If you’re waiting for artificial intelligence (AI) to become relevant to your finance function, you’re already behind. Your competition isn’t debating whether to implement AI. They’re making decisions based on real-time data while you’re still waiting for last month’s financial reports.

I recently attended an event where I spoke to SMB CEOs about AI in finance and accounting. The core message? AI isn’t about replacing your team with robots. It’s about transforming your finance function from a reactive reporting department into a strategic advantage.

Below, I explain what AI can do for your business, share real examples, and give you specific questions to ask your CFO.

Table of Contents

Understanding the Three Types of AI

Before we get into practical AI applications, you need to understand what we’re talking about. There are three types of AI tools relevant to your finance function.

The No-BS Financial Playbook for Small Business CEOs

Are you tired of making costly financial mistakes? Stop guessing and start growing. Learn how to create a scalable and valuable company while minimizing risk with this playbook from a serial entrepreneur who has been in your shoes.

Reactive Assistants

These are the chat-style helpers you have probably used – generative AI tools like ChatGPT, Claude, and Gemini. You ask a question and get an answer. You can use these tools to summarize information, analyze complex queries, or get quick insights. These AI systems are simple; they answer one question at a time.

Task Agents (Bots)

These are triggered automation tools. Something happens (a trigger), the tool runs its function, and completes the task.

Think about receiving a vendor invoice via email. The system automatically extracts key data, categorizes the expense, and creates the entry in your accounting system. Or imagine email rules that automatically route messages to specific people. These are repeatable, predictable tasks that can happen without human intervention.

Digital Staff (Agentic AI)

Here is where it gets interesting. Agentic AI technologies can make decisions independently.

For example, a digital AI assistant that wakes up at 7 AM, fetches your last 24 hours of emails, organizes them, identifies which require action, and sends you a prioritized summary by 9 AM. Or a system that researches everyone on your calendar before meetings and provides background information so you’re not scrambling to remember who they are.

These AI-driven agents can work across multiple systems, make decisions along the way, and do work that used to require many hands. What took hours or days now happens in minutes, 24/7.

Real ROI: What AI in Finance and Accounting Actually Delivers

Let’s talk numbers because that’s what matters. I have seen the impact firsthand.

Case Study: Manufacturing Firm

An $8 million manufacturing business reduced its month-end close from 17 days to 3 days. Three days! They automated their reconciliation process, implemented real-time variance analysis, automated recurring journal entries, and used workflow automation for repetitive tasks.

The result? Hundreds of thousands of dollars saved, faster decision-making, and better business insights. The toolset? QuickBooks Online, Dext for AR/AP management, and Numeric for automated month-end close.

They implemented this solution in less than four months.

Case Study: Services Business

A services firm discovered $150,000 in miscategorized expenses—mainly meals that were in the wrong buckets. By amending their returns, they recovered $50,000 and established ongoing savings. They also fixed inconsistent customer cost allocations. That enabled them to finally see profitability by client and make informed decisions about pricing and which customers to keep.

The Math on ROI

For a $10 million business, improving decision-making speed and accuracy by just 1% could save over half a million dollars annually. The cost to invest in AI tools is minimal. We’re talking $15,000-$27,000 annually for a comprehensive implementation—a fraction of the cost of hiring another full-time person.

Consider this comparison: A full-time staff accountant costs around $65,000 plus benefits, training, and management overhead. They take 2-3 months or more to get fully productive. AI tools cost less than 25% of that and can be productive in under 30 days. Plus, they scale without additional investment.

The AI Tools for Accounting and Finance We’re Actually Using

Let me share some practical examples of tools we’ve built for our clients. These aren’t theoretical—they’re working in real businesses right now.

Operating Expense Audit Tool

We created a tool that audits 90 days of general ledger transactions in minutes. It identifies potential errors, duplications, vendor overpayments, anomalies, and significant variances from prior months. For a marketing firm with hundreds of transactions, it flagged eight unusual transactions requiring research, highlighted spending trends, and identified duplicate charges and missing vendor names.

What used to take days of manual review now takes minutes, with a clear roadmap of exactly where to focus attention.

13-Week Cash Forecast

This interactive tool imports your general ledger transactions, AP aging report, and AR aging report. It allows your controller or accounting manager to select which bills to pay and when, adjust when receivables will actually arrive (not just when they’re due), and see the week-by-week impact on your cash position.

You can see exactly when your cash will dip below comfortable levels and make proactive decisions about drawing on credit lines or cash reserves before you have a cash flow problem.

Executive Dashboard

We build monthly performance dashboards that pull data from both accounting systems and CRMs. These aren’t just backward-looking reports—they highlight the specific areas that need attention.

Client concentration problems? Revenue trends? Cash analysis? Sales pipeline health? It’s all there in a format that takes minutes to digest (and create) vs. hours.

The AI generates discussion points automatically. Of course, your CFO should review these before sharing them with you (always have a human in the loop), but it dramatically cuts the time to create meaningful executive reports.

Interactive Forecasting Tool

This is where scenario planning gets powerful. We built a tool that lets you sit with your CFO and adjust assumptions in real-time.

How many projects per month? How long until projects start generating revenue? What’s the average project value? What’s our backlog?

As you change the inputs, you see the P&L impact instantly. You can quickly explore worst-case, base-case, and best-case scenarios without your CFO spending days rebuilding models.

Clearly, these tools save time and provide quicker insights by automating routine tasks, identifying patterns, and performing predictive analytics. But they also enhance essential capabilities such as risk management and fraud detection.

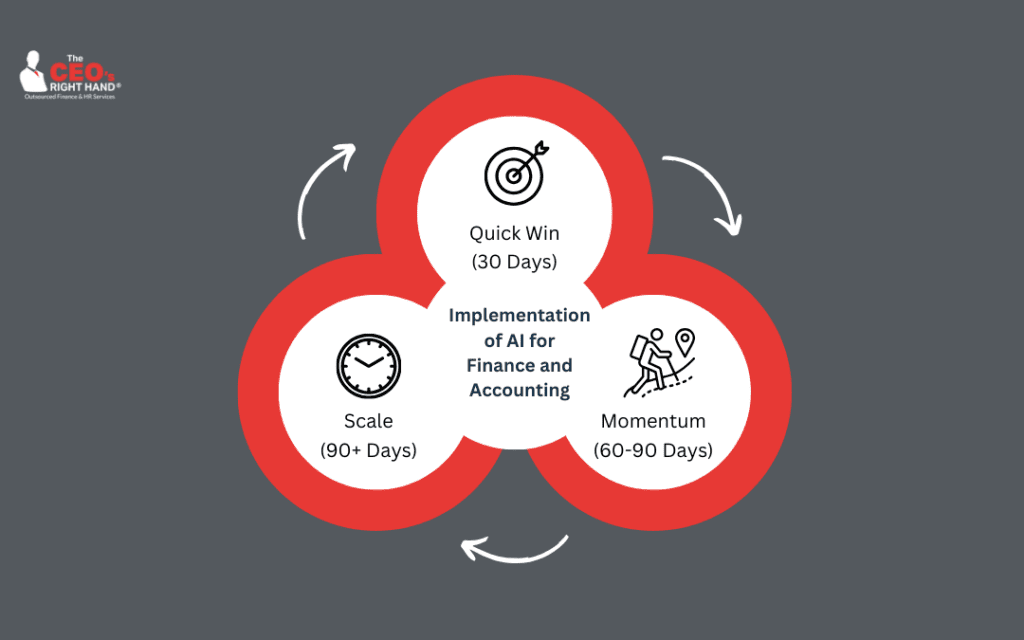

Implementation of AI for Finance and Accounting: Weeks, Not Years

Here’s what I tell every CEO who’s overwhelmed about where to start with AI. Think in phases, not big-bang implementations.

Phase 1: Quick Win (30 days)

Pick one painful but not overly complex process. For a $15 million distribution business, we started with invoice processing. The company had 200+ vendor invoices per month. We automated the categorization and booking, reducing manual entry by 18+ hours each month.

It paid for itself immediately.

Phase 2: Build Momentum (60-90 days)

Next, we tackled customer billing. We reduced errors and improved cash flow by eight days. That’s real working capital improvement.

Phase 3: Scale (90+ days)

Then we moved to inventory management. Each phase built on the previous one without overtaxing the team.

The key is to establish baselines before you start. You need to know where you’re beginning so you can measure the ROI at the end. If you can’t prove the return, you won’t get buy-in to scale.

Common Pitfalls and How to Avoid Them

I’ve seen plenty of AI implementations fail. Here’s what typically goes wrong and how to avoid it.

Going Too Big, Too Fast

Don’t try to automate everything at once. That creates chaos. Start with one process, prove the ROI, then expand. Think crawl, walk, run.

Lack of CFO Buy-In

If your CFO or whoever owns the function isn’t on board from day one, it’s going to fail. Period. They need to be the champion, not a reluctant participant.

Choosing Features Over Integration

A tool with amazing features that doesn’t integrate with your accounting platform is worthless. Integration is non-negotiable.

Skipping the Pilot Phase

Don’t marry someone after the first date. Run a pilot, gather data, prove the concept, then scale.

Underestimating Change Management

Your team may resist. Plan for that. Communicate early and often. Celebrate wins and show them how this makes their jobs better, not redundant.

Questions to Ask Your CFO Immediately

Here are the specific questions you should be asking your CFO right now:

Operational Efficiency

- Where are you and your team spending time on work that doesn’t require judgment? (Think month-end close, data gathering, reconciliation.)

- What analyses do you wish you could run weekly but only do quarterly because of the time involved?

- What questions do I ask you that take two or three days to answer, but could take hours—or minutes?

Strategic Framing

- If we cut your team’s data-gathering time by 50%, what higher-value work would you redirect them to?

- What financial insights would change our decision-making if we had them in real time versus monthly?

Implementation Planning

- Where should we start with low-risk automation that could build to strategic analysis?

- How should we measure success beyond just hours saved? (Think faster decisions, reduced human error, better insights.)

These questions will tell you quickly whether your CFO is thinking strategically about AI or just hoping it goes away.

Artificial Intelligence in Accounting and Finance: The Bottom Line

According to recent surveys, 68% of CFOs admit they don’t even know where to begin with AI implementation. That’s understandable. There are countless AI solutions, constant changes, and plenty of stories about failed investments.

But here’s the reality: your competition is already doing this. While you’re debating, your competitors are making decisions based on tomorrow’s data. They can look at their cash position 90 days out, identify collection problems before they happen, see real-time profitability by product line, and spot expense leakage as it happens.

The question isn’t whether to implement AI in your finance function. The question is: do you want to be the disruptor or the disrupted?

Start small. Pick one painful process. Get your CFO on board, run a pilot, and measure the results. Then scale what works. You can do this in weeks, not months or years.

And remember: AI is about augmentation, not replacement. The goal is to free your finance team from data entry and manual accounting tasks so they can become strategic advisors. You want them working on the business, not in the weeds.

The CEO’s Right Hand has helped dozens of companies implement AI in their finance functions, resulting in faster closes, better insights, and significant cost savings. If you’re ready to explore how AI can transform your financial operations, let’s talk.