Business Tax Services

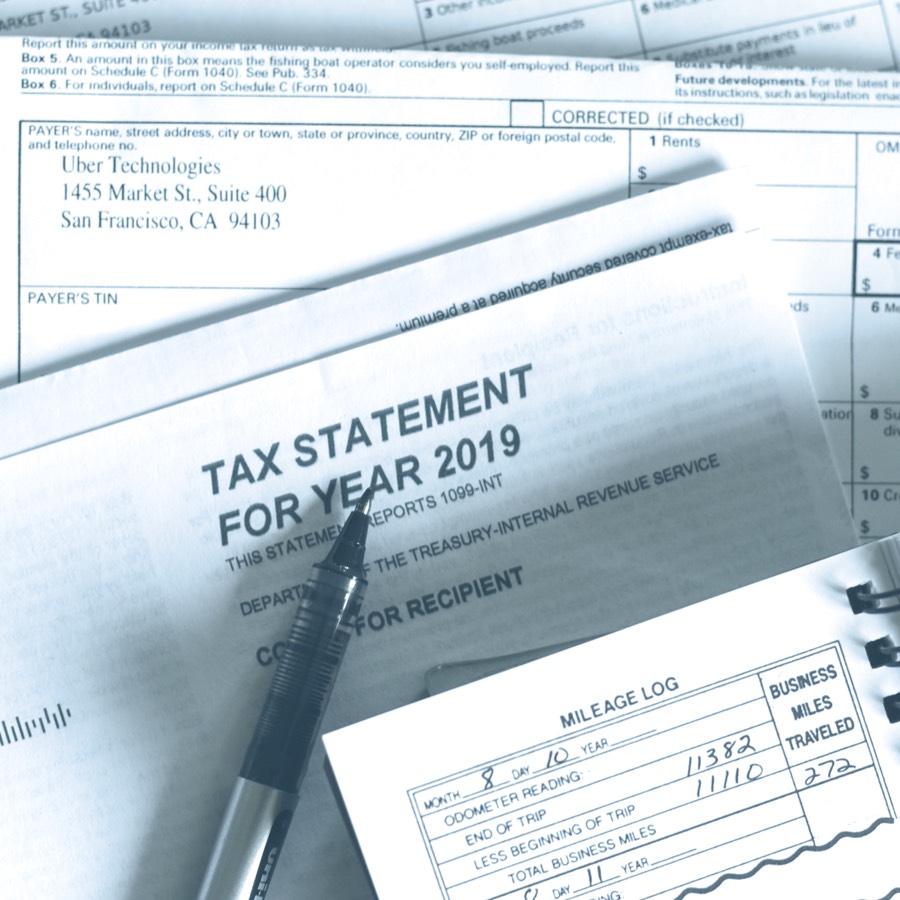

Tax advisory, preparation, and filing services for small and mid-sized businesses.

As an executive of a growing company, you have more pressing matters to attend to than tax planning. Yet, you are aware that local, federal, and international taxes affect your bottom line. You need a partner who is invested in your success and who can help you fulfill your obligations while planning for and taking advantage of potential tax savings.

At The CEO’s Right Hand, we provide business tax services designed to simplify the challenges and opportunities faced by small and mid-sized companies. Our clients hire us to help them implement fiscally responsible growth strategies. The following tax services round out our offering:

Tax Planning

We integrate tax planning into your business strategy so you can anticipate the cost of new initiatives, plan for payroll and sales taxes, and limit your tax liability.

Tax Accounting

Stay abreast of changes in the tax laws, while keeping immaculate records so you can save time and money during tax season and avoid triggering an audit.

Tax Preparation

Let our tax professionals prepare, file, and pay your taxes while you focus on running your business. Gain peace of mind from knowing that we have it under control.

Local, Federal, and

International Taxation

Navigate the complex laws that affect your business activity around the world. Plan for expansions and clarify your eligibility for tax advantages under NAFTA.

Sales Tax

Services

Allow our team to guide you in the selection and implementation of systems and processes that will simplify and localize the collection of online and offline sales taxes.

Tax Problem

Resolution

Gain a partner who will help you understand your options, develop an achievable plan, and represent your business in the unlikely event of an audit.

What to Expect from a Business Tax Service

At The CEO’s Right Hand, we work with you to navigate the challenging world of income and sales taxes and to clarify the potential impact of local, federal, and international taxes on your business plans. We also handle the day-to-day management of your books and protect you from any mishaps that could draw the attention of tax authorities. Finally, we prepare, pay, and file your taxes.

As a full-service finance and accounting firm, we provide strategic, financial, and operational services. We take a holistic, consultative approach and shape our process around your needs so we can drive growth, help you avoid risk, tackle tough projects, and develop financially sound business strategies. Our business tax services are an extension of this work. We see them as part of our mission to support your short and long-term goals.

Schedule a free consultation today to learn what we can do for you.

Frequently Asked Questions (FAQs)

How much do you charge for business tax services?

Our tax advisory and preparation pricing varies depending on the breadth and depth of your needs. Furthermore, these services are typically provided as an extension of our fractional CFO and accounting services. In general, you can expect pricing starting at roughly $1,000.

How will you protect my data?

We use tax preparation and accounting systems equipped with the most current data and identity protection technologies. These systems secure your sensitive financial data against unauthorized users.

What information will you need from me?

To prepare your taxes and offer advice, we will need a complete set of financial statements, including your income statement, balance sheet, and cash flow statements. We will also need insight into your goals and objectives and access to payroll information along with prior income tax returns.

What are the benefits of working with a business tax service?

The main benefit of business tax services is that you get access to experienced, highly trained tax professionals at a fraction of the cost of hiring someone full time. However, since most of our clients also make use of our fractional CFO and accounting services, they get the added benefit of working with a provider they trust. We’re already intimately familiar with their business and can offer strategic tax advice that will support their growth strategies.

Can you help me manage the tax implications of my PPP loan?

Absolutely! We have been keeping a close watch on the payroll protection program (PPP). Our team has been tracking the changes that have taken place and the steps required to maximize loan forgiveness. We are well prepared to help you navigate the tax implications.

When should I focus on taxes . . . April?

Tax planning is a year-round exercise. If you want to avoid nasty surprises come tax filing time, then creating a solid plan is critical. In that way, you can minimize your tax liability as well as reduce the risk of an audit, penalties, interest, etc.

Do I need to collect sales taxes from my customers?

This is a seemingly simple question, but it can be quite complicated to answer in some cases. It used to be that only companies that sold a physical product needed to collect sales tax. And, even then, only if sold in the state in which you had a physical presence. The internet and subscription model businesses, coupled with shrinking state and local government tax revenues, has caused a major shift in sales tax policy. We strongly recommend all our clients perform a simple sales tax audit to ensure they are compliant. Contact us today to schedule one for your company.