The following article was written by Geri Stengel, founder of Ventureneer.com, and Contributing Author Rachel Hersch, Prestige Capital

—

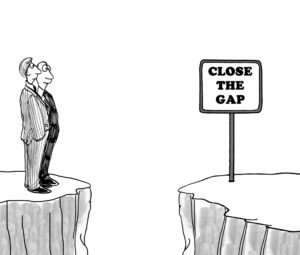

Even profitable businesses can have cash-flow issues. This is especially true in industries with long payment cycles, such as apparel, construction, food and beverage, government contracts, hospitals and nursing homes, importers and exporters, manufacturing, staffing, transportation, and wholesale/distribution. “There is an $87 billion gap in financing for small businesses,” said Marina Linhart, CEO at Next Street. The firm advises cities, foundations, large institutions, lenders, and nonprofits that serve small businesses on how to do it better. The key to closing the gap “is having access to the right form of capital in the appropriate amount that is needed.” she noted. “Alternative finance provides a very useful product for very specific circumstances for a business.”

Even profitable businesses can have cash-flow issues. This is especially true in industries with long payment cycles, such as apparel, construction, food and beverage, government contracts, hospitals and nursing homes, importers and exporters, manufacturing, staffing, transportation, and wholesale/distribution. “There is an $87 billion gap in financing for small businesses,” said Marina Linhart, CEO at Next Street. The firm advises cities, foundations, large institutions, lenders, and nonprofits that serve small businesses on how to do it better. The key to closing the gap “is having access to the right form of capital in the appropriate amount that is needed.” she noted. “Alternative finance provides a very useful product for very specific circumstances for a business.”

Many companies in these industries rely on an alternative financing option known as factoring.

Factoring means that a business sells its accounts receivable (invoices) to a third party (called a factor) to get its money quickly rather than waiting for the customer to pay directly. It provides a flexible funding strategy. It’s not a loan because you don’t incur debt. It’s not equity because you don’t give up a piece of your company. However, invoice factoring can provide the financing your company needs.

“You’re not borrowing money from a factor and you don’t pay interest on the money,” said Rachel Hersh, Sales Director, North America, Prestige Capital, a factoring company. “Instead, you sell your invoices at a discount to get cash. The factor then owns the invoices and gets paid when it collects from your customers.”

Factoring is particularly useful when your startup or small business doesn’t qualify for traditional financing, when you need to supplement an equity raise or when you need money faster than banks can deliver it. The application process is typically quicker and simpler than a bank’s.

While factoring is more expensive than a bank loan, “the benefits of qualifying based on your customer’s creditworthiness, not yours, an easier application process and speed of receiving money can outweigh its costs,” said Hersh. It is important that you understand the costs and compare factoring to traditional loans. Your accountant can help you do an apples-to-apples comparison by calculating the equivalent APR based on the factor’s discount.

Startups and small businesses typically turn to factoring to:

- manage seasonal fluctuations in sales

- fund payroll inventory and other working capital needs

- purchase machinery and equipment

Companies may also turn to factoring if they need money for:

- bridge financing

- debt refinancing

- early-stage financing

- growth and acquisition financing

- leveraged buyouts or turnaround or debtor-in-possession financing

Factors provide other services as well. “Some startups and small businesses are so happy to get a sale, they don’t bother to find out if the customer has the capacity to pay them,” said Hersh. Factors may provide back-office services such as evaluating the creditworthiness of a company’s customers to determine the extent to which payment terms should be extended – a very useful additional service.

Factors also can provide insight into the true payment cycle of the industry and of a specific potential customer. This can help you negotiate better terms. “Big companies may tell an inexperienced company they pay in 45 to 120 days so they can hold on to their money longer, but factors know whether you can negotiate a faster payment cycle,” said Hersh. “This insight can be invaluable.”

Factors may differ in terms of:

- size of companies they work with

- industries they specialize in

- stage of business (some will work with startups, others won’t)

- number of invoices they fund (some factors may have a minimum number of invoices they require)

- whether you can cherry-pick invoices to be managed or have to have the factor manage all your accounts receivable (some companies don’t want to lose their ability to collect from their customers so being able to select invoices to manage can be key)

- how quickly they can provide money

- amount of documentation (do they demand financials and tax returns?)

- whether they require a personal guarantee

- discount rates and fee structure

- repayment terms

Be aware that rates will differ depending on volume. The more invoices and the higher the amount of the invoices, the lower your rate. Rates also will differ depending on how long the money is outstanding.

How do you find the right factor to meet your needs? Your accountant is a great place to start, but also ask your banker. Yes, even though your banker may not be able to fund you, they want you to be successful and can frequently refer you to other more appropriate financing options.

This unique financing option can help your business level out cash flow, manage unpredictable payment cycles, and acquire much-needed capital for growth. It pays to shop around for a factor that understands your industry and can customize a service package that meets your needs.

Do you have invoices that you could get cash for by going to a factor?