt | When earned (i.e., when the service is performed (if hourly), upon the attainment of certain milestones (if project-based), or when the customer accepts delivery of a product) |

Expenses | Upon payment | When incurred, accruing for any unpaid expenses before closing the books each month |

Loan or Equity Infusion | Upon receipt | Upon receipt |

Payroll | Upon payment | Depending on the payroll cycle, payroll accruals may be needed |

Earned Vacation Time | Upon payment | Accrued as a liability on the company balance sheet until paid |

Earned Bonus Money | Upon payment | Accrued as a liability on the company balance sheet until paid |

Taxes | Upon payment | Accrued as a liability on the company’s balance sheet until you pay taxes |

Accrual Versus Cash Accounting Pros and Cons

Cash-basis accounting is a legal method used by many small companies. CPAs use it, too, for tax purposes. That’s why some business owners find it confusing when we suggest they switch. However, just because it is possible and accepted in some scenarios doesn’t mean it is best for your business.

Companies that adhere to Generally Accepted Accounting Principles (GAAP) use accrual accounting because it’s the industry standard. But, even if your business is small and doesn’t adhere to GAAP yet, transitioning to accrual accounting will become necessary as you grow because it becomes harder to function correctly without it, and every savvy business leader, lender, and investor who reviews your financial records will expect it.

Therefore, simplicity is the only real “pro” of cash accounting, but it’s only simple if your business is, too. If you run a one-person shop and do not plan to take out a loan, hire, or grow, you can get away with it. In this scenario, you typically don’t have receivables or accounts payable; you earn and spend money as you go. Even if you use accounting software and apply accrual accounting practices, they aren’t necessary because your business functions on a cash basis.

However, as companies mature and their operations become more complex, you must switch to accrual vs cash accounting. It is more complicated, but it’s worth it because it will make it easier to build the reliable financial reporting function you need to manage your business confidently. With accrual accounting, you get the following business performance-enhancing benefits and more.

- Clear and Holistic Financial Reporting: Accrual accounting smooths revenue and expenses over time, providing better insight into the profitability of customer relationships and a more accurate picture of the company’s financial health. You will no longer be at risk of misinterpreting your cash situation and making ill-informed decisions.

- Better Data for Accurate and Realistic Forecasting: With this information, you can project cash flow into the future, compare your trajectory to your goals and plans, and make any necessary adjustments before things spiral out of control.

- More Respect in Your Business Dealings: After you switch to accrual accounting, you can share your financial data with external entities that require it in the form they expect. That will make securing funding easier and could even help with hiring and sales.

Of course, a side benefit of switching to accrual accounting is that you’ll never have to read another article or listen to a CFO lecture you on the merits of accrual vs. cash-basis accounting again (kidding, not kidding).

Cash vs Accrual Accounting: The Bottom Line

Cash accounting could be acceptable if you run a tiny business and plan to keep it that way. However, suppose you wish to build a financially viable organization that can grow, scale, and produce a return for years. In that case, I strongly recommend you switch to accrual accounting and learn how to use the resultant data to guide your decisions. If you’re unsure where to start, check out our Right Hand Finance™ offering or reach out today to discuss your situation.