There comes a time in every business owner’s life when you must consider your next move. Perhaps you have another brilliant idea you want to pursue, or you’re ready to retire. Whatever the reason, business exit planning is vital to realizing that dream. As a value strategist, I have helped many CEOs traverse this path. Below, I explain how I approach this process to create the most value.

What Is an Exit Plan and Why Do You Need One?

Business exit planning is the process of assessing the state of your business, considering your short—and long-term goals, and outlining the steps you must take to make your company more valuable before pursuing an exit strategy.

If you wish to leave your company, your exit strategy probably involves selling your business, but there are many types of exit strategies. For a lucky few, an initial public offering (IPO) might be your path. But, for most small business owners, a common exit strategy includes selling to a private equity firm or a competitor.

In other words, any arrangement involving giving up company ownership or majority control is an exit. However, for this blog post, we will assume that your goal is to transfer ownership to another party (a private equity firm, partner, or family member), sell the firm to your employees, or engage in a management buyout.

The No-BS Financial Playbook for Small Business CEOs

Are you tired of making costly financial mistakes? Stop guessing and start growing. Learn how to create a scalable and valuable company while minimizing risk with this playbook from a serial entrepreneur who has been in your shoes.

What is the Purpose of Business Exit Planning?

Exit planning is critical because it helps you strengthen your position before pursuing a buyer and negotiating deals, thus improving your outcome. When building an exit plan, you think through the price, terms, conditions, and deal structure that would make a transaction worthwhile. You also scrutinize the state of your business to determine what you must improve to make such a deal possible. The better job we do, the better off you will be, with more choices and control over the sales process.

In most cases, the ideal arrangement for the seller is to receive the entire price in cash. However, as you go through this exercise, you will get the opportunity to consider other arrangements.

For instance, if an investor offered you 20% cash and 80% earned over time based on the company’s performance, would the risk be worth it? Probably not, especially if someone else will be making the business decisions. But if someone gave you the choice between $5 million today or $3 million and the potential for another $10 million over time, that might get your attention.

When I work with clients, my general rule is to get them to a point where they are happy with the cash they receive at signing. Said differently, even if you accept a go-forward role, we aim to structure a deal that gives you freedom and flexibility after the transaction closes. Therefore, I would coach you to avoid any arrangement that leaves you in a situation where you desperately want or need an eventual payout.

4 Steps of Business Exit Planning

So, what does the exit planning process entail? Let’s go through the steps so you know what to expect.

1. Find a Trusted Advisor

Selling and exiting a business isn’t easy, but not always for the reasons you would imagine. Naturally, the mechanics require expertise, but sometimes, the hardest part is being honest with yourself about what is and is not possible. If you built your company from the ground up, you have a lot at stake, both emotionally and financially. So, find an exit planning advisor you can trust who can be your objective partner throughout this process.

Contact your network or ask your financial advisor, estate planning professional, or tax accountant for recommendations. Ideally, you will find an experienced third party, such as a business strategist or fractional CFO, who can examine your situation, provide unbiased advice for creating value, and connect you with brokers or legal professionals when it is time to press forward.

2. Perform an Assessment and Clarify Your Goals

When I do this with my clients, I start with a company assessment. I identify issues and opportunities by looking at your business through a potential buyer’s lens. For example, we will go through an exercise to determine which aspects of your business could contribute to or detract from your valuation by looking at factors such as the following:

- Market Position: Do you have a differentiated product, brand, or reputation?

- Leadership Team and Talent: Is the CEO running everything, or are responsibilities shared among a strong management team and supported by a deep talent bench?

- Client Base: Do you have a few large clients, many smaller ones, or a mix?

- Processes: Do you make it up as you go or have documented systems?

- Track Record: Are your monthly results consistent, or do they vary?

- Governance and Controls: How are decisions made at your company?

These are just a few items we will discuss concerning your organization. We will also examine your business plan and explore your readiness as a team. Then, we will use what we learn to develop an estimated baseline valuation.

Next, we discuss your goals with the above context in mind. I might ask you questions like:

- Why do you want to sell your business?

- What kind of buyer do you hope to attract?

For instance, do you intend to sell your company to someone who will take over the day-to-day running of the business? Or are you comfortable working with a strategic buyer who may only want your technology, clients, or team? - Are there any people you wish to protect or benefit in this process?

- What is your ideal outcome? How much do you hope to receive, and under what terms and conditions?

- Where would you be willing to compromise?

- What is your desired timeline?

I encourage all business owners to run their companies as if they were going to sell anytime, optimizing as they go. However, most people engage an advisor at least 12 months before starting a sale process, but ideally, you should plan your exit strategy 2-3 years out.

Once we have completed these questions, we will compare the assessment to your goals to see if they align. If your goals aren’t realistic, given the state of your company, I might suggest you give yourself more time to shore things up and grow the business or adjust your expectations. Then, once we decide we are ready to press forward, we’ll build your plan.

3. Develop Your Plan

In most cases, preparing for an exit involves using what we learned to change fundamental aspects of the business to maximize valuation and get beneficial terms for the sale. We will use what we discovered in step 2 to prioritize.

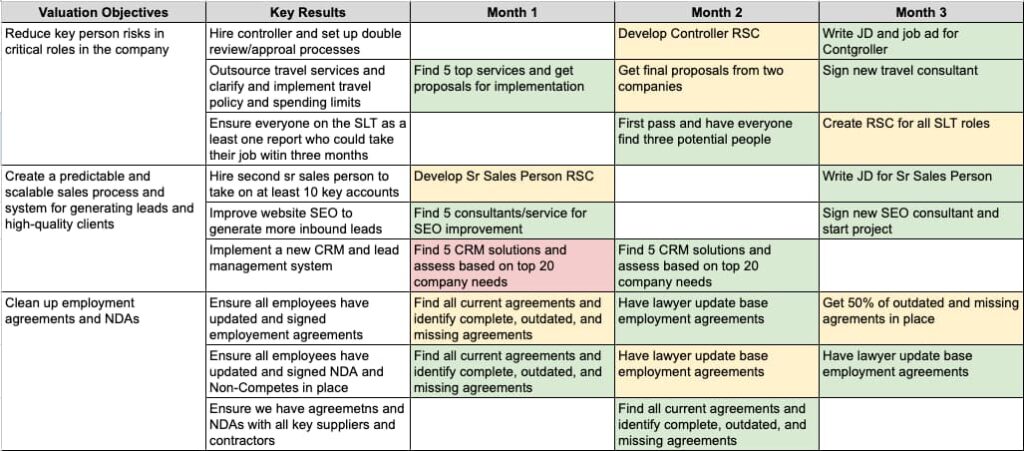

First, we will identify 3-5 key objectives and what we expect them to do for you. These will be the improvements that will have the most positive impact on your outcome. Then, we will set targets and build an implementation team. Each month, we set specific goals and track progress as we go. Here is a snapshot of what your plan might look like.

Finally, before we move forward, we will agree on an implementation plan. For instance, team leaders may meet every 30 days to discuss high-level progress, update the plan, and reassess their objectives every 90 days. Meanwhile, each team might have a weekly call to discuss and troubleshoot any problems or opportunities.

4. Optimize Your Business

At this point, we will be ready to start the sale process. We can complete steps 1-3 above in about 30 days, but optimizing your company will take some time. So, I will remind you that, as the owner of your company, your job is to focus on running the business. Once we have a deal team in place, they will be in charge of whipping things into shape while you preserve the value you have already created.

After implementing our plan, we will reassess your company’s valuation and bargaining position. If satisfied, we will proceed with selling your business – packaging, buyer identification, negotiations, due diligence, etc. But we will save that discussion for another day.

Business Exit Planning: The Bottom Line

Before you pursue a business exit strategy, you must develop and implement a plan to improve your valuation and strengthen your negotiating position. That will help you confidently enter the sales process and improve your outcome. Check out our brochure to learn more about how we can help, or contact us today.